Your Leading Indicators | UK CRE Exposure To Bank Volatility | Interest Rates | UK Inflation

Discover key economic and financial metrics, and what to look out for in the week ahead.

2 minutes to read

Here we look at the leading indicators commodities, trade, equities and more. in the world of economics. Download the dashboard for in-depth analysis into commodities, trade, equities and more.

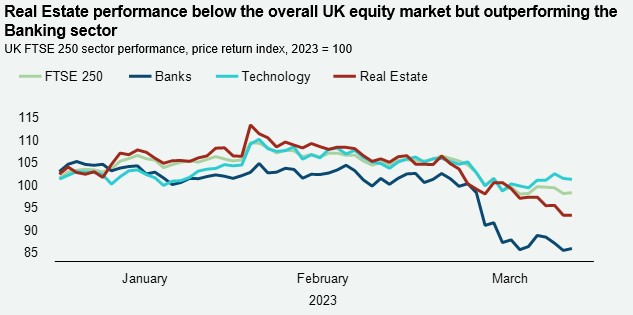

UK CRE less exposed to bank volatility

The recent bank failures have raised questions surrounding commercial real estate, as it is a levered asset class. However, the situation in the UK is different from that of the US, where markets are concerned about the c.$5.6tn commercial real estate loans in rotation. Firstly, the UK is yet to see a bank failure this cycle. Furthermore, UK bank exposure to real estate debt is currently relatively low at c.6% of all debt, compared to 12+% pre-GFC, according to Capital Economics. UK banks have also been relatively restrained, with 80+% of UK CRE loans at an LTV of under 60%, again below pre-GFC levels. And notably, over the last 15 years, we have seen a rise in non bank lenders, another source of available liquidity for CRE investors. Credit conditions may tighten for CRE lending in the short term, but longer term, downwards pressure on rates may gradually ease financing conditions.

Interest rates may have peaked

Despite the recent global banking sector volatility, the US Federal Reserve and Bank of England (BoE) raised borrowing costs by 25bps to 5.00% and 4.25%, while the European Central Bank hiked rates by 50bps to 3.50%. For the BoE, economists widely expect this to be the last rate hike in the current tightening cycle, albeit this remains conditional on whether wage growth and services inflation strengthens further. The BoE outlined it would “monitor closely any effects of the banking turmoil” on businesses and households, which may suggest the central bank is hesitant to push rates much further. In line with this, a number of forecasters expect the BoE to cut rates to between 3.25% and 3.00% by Q4 2024. All else equal, lower interest rates will likely be supportive of real estate prices.

UK inflation rises, but was it just a blip?

The UK inflation rate unexpectedly rose to 10.4% in February, from 10.1% in January, the first increase in four months and missing market expectations of 9.9%. Despite this, the Bank of England (BoE) Monetary Policy Committee (MPC) does not see February’s rise as a sign of persistent inflationary pressure. Instead, the MPC stated that it expects inflation to fall to a lower rate in 2023 than previously thought. The BoE noted that some of February’s rise in inflation was due to volatile clothing prices, which it expects to prove less persistent. Meanwhile, other recent economic data showed signs of further improvement, including robust retail sales figures, expansionary PMIs and improving consumer confidence.

Download the latest dashboard here