Marbella is in the spotlight and Spain’s new digital nomad visa will strengthen demand further

The pandemic led to increased demand for resort living and Marbella is emerging as a key beneficiary.

5 minutes to read

Last updated: 11/09/2023

The 30-second read

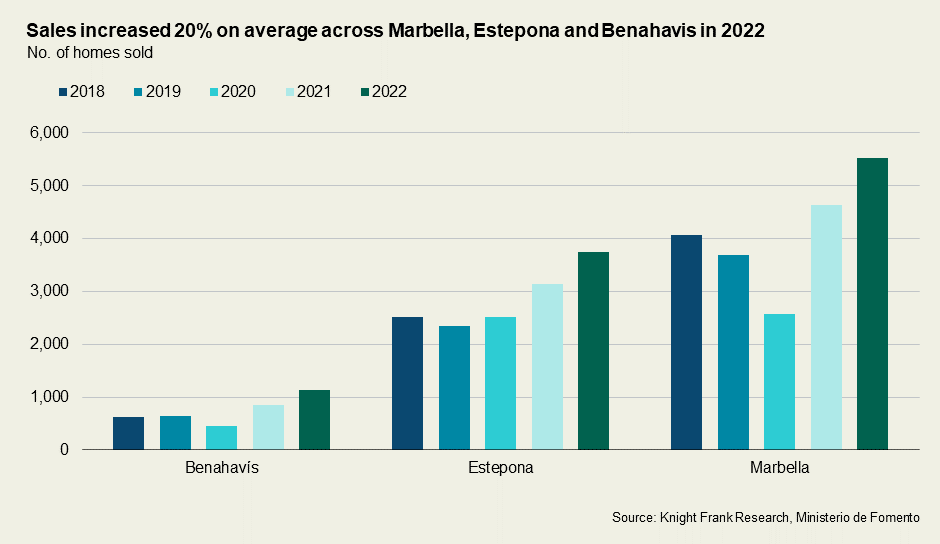

- Sales across Marbella, Benahavís and Estepona jumped 20% on average in 2022 with Benahavís recording the largest increase

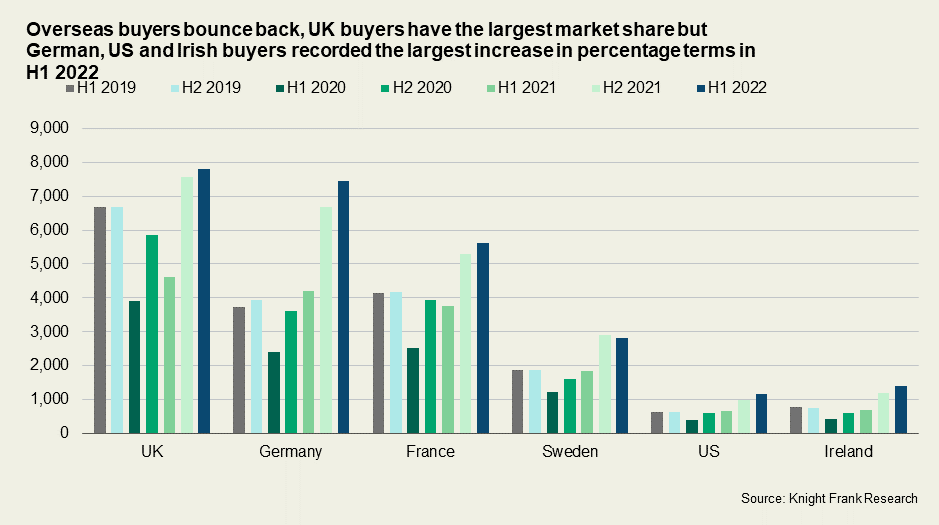

- Overseas buyers purchasing in Spain increased 53% in the first half of 2022 compared to the same period in 2021. German, US and Irish buyers registered the strongest uptick

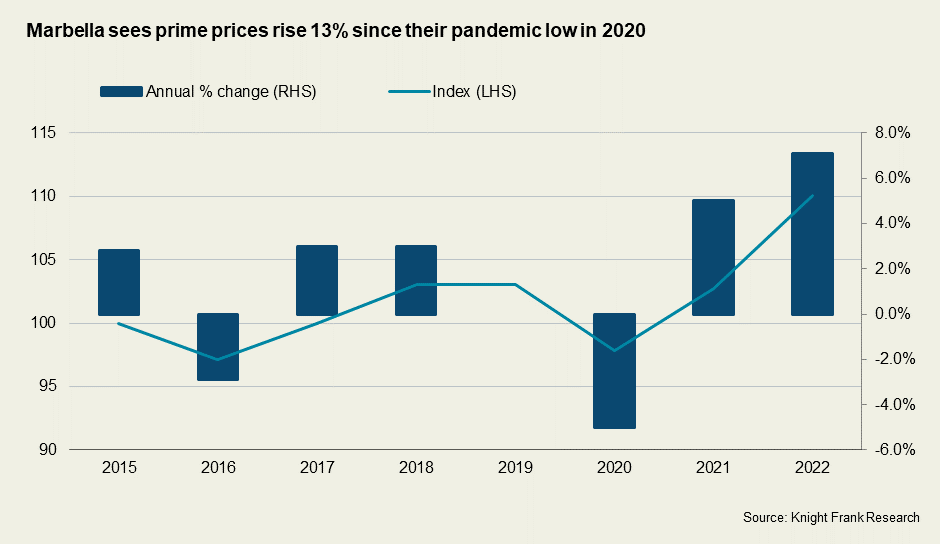

- Prime prices in Marbella increased 7% in 2022 and are 11% higher than before the pandemic

- Spain’s newly-launched Digital Nomad Visa offers British and other non-EU residents a potential means around the 90 out of every 180 days limitation that has applied since 2020 when it left the European Union (EU)

The longer read

New data reveals that across the region’s key municipalities of Marbella, Benahavís and Estepona, sales increased 20% on average in 2022.

At 31%, the exclusive enclave of Benahavís which encompasses the gated estate of La Zagaleta, registered the highest annual percentage increase in sales but Marbella still commands the largest total with over 5,500 properties changing hands in 2022.

Since their pandemic low in 2020, sales volumes across Marbella have more than doubled according to the Spanish General Council of Notaries.

Mark Harvey, Knight Frank’s Head of International sales comments, “Marbella is back on the radar of northern European buyers seeking a home from home in this new age of hybrid working. It counts as one of Europe’s most international markets, it is easily accessible via Malaga and Gibraltar Airports and offers a wealth of amenities year-round. In 2022, we saw enquiries strengthen 32% year-on-year.”

International demand

Non-resident purchases recovered strongly in 2022. Over 72,000 sales were agreed to non-resident purchasers in the first half of 2022, up 53% year-on-year.

Data from Knight Frank’s Attitudes Survey reveals that Spain is amongst the top three preferred purchase destinations for ultra-high-net-worth individuals (UHNWIs) globally and number one amongst European UHNWIs.

Sales to non-residents accounted for 14% of all Spanish transactions in 2022, the figure rises to 34% in Malaga Province which encompasses Marbella.

Although UK purchasers remain the largest in number, German, US and Irish buyers have seen the biggest increase in percentage terms since the start of the pandemic, up 99%, 88% and 77% respectively in H1 2022 compared to H1 2019.

US interest

The strong dollar, the resumption of direct flights from New York to Malaga following the hiatus of the pandemic, and the appeal of the Spanish way of life is driving US demand.

Currency is key. A US buyer enjoyed a 22% discount when purchasing in September 2022 compared to a year earlier, due primarily to the Federal Reserve embarking on its fastest pace of rate hikes since the 1980s.

According to Pia Arrieta, Head of Diana Morales Properties Knight Frank, “US web traffic on our website increased 42% in 2022 year-on-year, but sales to Polish, British and Swedish nationals ranked highest.”

Golf is a key draw and the Solheim Cup in nearby Casares in September 2023 is sparking additional interest.”

A new route for UK residents post-Brexit

In March 2023, Spain launched its new digital nomad visa which allows non-EU residents to live in the country for up to five years and pay lower tax (15% for the first four years instead of the standard 24%).

If you spend more than 183 days in Spain, whether working for a foreign company or not, you are considered a Spanish tax resident. As a result, nomads who live and work there can take advantage of tax benefits. For example, remote workers earning below €600,000 a year can pay 15% tax instead of 24% during the first four years of your stay.

Applicants must not have lived in the country within the five years prior to applying and it is open to non-EU residents who work remotely for non-Spanish companies. Applicants must also have been working remotely for at least one year.

It allows you visa-free travel in other Schengen countries including France, Italy and Germany.

With a digital nomad visa, you can stay up to one year. After that, you can apply for a three-year residence permit and renew it for two years.

The income threshold is set at 200% of Spain’s monthly minimum wage. Currently, this equates to c.€28,000 per annum. Initially valid for 12 months the visa can be renewed for up to five years.

Furthermore, Spain has double taxation with 90 countries, meaning that if you are paying tax for foreign income in your country, you will not be taxed again in Spain.

For British workers constrained by the 90 out of every 180-day rule since 2020, the new visa could be a gamechanger for freelancers, tech start-ups and entrepreneurs as well as the burgeoning cohort of hybrid workers globally.

Prices

Strengthening demand is pushing up prices at a time when stock is becoming constrained as homeowners opt to stay put against a backdrop of rising mortgage costs.

Prime property prices in Marbella have risen by 7% in 2022, according to Knight Frank’s Prime International Residential Index (PIRI) and sit 13% above their pandemic low in 2020 when borders were closed.

Need to know:

- Purchase costs in Spain are typically 7-10% of the purchase price (this is 7% transfer tax plus additional costs such as notary, registry, lawyer fees, financing) and VAT of 10% is payable on new homes (on new homes it’s 10% VAT plus 1.2% Stamp Duty).

- Marbella’s most expensive properties are located on the frontline beach area of the Golden Mile and can command prices of c.€15,000 per sq m. However, for those seeking value, Estepona and La Alqueria in Benahavís offer good opportunities with prices closer to €4,000 per sq m.

- Malaga Airport has direct flights to over 155 destinations via 48 airlines and is located within a 40-minute drive of Marbella

- Spain’s new Wealth Tax is being levied on net assets of €3 million-plus although Spanish resident taxpayers may apply a €700,00 reduction and an additional €300,000 is deductible for primary residences. The new tax is temporary and will apply to net wealth in 2022 and 2023.

- In 2022, the region of Andalucia within which Marbella sits, scrapped its inheritance tax (IHT), which means that anyone (resident or not) who inherits Andalucían assets of up to €1 million is no longer liable to pay IHT.

Next steps

• Contact Mark Harvey to discuss your requirements

• Sign up to Knight Frank’s Spanish research

• Download the Spanish Buying Guide