Banks in turmoil | The case for a pause in rate hikes | Chinese and Russian leaders meet in Moscow

Discover key economic and financial metrics, and what to look out for in the week ahead.

2 minutes to read

Here we look at the leading indicators commodities, trade, equities and more. in the world of economics. Download the dashboard for in-depth analysis into commodities, trade, equities and more.

Banks in turmoil

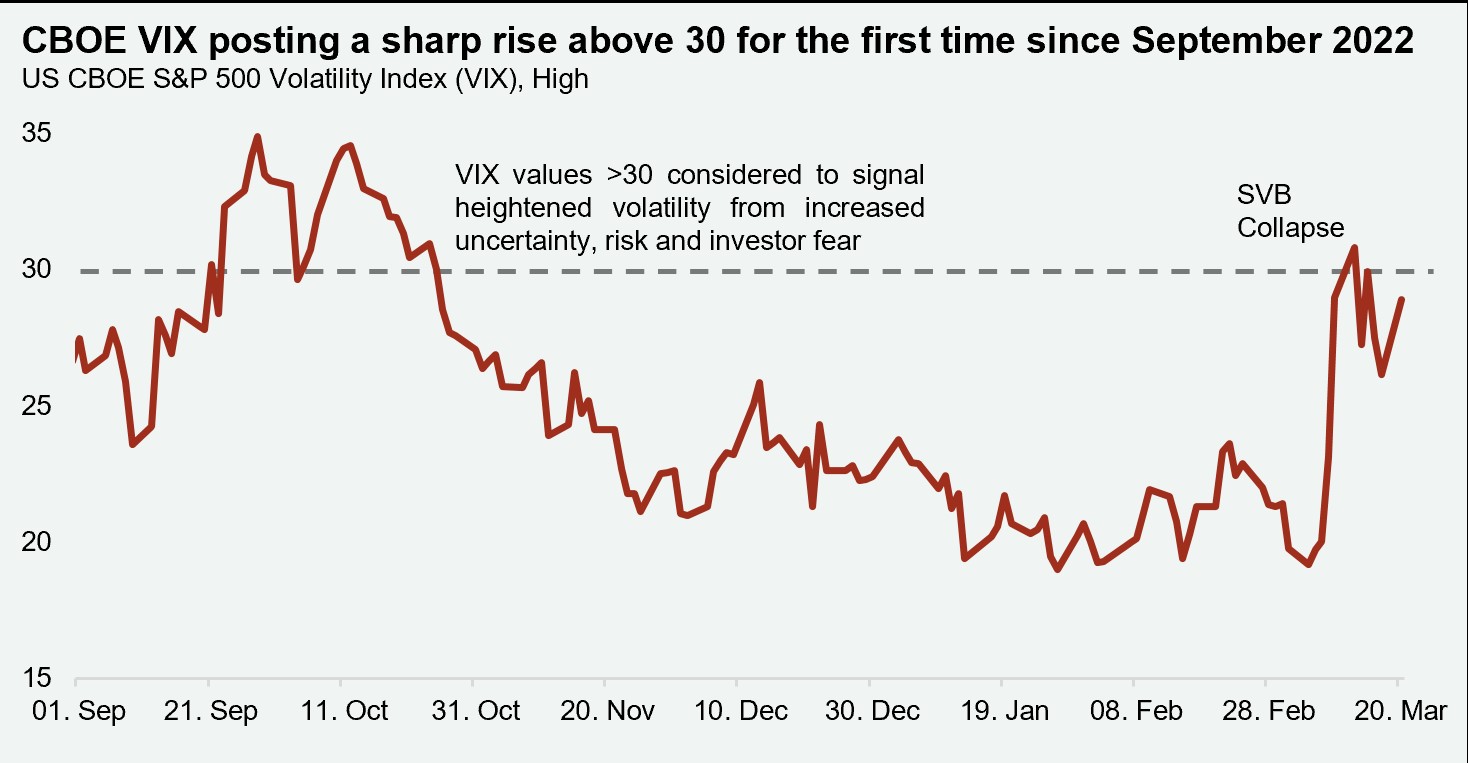

The UBS takeover of Credit Suisse and the failure of regional US lenders have raised concerns over a wider banking crisis. In reality, each of the organisations affected had faced specific challenges, while larger banks are better regulated than pre-GFC, with lower leverage. In the short term, the potential real estate implications include a) a tightening of credit conditions; b) job losses at specific (non-UK) organisations; and c) a general hit to economic sentiment. For now, however, markets have calmed, thanks in part to central banks stepping in to provide additional liquidity and commentary relating to the high degree of support that they are willing to provide.

The case for a pause in rate hikes?

Concerns over the health of the global banking sector have raised the question of whether central banks should forgo further interest rate rises. Both the Federal Reserve Bank in the US and the Bank of England will deliver their interest rate decision later this week. They will need to find a balance between controlling waning inflationary pressures through tighter monetary policy and supporting financial market liquidity. Money markets were previously pricing in a quarter point rise in the UK bank rate to 4.25% on Thursday, yet this will depend on whether market conditions worsen, and on the release of UK CPI inflation data on Wednesday. Should this provide more evidence of domestic price pressures fading, the case for another rate hike would be further weakened.

Chinese and Russian leaders meet in Moscow

Russia became China’s largest oil supplier last year and is expected to increase gas exports to its neighbour by a third this year. While the EU’s shortage of fossil fuels left it vulnerable after Russia cut gas supplies, it is also reliant on raw material imports, particularly from China. To reduce dependencies for raw materials, the EU last week presented the Critical Raw Materials Act which proposed classifying copper and nickel as critical raw materials, alongside other metals key to the energy transition. The global decarbonization drive is set to turbocharge demand for these materials as production of copper will need to almost triple by 2040 if the world is to hit targets for net-zero carbon emissions, according to Bloomberg.

Download the latest dashboard here