Will spring mark the end of the housing market hangover?

Making sense of the latest trends in property and economics from around the globe.

6 minutes to read

Housing market activity

Has the housing market stabilised in the wake of the mini-budget? If it has, where has it settled relative to the preceding months?

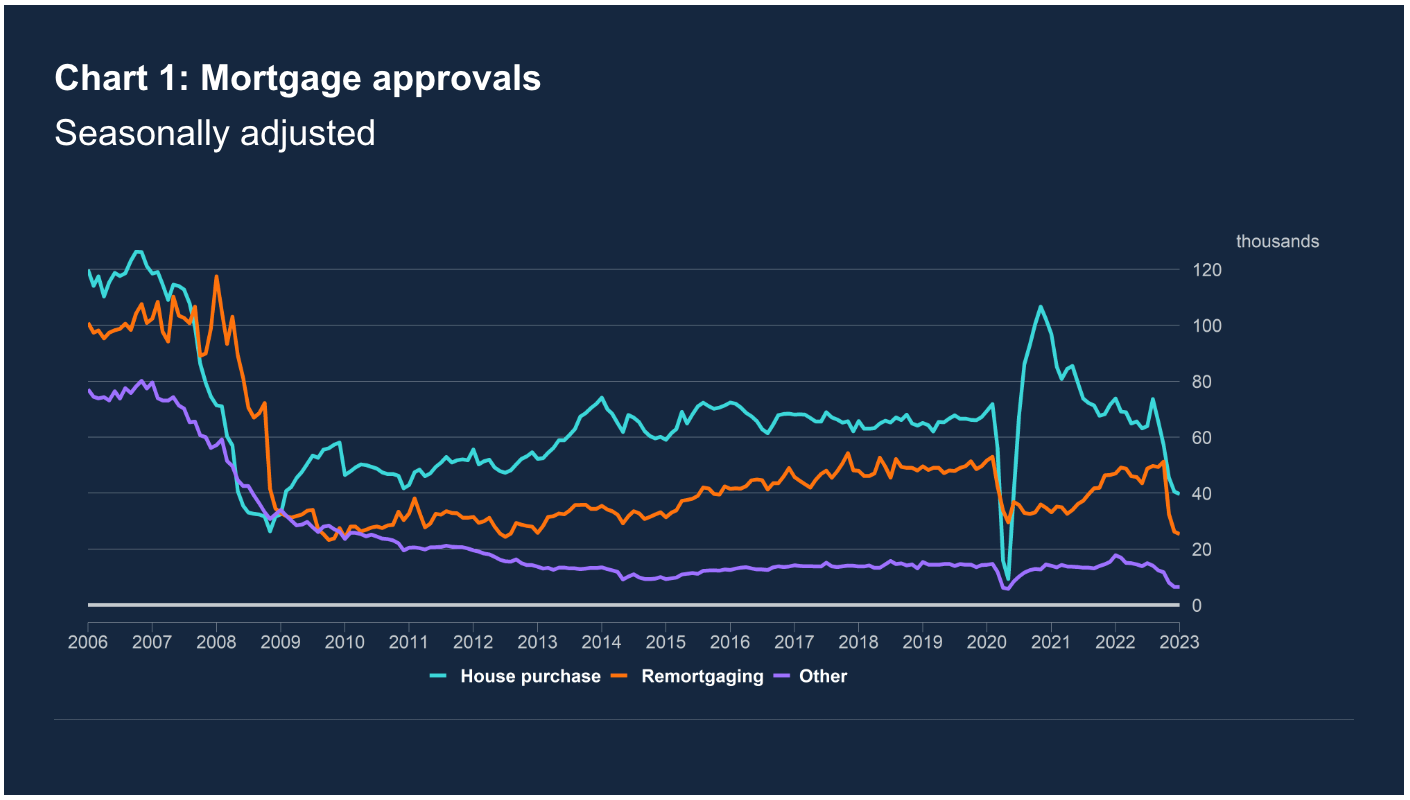

These are key questions with few clear answers, for now. Nationwide this week said house prices fell 1.1% during the year to February, the first annual decline since the summer of 2020 and the weakest reading since November 2012. Prices fell 0.5% during the month, capping a 3.7% fall from August's peak. Similarly mortgage approvals for the purchase of homes fell again in January to 39,600, down from 40,500 in December, according to Bank of England data published on Wednesday (see chart). Net mortgage lending decreased to £2.5 billion, from £3.1 billion.

"The economy has largely moved on from the mini budget, but the hangover for the UK housing market is more prolonged," Knight Frank's Tom Bill told CNN on following the release of the Nationwide figures.

Indeed, but as Tom pointed out to other publications, we are still seeing a mismatch between these data releases and the anecdotal evidence from our network, which suggests that activity has been solid so far this year as buyers and sellers adapt to higher mortgage rates. This mismatch showed in the latest RICS survey, too, as we discussed earlier this month.

Housebuilding

The housebuilders provide good examples and offer answers to our key questions. Earlier this month Bellway, Redrow and Barratt Developments revealed that net reservation rates per week had improved markedly over the first five weeks of the calendar year (see note linked above).

We got more evidence of a pick-up in the new homes market this week. Persimmon on Wednesday said sales rates per outlet per week had risen to 0.52 in the first eight weeks of 2023, compared to 0.30 in Q4. That compares to 0.96 in the same period last year. Meanwhile, Taylor Wimpey said yesterday that trading shows "some signs of improvement" relative to Q4. Its private sales are running at about 0.66 per outlet per week following "recent reductions in mortgage rates, early signs of stabilised customer confidence, usual seasonal trading patterns and the benefit of our focused promotional activity...the level of down valuations remains low."

The housebuilders are shifting to defensive strategies as activity settles notably lower than the boom years of the pandemic, and we expect this settling to show in the larger data releases soon. All of this is in line with our view that prices will decline by about 10% from 2022’s peak.

Green homes

Granted, the housebuilders enjoy some particular tailwinds. Various surveys indicate that the energy efficiency of homes is becoming a core issue for buyers and tenants following sharp rises in energy prices.

EPC data from more than 600,000 new and existing properties transacted over the last three years points to an average 56% saving on annual energy costs (lighting, heating and hot water) when comparing a new-build with an existing property, Ollie Knight revealed earlier this week (see chart).

There remains some degree of uncertainty as to how much the theme translates to prime markets, where buyers aren't impacted by energy costs to the same degree. We have some anecdotal evidence - I spoke to Mike Spink for The Wealth Report 2022 (p.26), who said that for 25 years clients had rarely shown any interest in sustainable homes, but suddenly he was meeting clients who were demanding that sustainability was the top priority, whatever the cost. More comes from Bloomberg this morning on this topic.

We covered green real estate issues in our Intelligence Talk’s podcast on the Government’s Net Zero plan here.

Prime London

A new prime central London index offers more evidence of robust activity. The number of new prospective buyers registering the first seven weeks of the year in London was 28% higher than the five-year average. Meanwhile, the number of new sales instructions was 36% higher.

For the time being, activity is stronger in higher price brackets where there is less reliance on mortgage debt - roughly half of sales in PCL are in cash.

The number of £2 million+ exchanges was 66% above the five-year average in January. Below this level the increase was 12%. Meanwhile, the number of new £2 million+ prospective buyers was 52% higher, while the rise was 20% in the sub-£2 million bracket.

“Nerves have settled and the aftershock of the mini-Budget is dissipating,” said Rory Penn, head of London sales at Knight Frank. “However, the true test of strength across all price points will be the spring market.”

The stronger-than-expected sales market means more owners are attempting to sell their property rather than becoming landlords. Compared to the first two weeks of 2023, the number of lettings instructions in London was 21% lower in the second fortnight of the year and 12% down in the following two-week period. That's going to keep supply tight and maintain upwards pressure on rents over the short term, according to Knight Frank's head of lettings Gary Hall. You can read more on the PCL lettings market here.

London offices

While the office investment market has been adjusting to higher interest rates, the momentum in occupier markets has remained strong. Take up climbed 12.5% to 2.98 million square feet during Q4 compared to Q3, according to our latest London Office Market report. That caps 11.54m sq ft of take up for the year, up 31.6% compared to 2021 and within 6.8% of the long-run average.

The clamour for best-in-class buildings led to an acceleration of take-up of new and refurbished buildings to 6.77m sq ft - that's now 60% of all transactions. Prime availability will become more acute in coming years as the pipeline fails to satisfy long-term average levels of take-up for top-quality space. As of 2022 Q4 there was 15.42m sq ft under construction, of which 11.0m sq ft is being built speculatively. Extending trend levels of demand for new and refurbished buildings implies a shortfall of almost 11m sq ft across London by 2026.

The West End is going to be a particular pinch point, where new and refurbished buildings account for just 20% of the total available, our report reveals. The FT covered Pimco's deal with Derwent London at 25 Baker Street earlier this week, which the company said is reflective of companies' desire for green, modern buildings as workers gradually return to the office.

“If you want a new building in the West End, you ain’t got much choice,” Derwent chief executive Paul Williams tells the paper.

For more on green office buildings and the rise of the retrofit trend listen to our interview with GPE’s Janine Cole here.

In other news...

The Wealth Report, Knight Frank definitive assessment on private capital and investment, launched this week. In today’s Intelligence Talk episode we unpack one of the key issues to emerge from the report – global mobility of wealth. With UHNWIs increasingly on the move and competition from governments to attract both them and their tax revenue we speak to leading migration expert Kristin Surak to understand the implications for real estate – listen here.

Knight Frank's head of planning Stuart Baillie on the government's proposals to hike planning fees (Linkedin), US homes post first annual price decline since 2012 (Bloomberg), older workers are returning to the labour market (Times), people are going back to the office and back to the shops (Times), UK businesses expect inflation and costs to ease but wages to stay high (FT), women make up 40% of boards at top UK companies for first time (Reuters), and finally, another BoE rate rise isn't inevitable, Bailey says (Reuters).