Will the housing market surprise on the upside?

Making sense of the latest trends in property and economics from around the globe

4 minutes to read

Lease expiries

The leases of almost 500 of London's office occupiers* will expire at some point between now and 2027, according to the London Report 2023.

These companies currently occupy about 23.5 million square feet and most remain intent on redesigning and reconfiguring space when they have the opportunity, drawing particularly on greater amenities and services in a bid to make the office more attractive to staff. Not everybody is likely to get what they want - 7 million of those lease expiries are for space that currently has an EPC rated C or below, for example, and not everything can be brought up to the standards that modern occupiers expect. That, combined with the limited pipeline under construction, is expected to leave London with an 11 m sq ft shortfall of the best quality space.

The clamour for better offices offers the clearest signal of the value corporate leaders place on proximity. Though working habits will remain far more flexible than they were pre-pandemic, more and more occupiers are adopting an 'office first' approach. As Lee Elliott put it during the London Report breakfast last week, the 'Martini Syndrome' of working anytime, anyplace, anywhere, is not the desired outcome for most companies.

But how do occupiers intend to use the newly configured space? And which occupiers are currently leading the charge? And how can investors capitalise? To find out, I spoke to Lee for a new episode of Intelligence Talks. Listen here, or wherever you get your podcasts.

London outperforms

The UK economy is estimated to have contracted 0.5% in December due to a mixture of the squeeze on household incomes, strikes and the pause in Premier League football for the World Cup, according to ONS data out this morning. That means quarterly growth was flat and annual growth caps the year at 4%.

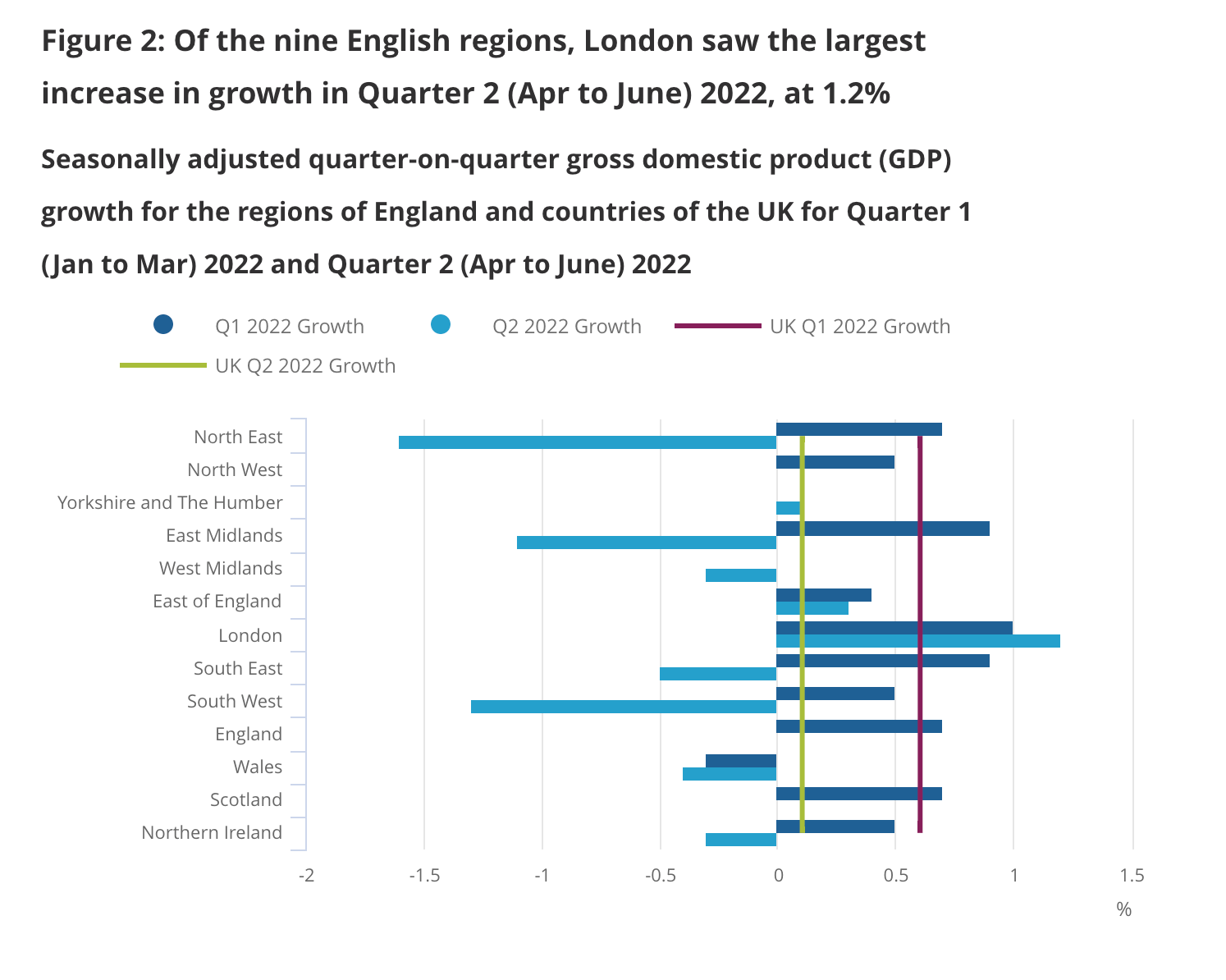

ONS figures published yesterday revealed regional disparities in the UK's recovery from the pandemic. The capital's economy expanded 2.7% during Q2 last year compared with the final quarter of 2019 before the pandemic arrived. By way of contrast, this morning's figures show that the UK economy as a whole remains 0.8% smaller than it was before the pandemic hit.

Surprising on the upside?

Metrics spanning new buyer demand, sales, fresh listings and prices were all on the downward trend in the RICS Residential Market Survey for January, published Wednesday. Near-term expectations suggest that the subdued picture is likely to remain in place for a while longer, "despite some more sanguine anecdotal remarks from a number of contributors," the report said.

That's an interesting remark. The back of the report contains a monthly list of anecdotal commentary from survey participants. January's is mostly negative, but look closely and another theme starts to emerge:

"Strong start to the new year," says David Shaun Brannen of Brannen & Partners in Whitley Bay. "Encouraging start to the year after a poor December," says Alexander James McNeil of Bramleys in Huddersfield. "A positive start to the year, with a good number of fresh new instructions leading to a promising number of sales," says Peter Buckingham of Andrew Granger & Co in Market Harborough. "Somewhat surprisingly, January was a better month than we had expected," says Colin Townsend at John Goodwin in Malvern.

There is a large body of evidence suggesting 2023 is going to be a difficult year in the housing market as homeowners adjust to the reality of fixed rate mortgages starting with a four, but several data points published in the past four weeks raise the distinct possibility that the housing market surprises on the upside, as it did during the pandemic - see recent notes here, here, here and here.

Sequential improvements

Trading updates and results reporting from Bellway, Redrow, and Barratt Developments continue the theme.

Bellway's private reservation rate fell to 91 per week during the final quarter of 2022, down 60% compared to the same period a year earlier. That improved to 107 per week in January, during which the reservation rate "sequentially improved throughout each week".

Redrow's net private reservation rate per outlet per week over the first five weeks of calendar year 2023 was 0.51 compared to 0.38 for the first half of the financial year. "Whilst 2023 will be a challenging year as the market resets, early indications are better than anticipated and the market appears to be finding a new, natural level," the statement said.

Barratt meanwhile said net private reservations per active outlet per average week from 1 January 2023 through to 29 January 2023 stood at 0.49. While that's 46% below the 0.90 in the equivalent period in 2022, it is an uplift compared to the level of activity seen between the company's AGM announcement through to 31 December 2022.

"Whilst we have seen some early signs of improvement in current trading during January, we will need to see continued momentum over the coming months before we can be confident that these challenging trading conditions are easing,” the company said.

In other news...

Office buildings with the highest energy performance certificate ratings have a 72% lower gas cost per square foot than those with the lowest efficiency, says BDO (EGi), Buy-to-let crisis is a golden opportunity for these landlords (Telegraph), and finally, German inflation hits a five-month low (FT).

*Those occupying space of at least 20,000 sq ft.