Which global city generates the highest waterfront property price premium?

High demand spurred on by the pandemic sees the premium for a waterfront home increase.

2 minutes to read

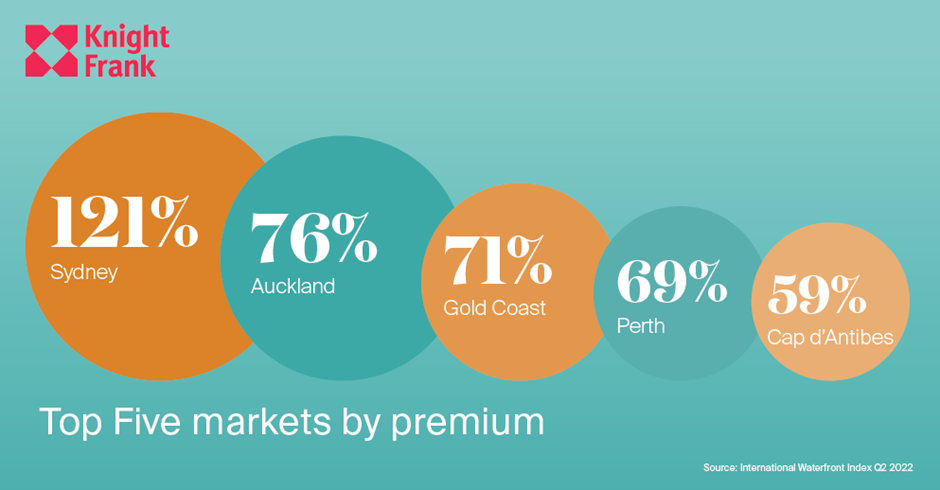

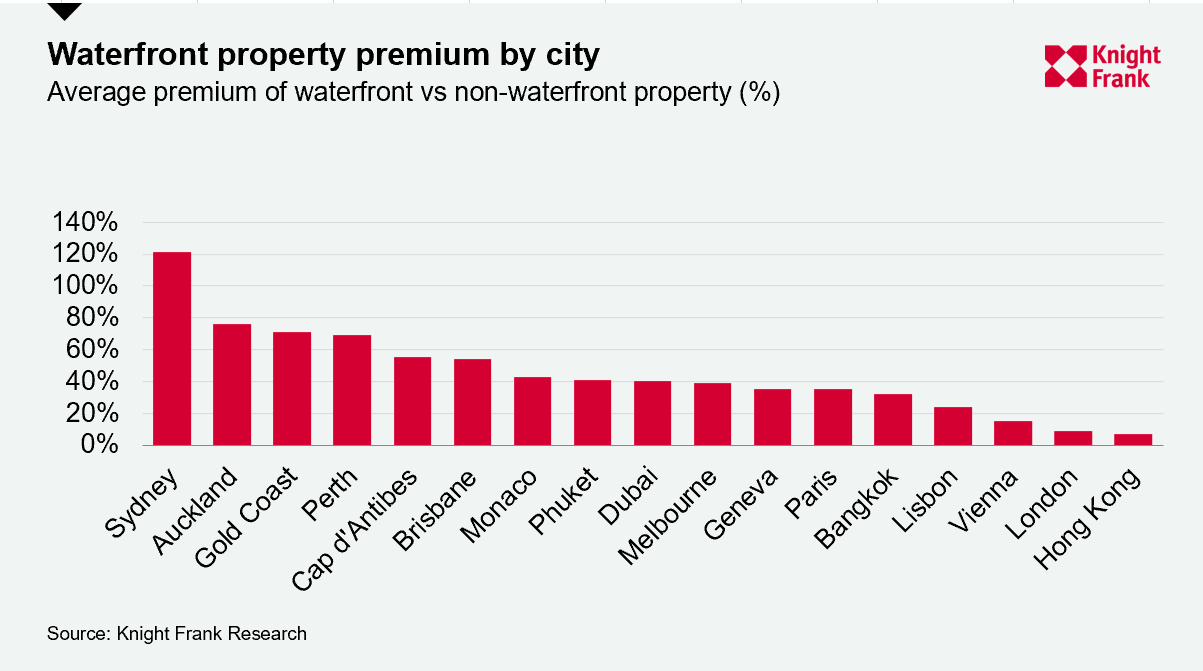

Australian cities have taken three of the top five slots in this year’s International Waterfront Index with Sydney leading the rankings.

A waterfront property in the city with iconic views across its harbour attracts an average premium of 121% compared to an equivalent home set away from the water.

New Zealand’s Auckland on the country’s North Island was second with a premium of 76%, edging out the Gold Coast (71%) and Perth (69%). The Cap d’Antibes peninsula (59%) in the South of France was the highest European entry in the list of 17 international locations.

“Regardless of the season in Sydney, there is always strong appetite for waterfront homes, especially those with uninterrupted iconic views of the Sydney Harbour Bridge and Opera House,” said Michelle Ciesielski, head of residential research at Knight Frank Australia.

“A waterfront property also offers the potential for maritime facilities, and we’ve seen elevated enquiries since the pandemic. There’s only a limited number of prestige properties on the harbour due to nature reserves and parklands,” Michelle added.

The pandemic and successive lockdowns have put greenery and space at the top of buyers’ requirements for homes, fuelling sales and price growth in prime regional markets. Low supply has also kept upwards pressure on prices.

Successive lockdowns around the globe have pushed the appeal of waterfront living to the fore, with 42% of respondents to Knight Frank’s Global Buyers Survey stating they were more likely to buy a waterfront property as a consequence of the pandemic.

In the 12 months to June 2022, the average price increase for a waterfront property in the index was 10.9%. This compares with an increase of 9.8% in the UK.

International premiums

The average international premium for a waterfront property compared with a non-waterfront home was 40% in Q2 2022.

Beachfront property was the most sought-after location, with waterfront property there attracting an average premium of 63%. This narrowly pipped a harbour location (62%), with coastal, where waterfront buyers pay an average premium of 40%, third.

“Globally the pandemic has led to a fundamental reassessment of housing and lifestyle requirements. For many being near the water with more space and greenery has been a primary driver, and with supply limited in all markets this has supported price growth and premiums,” said Chris Druce, senior research analyst at Knight Frank.

Discover Waterfront View 2022

Sign up to our Monthly Global Residential Newsletter