UK economy shrinks, Prime London performing and US unemployment rate drops

Making sense of the latest trends in property and economics from around the globe.

4 minutes to read

Momentum builds in prime London

The pipeline of transactions in prime London residential markets expanded further in July as supply continued to catch-up with demand.

The number of offers accepted across the capital last month was the highest figure in a decade, underlining the current strength of appetite for higher-value property in London. Much can be attributed to the resumption of international travel - the number of international arrivals at Heathrow in June was only 17% down on the same month in 2019, although arrivals from Asia are still down more than 40%.

Prime London markets are also relatively good value as buyers continue to reassess how and where they live after Covid. Average prices in prime central London are still 15% down on their previous peak seven years ago. There is also a creeping sense that investors are looking more closely at safe-haven assets, which has traditionally benefited the prime London property market.

Read the latest update from Tom Bill for more.

Prime London rental distortions

The prime London lettings market remains a long way from normality.

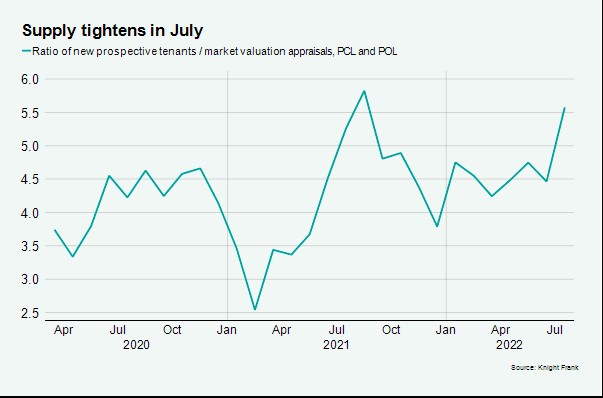

While demand is robust as the economy re-opens and tenants reassess how and where they live, supply remains tight. There were almost six prospective tenants for every valuation appraisal conducted during July, a good barometer for supply relative to demand (see chart).

A flood of short-let properties came onto the market last year due to staycation restrictions, which drove down rental values. As the economy re-opened, supply subsequently fell and demand spiked, causing rents to spike. The arrival of international students and corporate tenants this summer will further fuel the imbalance.

Average rents in PCL rose 22.2% in the year to July, a rate that has narrowed from a peak of 29.2% in April. In POL, the annual rise fell to 17.3% from 23.5% in April.

There's more here.

UK growth

Official figures out later this week are likely to show that the UK economy shrank slightly during the second quarter, the first quarterly contraction since the depths of the pandemic. A Bloomberg poll of economists suggests that could come in at about -0.2%.

The Bank of England's baseline scenario, published last week, suggests that reading will mark the beginning of five consecutive quarters of economic declines. The heat is certainly coming out of the jobs market - employers hired at the slowest rate for 17 months in July, according to the latest Recruitment and Employment Confederation survey. That also showed temporary employment outpaced permanent employment and pay growth, though strong by historic standards, came in at the weakest level in almost a year.

Retail sales continue to hold up well, which looks unusual in light of various consumer surveys showing sentiment at or close to record lows. In fact, retail occupier markets are increasingly showing signs of life and vacancy rates are slowly receding. Retail investment activity is strengthening and pricing is holding firm or even tightening in places. What's going on here? Read Stephen Springham for more.

US jobs

US employers added more than half a million jobs in July as the unemployment rate dropped to 3.5%, according to official figures published on Friday. That's highly unusual in light of the fact that the US economy has technically contracted for two straight quarters.

The data does give the Federal Reserve more latitude to push on with more bumper interest rate hikes in its battle to tame inflation, though policy makers have for weeks maintained that reining in inflation is the primary task and the stability of the jobs market comes in second.

The consumer price index, due to be published late this week, is likely to show that core inflation climbed 0.5% last month, according to another Bloomberg poll - the core index strips out energy and food. That's a slowing in the rate of growth but still hot enough to suggest we could see another 0.75% hike in September.

US mortgage rates have dropped sharply from recent highs as markets increasingly expect the Fed to pivot to easing monetary policy in 2023 as shoring up the economy becomes the top priority once more.

Subscribe now

Sign up to receive this newsletter straight to your inbox.

In other news...

A vegetable shortage looms (Telegraph), mortgage misery for millions (FT), and finally, high earners win the biggest salary rises (Times).