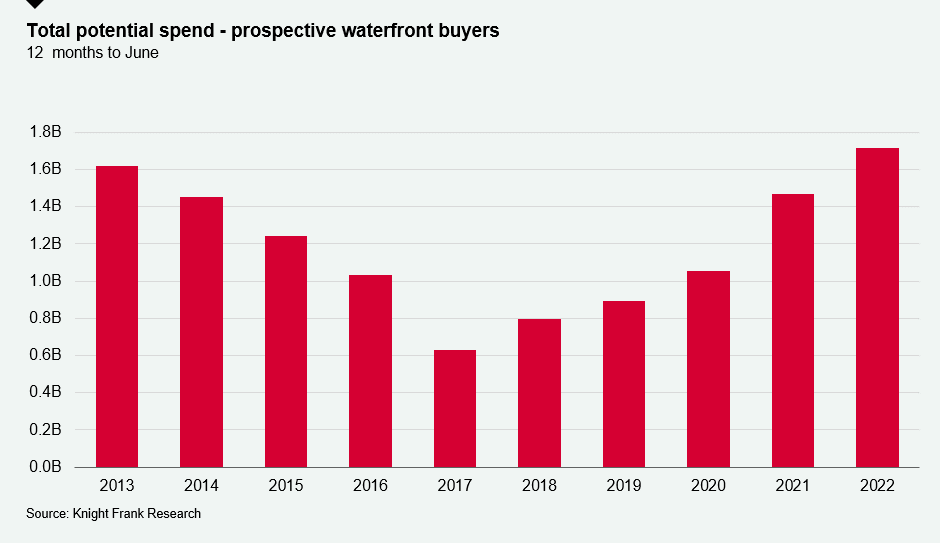

Spending power of waterfront buyers reaches decade-long high of £1.7bn

Average spend per buyer climbs 38% to £5.1m.

2 minutes to read

The financial firepower of buyers of waterfront property in the UK has reached a decade-long high, according to new analysis.

With waterfront property benefitting from the pandemic-inspired race for space, Knight Frank found that new prospective buyers were looking to spend up to £1.7bn in the 12 months to June.

This an increase of 13% on the figure of £1.5bn recorded in 2021 and is the largest amount in a decade (see chart).

The data also shows that buyers of waterfront property are looking to spend more. The average spend increased by 38% to £5.1m in the same period, again a decade-long high.

“With the pandemic causing a reset in what people want from a property, and waterside living providing the space and greenery that’s been so popular, buyers are keen to secure their preferred property in a sector characterised by limited supply,” said Chris Druce, senior research analyst at Knight Frank.

The pandemic and successive lockdowns have put greenery and space at the top of buyers’ requirements for homes, fuelling sales and price growth in prime regional markets.

Low supply has contributed to the price surge and the average price in the country market passed its previous peak set before the global financial crisis in March.

Waterfront property has followed the same course, with average prices increasing by 9.8% in the 12 months to June 2022 as demand has continued to outpace supply.

The number of new prospective waterfront buyers outside of London in the 12 months to June was 12% higher than the five-year average (excluding 2020), while market valuation appraisals (a measure of supply) were down by 6%.

Waterfront premiums

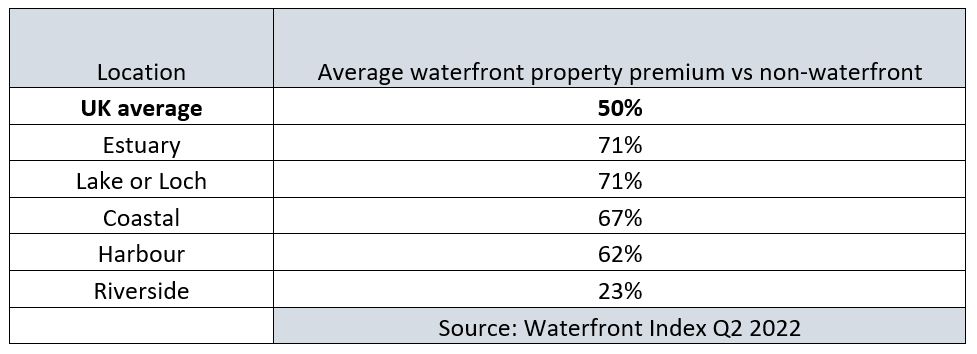

Despite the inflationary impact of the race for space, buyers can still expect to pay a premium for waterside living.

The average premium for a waterfront property compared to an equivalent home further back was 50% in June, a percentage point higher than a year ago.

Properties located on estuaries, lakes and lochs topped the list, attracting a potential average premium of 71% compared to equivalent non-waterfront property.

Photo by Rob Keating on Unsplash