A surprise economic rebound

Making sense of the latest trends in property and economics from around the globe

4 minutes to read

Population growth stagnates

The latest population projections from the UN reveal a world being transformed by declining levels of fertility.

Global population growth came in lower than 1% in 2020 and is now running at the lowest rate since the second world war. The world's population will peak at 10.4 billion during the 2080s before declining. Next year, India will surpass China as the world's most populous country.

In 2021, the average fertility of the world’s population stood at 2.3 births per woman over a lifetime, having fallen from about 5 births per woman in 1950. That will decline to 2.1 births per woman by 2050 - roughly the level required for zero growth in the long run. Fertility in Europe and Northern America has been running below that level since the mid-1970s. Their populations have been growing at an annual rate of less than 1 per cent since the mid-1960s and largely flatlined in 2020 and 2021. Both are projected to peak in population size in the late 2030s .

Fertility is declining in tandem with rates of mortality, which is ageing the global population rapidly. By 2050, the number of people aged 65 or over will outnumber children under the age of five by about two to one, and will be about equivalent to the number of people under the age of twelve.

There are huge implications for real estate investors here, but few are more pressing than the shortfall of appropriate housing - Ollie Knight took a deeper dive on the UK perspective earlier this month.

US inflation

The US Bureau of Labor Statistics will publish June's rate of consumer price inflation at 8:30am Eastern Time.

Analysts expect the headline rate will accelerate again to 8.8%, which will dominate headlines, but this could well represent the peak. Oil and gasoline prices declined this month, though much is dependent on activity in global energy markets over the months ahead.

The Federal Reserve opted to raise interest rates by 0.75% last month, the biggest hike since 1994. The majority of Fed officials have suggested that another hike of the same magnitude is pencilled in for next month, but June's report could have significant implications further out.

UK growth rebounds, for now

The UK economy enjoyed a surprise rebound in May, according to official figures out this morning. GDP expanded 0.5% during the month, capping 3.5% growth for the year. Construction grew by 1.5%, up from 0.3% growth in April.

All positive, but there are few reasons to suspect this will be sustained. UK consumer confidence hit a 22-month low last month. Consumers’ concerns over their personal finances were the weakest on record. Retail sales have also now fallen for three consecutive months.

Bank of England Governor Andrew Bailey has been prepping markets for a more aggressive approach to rate hikes should the next round of inflation figures look as bad as the last - full speech here. Markets now see a nearly 70% chance of a half-percentage-point rate hike on August 4th.

Another bike hike in NZ

The Reserve Bank of New Zealand opted for its third consecutive half-a-point hike overnight.

"The increase in mortgage interest rates will assist to bring house prices more in line with sustainable levels," the Bank said. As noted by Bloomberg, the RBNZ has moved well ahead of other central banks in bringing rates above neutral. Whether or not it succeeds in bringing down inflation without dire consequences for the economy is being watched closely by investors around the world.

House prices have fallen 5.5% from their November 2021 peak with forecasts it will drop 11% by year's end, according to ANZ New Zealand.

Barcelona

Kate Everett-Allen weighs up the supply/demand imbalance in Barcelona's prime housing market.

The number of individuals living in the city with more than US$30m in assets is forecast to grow by 61.3% to 2,298 by 2026. But, Barcelona's property market is arguably one of the most regulated in the world.

This means new supply is limited and demand continues to grow pushing prices higher. New supply has dipped in response to regulatory measures with only 8,119 properties completed in 2021, down from 44,160 in 2008.

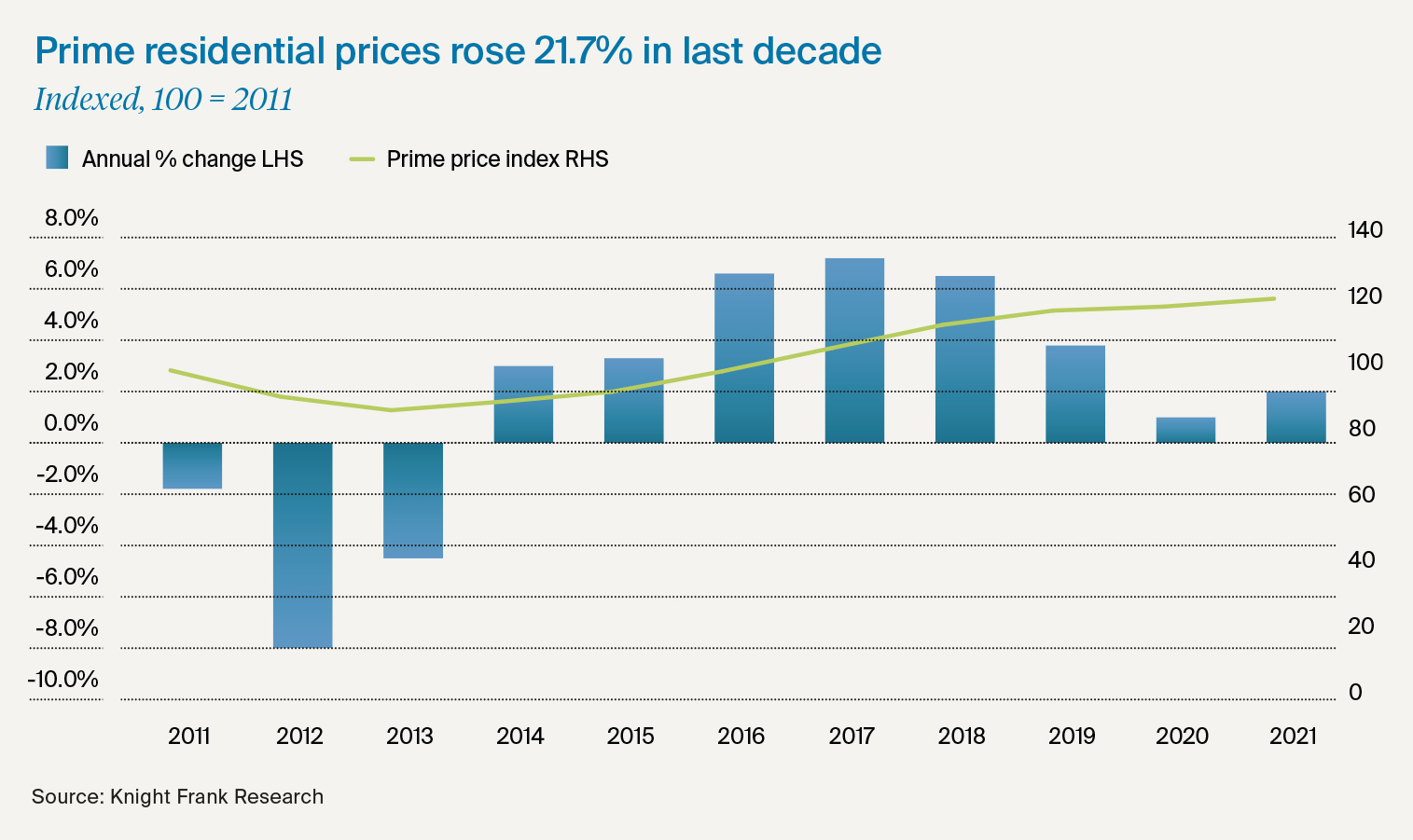

Prime prices, or the top 5% of the housing market in value terms, have increased around 21.7% in the last decade and are forecast to rise by a further 4% in 2022 alone. See the full piece for more.

In other news...

A useful round up of tax views and promises from the Conservative Party leadership candidates from Nimesh Shah.

Elsewhere - UK economic strategy needs more than tax cuts, warn three reports (FT), former banks are given new lease of life (Times), and finally, homebuyers across 22 Chinese cities refuse to pay their mortgages (Bloomberg).

Photo by Tejj on Unsplash