Which global cities lead our prime residential price forecast?

A lot has changed in global property markets since we issued our last global prime residential forecast in December 2021.

4 minutes to read

The recession threat has broadened, inflationary pressures have soared and mortgage rates are on the up. It therefore seems an opportune time to tap into the knowledge and insight of our global research network and update our outlook for prime markets given the changing landscape.

Central Banks in advanced economies, the Federal Reserve included, are front-loading and fast. According to The Financial Times, “The standard 25 basis point shift is dead … and even 50 seems meagre when chair Jay Powell is plumping for 75 at a time.”

Although the prime residential market sector has a higher proportion of cash buyers and therefore could be considered less exposed to higher mortgage rates, tighter monetary policy and its impact on economic growth and hence wealth creation is inevitably influencing prime markets too. But the picture is nuanced.

How has our prime forecast changed?

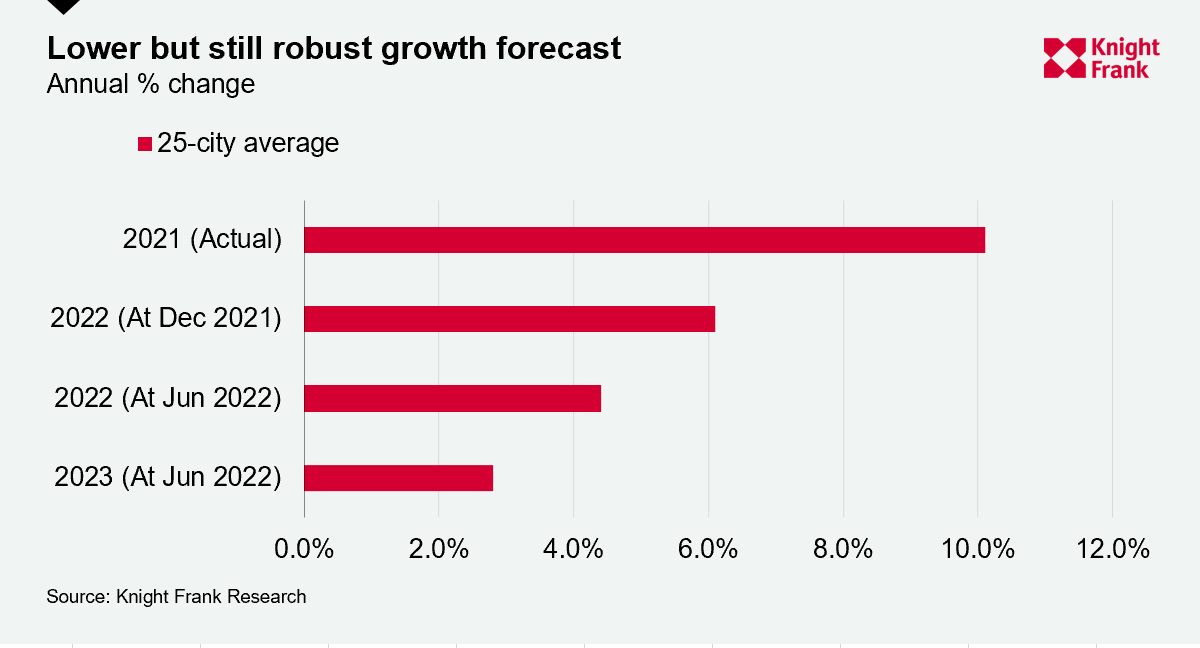

Across the 25 cities tracked, Knight Frank’s global research teams now expect prime prices to rise by 4.4% on average in 2022, down from 6.1% six months ago.

Despite the reduction to 4.4%, this still represents strong growth, outpacing our prime index’s growth in nine of the last 10 years.

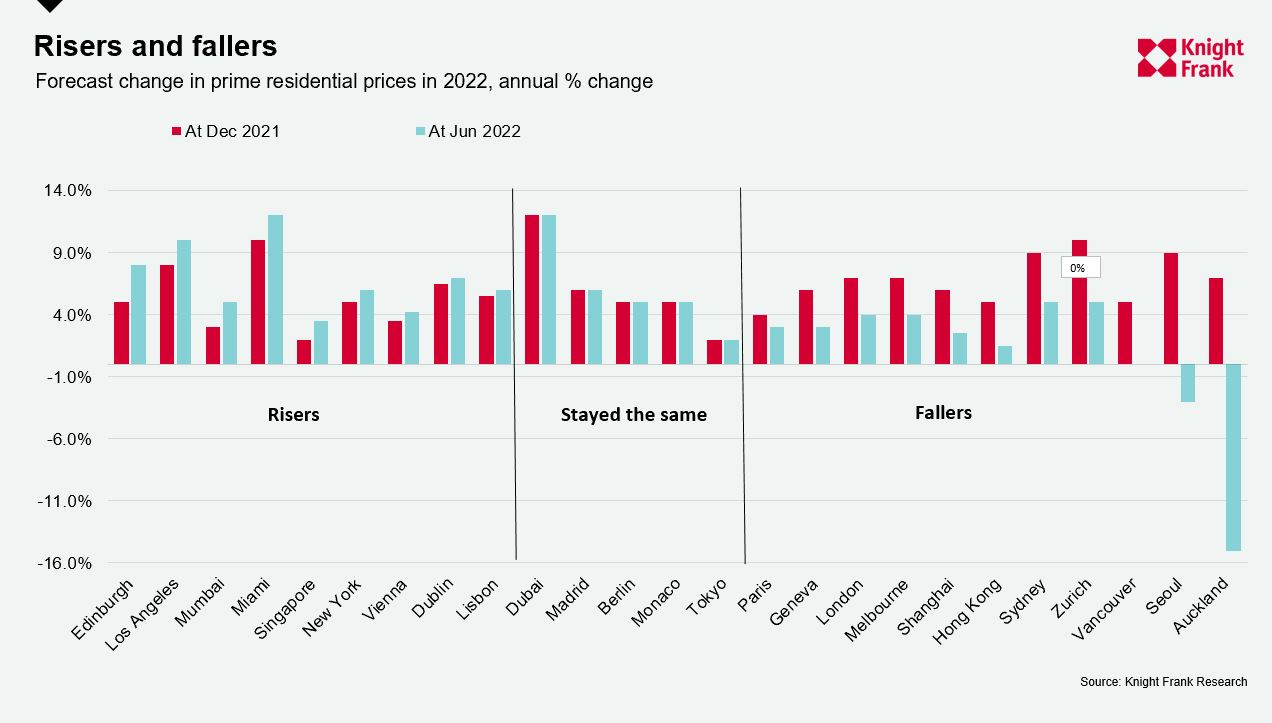

Of the 25 cities tracked 11 cities are expected to see weaker performance than that predicted six months ago.

The price forecast for five remains unchanged and perhaps surprisingly nine are predicting stronger price growth than anticipated at the end of 2021.

Which cities lead now compared to the end of 2021?

Miami now joins Dubai in the top spot with both cities expected to see growth of 12% in 2022.

However, for both prime markets this represents a slowdown compared to their stellar performances in 2021.

Biggest changes

Auckland, Seoul and Vancouver have endured the biggest hits to their prime price forecasts, dropping 22, 12 and 5 percentage points respectively since the end of 2021.

In Auckland, responsible lending laws introduced at the end of 2021 along with six rate rises since October 2021 mean buyer sentiment has changed from a fear of missing out to a fear of overpaying.

Meanwhile, Edinburgh, Los Angeles and Mumbai and Miami have seen the biggest upward revisions. Resilient demand, tight supply and an improving local economic outlook are behind their more positive outlooks.

What’s the outlook for 2023?

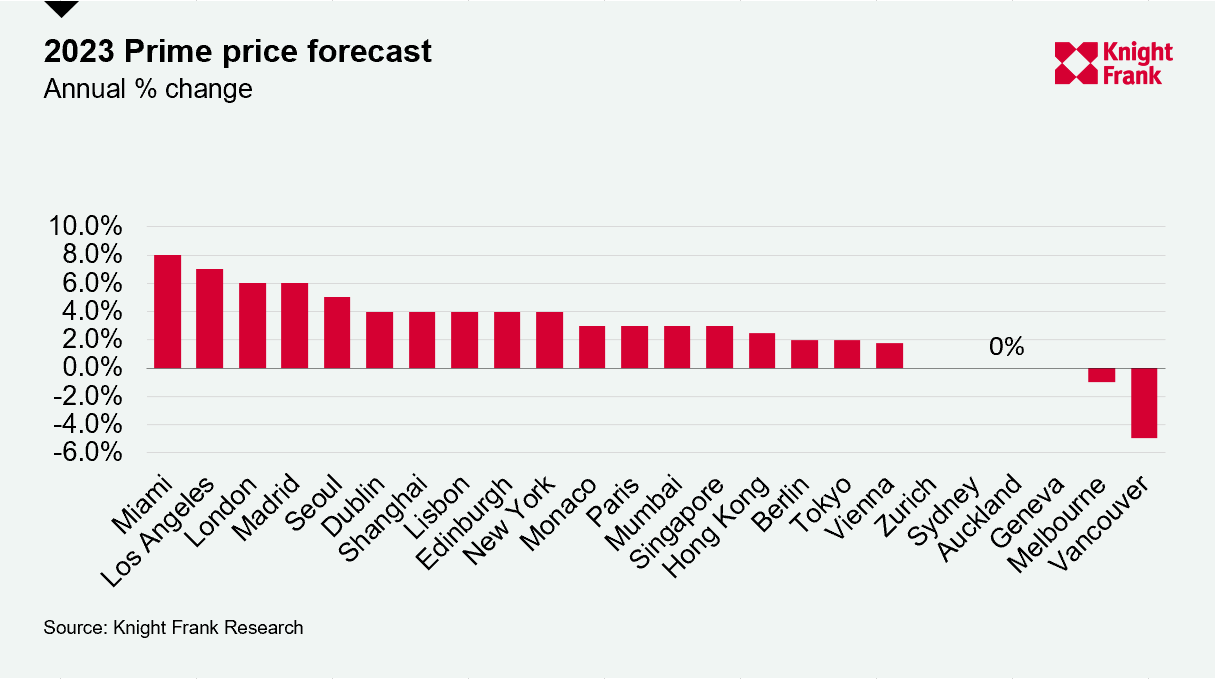

Overall, we expect more muted price growth in 2023, averaging 2.8% growth across all 25 cities.

The gap between the highest and lowest performing city is expected to narrow from 27 percentage points in 2022 to 12 in 2023.

Cities in the US are expected to continue to outperform with Miami and Los Angeles leading the forecast with prime prices expected to rise by 8% and 7% respectively.

London (6%), Madrid (6%) and Seoul (5%) complete the top five city prime price forecasts for 2023.

Buoyed by strong domestic demand, the London market is seeing the gradual return of international buyers, with some motivated by a weaker pound.

Wider housing market challenges and affordability concerns in countries such as the US, Canada and Australia may see rate rises halt or go into reverse in the second half of 2023, reigniting economic growth and as a result wealth creation, in turn boosting prime markets.

Key trends

- Inflation risks will be more persistent in the UK and Eurozone, making them amongst the last to lower rates, in 2023/24 this could weaken or reverse the currency advantage currently seen by dollar denominated buyers.

- The changing economic landscape in 2022 has stayed the hand of policymakers, delaying the introduction of cooling measures. Canada is one exception where a ban on foreign buyers comes into effect on 1 January 2023.

- The scarcity of prime homes will support prices in Singapore and Hong Kong despite recent waves of Covid and US interest rate hikes.

- Suburbs in Australian cities are still achieving record prices, but sales momentum is slowing in part due to the seasonal lull during the winter.

- For Mumbai, if luxury price growth of 5% is achieved as predicted, this will be the strongest rate of growth since 2010.

- In most markets, a strong labour market, rising incomes, the increased equity in prime homes accrued during the pandemic and for those with mortgages, the high proportion of fixed rate mortgages will mitigate the impact of the slowdown.

View Knight Frank’s detailed UK Residential Market Forecast

Keep up to date with prime global markets, sign up to receive our monthly global residential newsletter