UK house prices surge even as political volatility rises

A general election rather than a Tory party leadership vote would have an impact on the housing market but that feels unlikely this year

2 minutes to read

UK house prices have again appeared oblivious to external events.

Hours before the prime minister announced his resignation, Halifax reported 13% annual house price growth in the UK, the strongest figure in 18 years.

For over a year, house prices have confounded those expecting the cost-of-living crisis to take its toll. What is often overlooked though, is that prices have risen largely for the same reason as inflation – a supply chain disruption.

It appears that is beginning to change. Stock levels are rising, which will help reduce house price growth to single digits. Our full forecast can be found here.

Rising mortgage rates will also exert downwards pressure eventually. For now, as lenders withdraw their cheapest rates on a weekly basis, it has injected more urgency into the decision-making of buyers and sellers, a theme we explore here in more detail.

Will the price slowdown happen suddenly? In a market like residential property, which moves at a relatively slow pace, it’s unlikely.

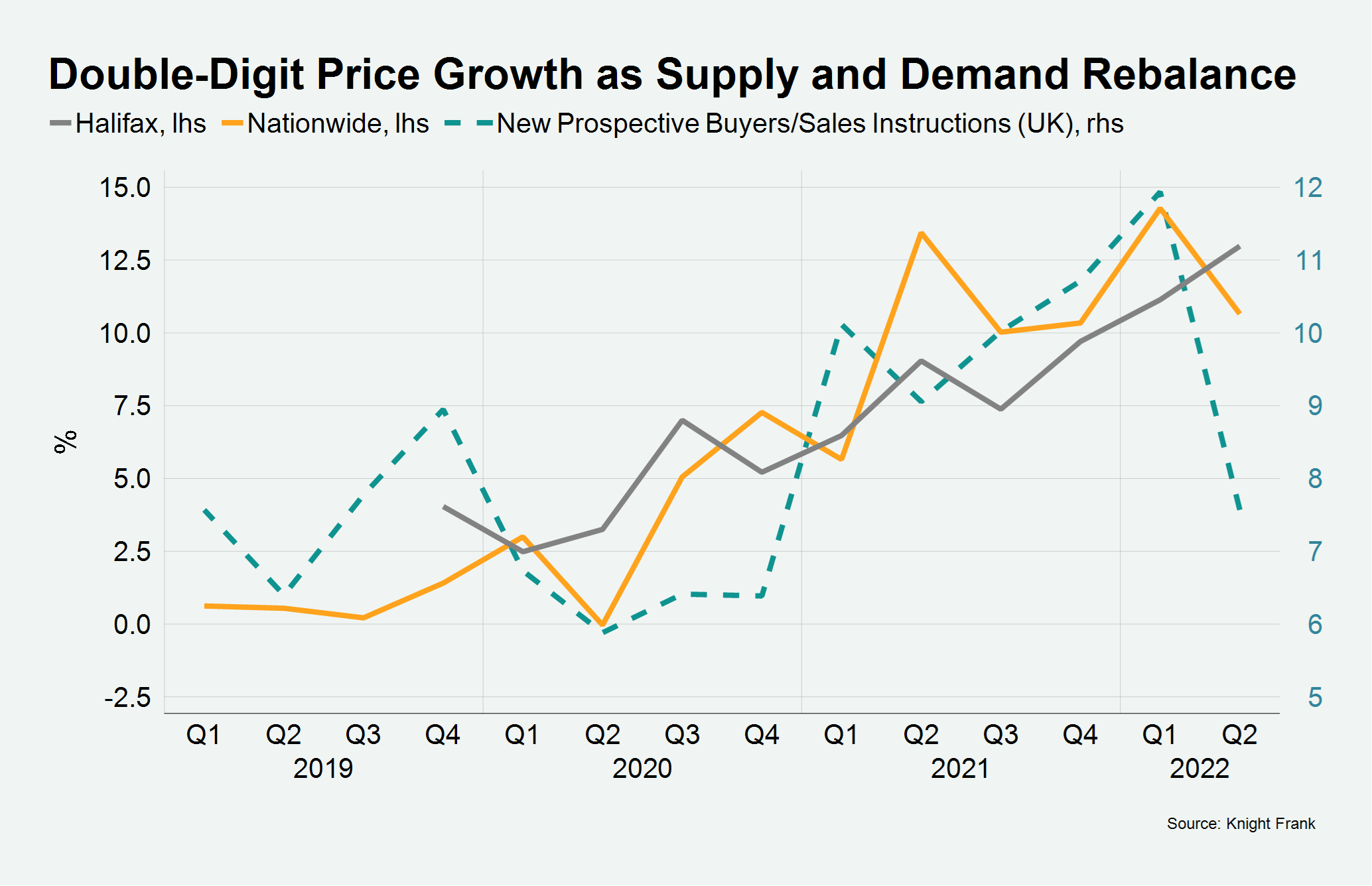

For now, the ratio between the number of new prospective buyers (demand) and sales instructions (supply) is clearly moderating, Knight Frank data for Q2 shows.

The ratio was 7.6 in the second quarter, which compares to 11.9 in Q1, as the chart shows.

The other question that has arisen is how political events could shape the property market this year.

The mid-term election of a new prime minister is hardly a new phenomenon, and the housing market is likely to take a leadership vote in its stride.

We expected a slowdown in the second half of the year as higher mortgage rates bite and supply continues to build, but that could be compounded if a leadership vote leads to a general election.

However, that prospect feels unlikely in the short term. Waiting until after inflation has peaked at the end of this year would be a lower risk strategy for any incoming prime minister.

By next spring, even with inflation falling, the calculation may be that waiting 12 months until the next scheduled election in May 2024 is the best option. Whenever the next election takes place, it will have the time-honoured impact of slowing the housing market in the run up.

Before then, it doesn’t feel like the country is about to change tack politically in a meaningful way. Electoral maths suggest the Tory Party needs to appeal to Red Wall and southern shire voters in a way the 2019 manifesto did. It could mean also mean tax cuts (which may have happened anyway), which would support sentiment in the property market.

Over the next several weeks it will become clearer whether the new PM can straddle those two groups of voters in the way Boris Johnson did. This will set the tone for the economy and housing market, which is likely to remain centre stage politically.

However, only once a general election looms on the horizon will politics have an appreciable impact on the housing market.