Rent rises narrow in prime London while demand stays firm

June 2022 PCL rental index: 186.4

June 2022 POL rental index: 191.2

2 minutes to read

Steep increases in rents in the prime London property market are calming down.

However, the slowdown is a mathematical inevitability rather than the start of a major shift in the supply/demand balance.

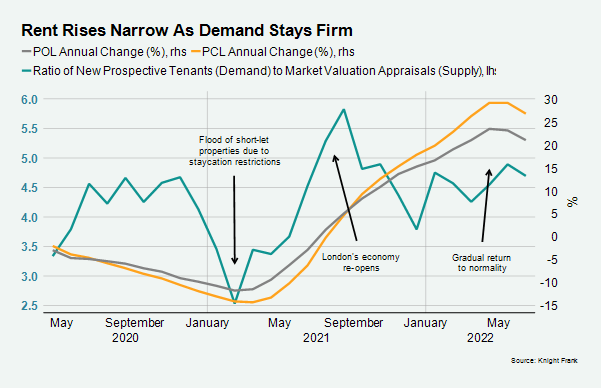

Rental values hit their low point in the first half of last year as the market was flooded with short-let properties due to staycation restrictions.

After reaching a peak in April, annual increases in June narrowed to 26.8% in prime central London (PCL) and 21% in prime outer London (POL). Over the first six months of the year, rents rose 8.4% in PCL and 7.4% in POL, underlining how a large part of this annual increase took place in the second half of 2021.

For what we think is likely to happen next, please see our latest lettings market forecasts for 2022 here.

Supply is picking up modestly in pockets of London but not to the extent that it is anything other than a landlord’s market.

More ‘accidental landlords’ are coming from the sales market as mortgage rates rise and prices peak. Meanwhile, there is a greater churn of lettings properties as tenants reassess their work/life balance and others move due to fast-rising rents, as we explored in more detail last month.

As a result, the ratio of new prospective tenants (demand) to market valuation appraisals (supply) fell to 4.7 in June, which is lower than it was last summer, as the chart shows.

This ratio may increase in coming months with the arrival of international students and corporate tenants. A “sprint for stock” took place last summer due to high demand and low supply – a phenomenon that will be marginally less frenetic this year.

“This summer won’t look hugely different to last summer in the prime London lettings market,” said Tom Bill, head of UK residential research at Knight Frank. “It will be a story of tight supply and frustrated tenants. The rental market in London will take time to rebalance, and I’d be surprised if it resembles its pre-Covid state by the end of the year.”