‘Sprint for stock’ as offices re-open and air traffic rises

The lettings market is heating up quickly as corporate relocation enquiries and passenger numbers soar.

3 minutes to read

The lettings market has been likened to a microwave oven - it can heat up very quickly.

It has certainly been on full power rather than defrost over the last six weeks.

In that time, a tenant’s market has become a landlord’s market as supply has fallen and demand has hit record highs.

Supply has been curtailed as the flow of short-let properties onto the long-let market has dried up as staycation rules have been relaxed. In other cases, would-be landlords sold to capitalise on surging demand in the sales market due to the stamp duty holiday.

In addition to the return of overseas students, the re-opening of offices has driven the demand side of the equation.

Those who made their move while it was still a tenant’s market will be feeling vindicated. A number took advantage of steep rental value declines to move further into central London, as we reported in January.

The latest wave of demand is contributing to upwards pressure on rents. Average rents in prime central London rose by 1.2% in the three months to August, the biggest such increase since July 2018. In prime outer London, the quarterly gain of 0.9% was the largest since June 2018.

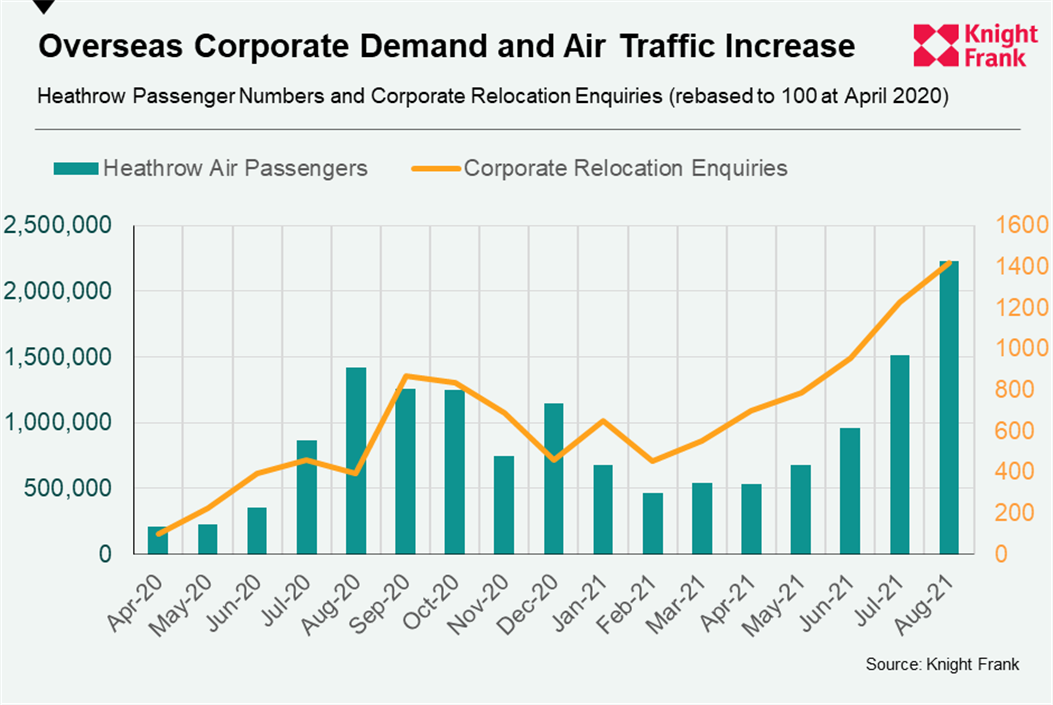

Two charts neatly demonstrate the changes taking place.

The first shows how corporate relocation enquiries and Heathrow passenger numbers have tracked each other through the pandemic. The enquiries come from companies of all sizes looking to relocate staff to the UK across a range of sectors including finance, tech and energy.

The correlation is perhaps unsurprising but the fact demand is only 18% lower than in August 2019 shows just how strong it has become compared to dwindling supply levels.

“I would expect to reach 2019 levels of demand early next year,” said John Humphris, head of relocation and corporate services at Knight Frank. “Corporate demand is increasing all the time, but the problem many face is a lack of supply.”

With companies still sending staff over despite the shortages, some are having to extend search periods.

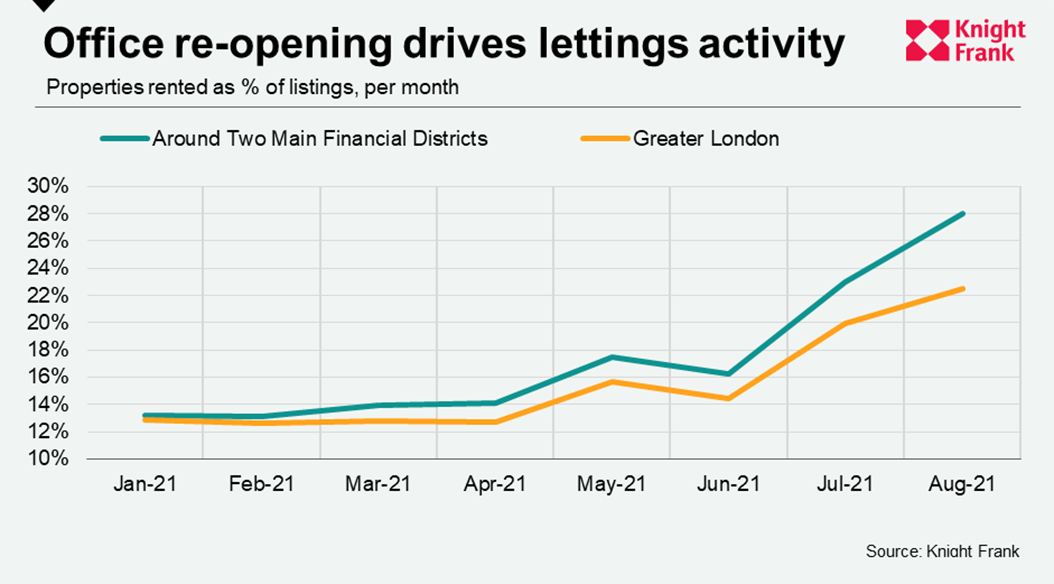

The second chart underlines how activity has picked up to a greater degree around London’s two main financial districts.

It compares how many properties were rented as a proportion of all listings in Greater London and an area that includes locations around the City and Canary Wharf, according to OnTheMarket. The neighbourhoods in the latter group include E14, the Southbank, Wapping, Shad Thames, south Islington, E1, E2, E3 and the square mile itself.

The rate in both groups was 13% at the start of the year but there has been a divergence in recent months.

While 22.5% of Greater London listings were rented in August, the figure was 28% in areas around the two financial districts.

In many cases, office workers are renting a London base having moved out of the capital as part of the ‘race for space’ trend, which has also been a defining feature of the property market during the pandemic.

Given how quickly a tenancy can be agreed compared to a sale, what’s taking place in the lettings market is more urgent and can be best described as a ‘sprint for stock’.

Photo by louis magnotti on Unsplash