Residential mortgages issued in Kingdom of Saudi Arabia rising

The number of residential mortgages issued in H1 is up ten times on H1 2016, whilst prime office rents in Riyadh recover to pre-Covid levels and foreign business investment licenses hit a record high.

3 minutes to read

While 2021 marks Saudi Arabia’s 91st National Day, it is also the fifth anniversary since the launch of the National Transformation Plan. Five years on from the launch of Vision 2030, Saudi Arabia’s real estate market has blossomed, with further exponential growth expected, according to the latest analysis by global real estate consultant Knight Frank.

Faisal Durrani, partner, head of middle east research, Knight Frank, said: “With Vision 2030, Saudi Arabia is a country declaring to the world that it has arrived. As we head towards the Kingdom’s 100th birthday in 2030, Vision 2030 is materialising before us and its powerful impact is nowhere more visible than in Saudi Arabia’s vibrant and resilient real estate market.”

Knight Frank is tracking close to US$ 1 trillion worth of real estate and infrastructure projects that have been announced in the wake of the National Transformation Plan and this is only a third of the total US$ 3.2 trillion of spending that is planned. So far this includes 8 giga projects and new super cities, including the cutting edge US$ 500 billion NEOM and the spectacular new US$ 20 billion Diriyah Gate neighbourhood in Riyadh that promises to transform luxury living in the capital, Riyadh.

Durrani added:“The momentum injected into the national property market is best reflected in the fact that at over 150,000, the number of residential mortgages issued in H1 2021 is more than ten times the level registered in H1 2016. Clearly, the government is delivering on its pledge to improve access to world-class housing for all and is doing so in style.

“Furthermore, in the national office markets, headline rents were clearly impacted by the pandemic, but rates for the best offices in Riyadh have recovered to pre-pandemic levels and demand is growing rapidly. The industrial markets too are expanding at an unprecedented rate as requirements outstrip demand in many locations.”

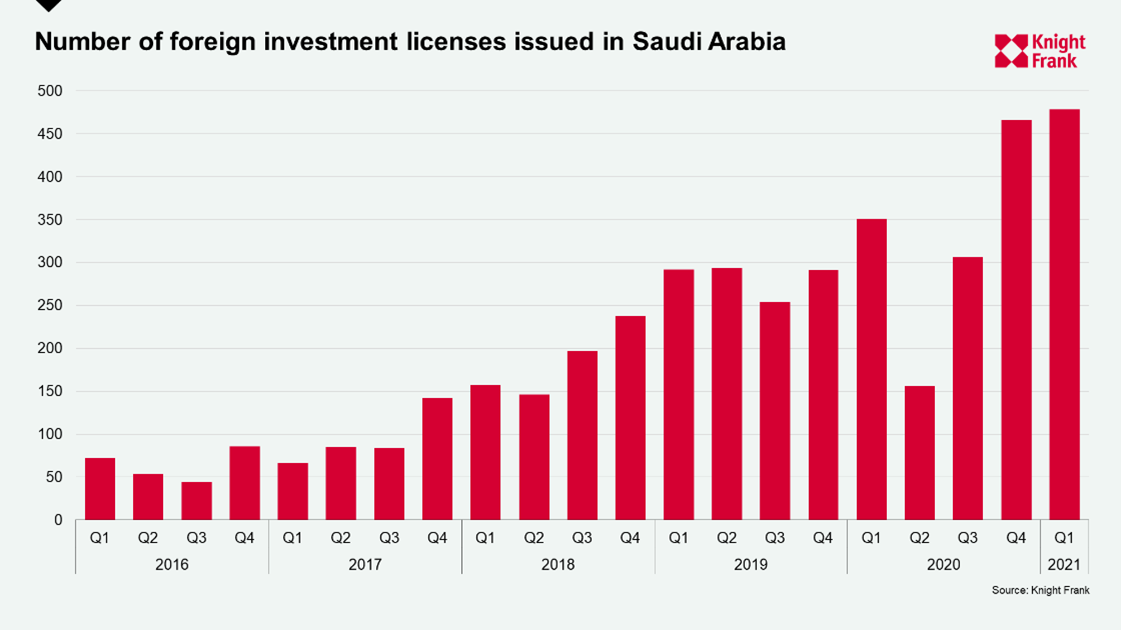

Government efforts to reshape the economic and real estate landscape are driving a sharp upturn in business activity, with the number of new business licenses issued soaring. Indeed, Q1 2021 has seen the highest ever number of new foreign business investment licenses issued.

“What we’ve seen happen over the last five years has been nothing short of incredible. The lightning speed at which reforms are being implemented and the pace at which giga real estate projects are rising is just the tip of the iceberg. We are witnessing the emergence of what looks set to be one of the hottest new real estate markets in the world”, concluded Durrani.

By 2030, Knight Frank anticipates the completion of more than 1.3 million residential units, in excess of 3 million square metres of new office space and over 100,000 hotel rooms across Saudi Arabia.

Harmen de Jong, partner, real estate strategy and consulting at Knight Frank Saudi Arabia, commented: “The peak in residential mortgages seems to correlate with demand for real estate advisory services this year, exceeding pre-pandemic levels seen in 2018 and 2019. We are beginning to see increased appetite from private sector real estate developers in the form of public-private-partnership initiatives with large scale government led projects. This is a key trend which will further support the realisation of Vision 2030”.

For more information, please contact Faisal Durrani