Monday property news update - 20 September

Travel eases, pay hikes all round and faith in the Bank of England wobbles

4 minutes to read

Inflation

The minutes of the Bank of England's latest Monetary Policy Committee meeting should make for fascinating reading when they are published on Thursday. The minutes, along with the accompanying report, set out the economic analysis and inflation projections that officials rely on to make their interest rate decisions.

Gas prices dominate the front pages today but leaf further through the newspapers and you'll find growing signs of inflation everywhere. For several months the BoE assuaged markets with reassurances that rising prices are the temporary result of the reopening of the global economy, but with each month that ticks by the outlook looks less clear. Outgoing BoE chief economist warned in June that his fellow rate setters were underestimating the risks.

The public is beginning to agree. The Bank conducts monthly surveys covering attitudes to inflation and the latest version - FT link - revealed only a third of respondents think the MPC is doing a good job at keeping prices under control, the lowest reading since the survey began in 1999.

Retail

August's ONS retail sales figures revealed that sales values excluding fuel climbed 1.4% as sales volumes declined 0.9%.

Stephen Springham's analysis of the data notes that, though growth in values was the weakest outside of a lockdown period since February 2020, the release is "the first time we have seen clear evidence of shop price inflation (as opposed to inflation in non-retail goods). More worryingly, these figures would suggest that it is actually stymying consumer demand."

Those figures will be one measure being weighed by BoE officials. Another will be whether or not low unemployment will drive increases in wages. Well, a new survey by the CBI reveals that more employers are planning pay rises than at any time since the global financial crisis.

Travel

The government's decision to ease restrictions on international travellers entering England will provide another injection of demand for property in prime central London. The government is working on ironing out creases for some destinations before October 4th, particularly the UAE, which isn't on the list of 17 countries from which vaccines will be given the same status as those delivered in the UK.

Corporate relocations, and the repopulation of London's offices and falling supply is already being felt in the prime lettings market. New analysis from Tom Bill reveals average rents in prime central London rose by 1.2% in the three months to August, the biggest such increase since July 2018. In prime outer London, the quarterly gain of 0.9% was the largest since June 2018.

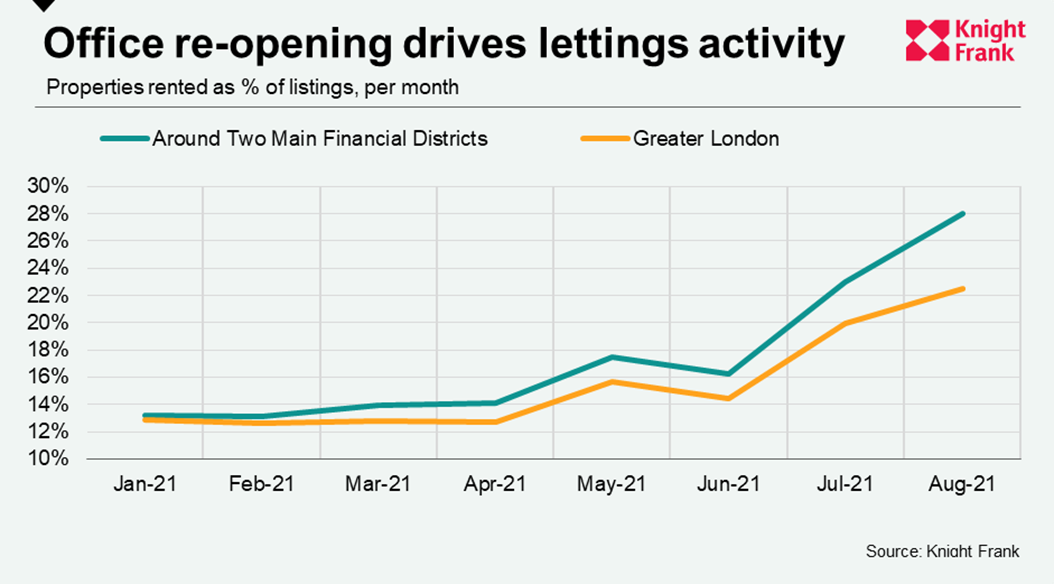

The strongest pickup in activity is being felt around London's financial districts (see chart below). The chart compares how many properties were rented as a proportion of all listings in Greater London and an area that includes locations around the City and Canary Wharf, according to OnTheMarket.

The rate in both groups was 13% at the start of the year but there has been a divergence in recent months.

Later life borrowing

New research from UK Finance - the trade body that represents UK lenders - reveals that 52% of mortgage lending to homeowners in 2021 has come with terms that extend beyond the main borrower’s 65th birthday.

The report, not online yet but the Times write up is here, reveals the degree to which borrowing beyond age-55 has surged in popularity. This is the first year the proportion has exceeded 50% and it was as low as a third back in 2014.

The huge build up in housing equity among older homeowners and the desire to access it while continuing to live at home is one of the biggest drivers of demand in what is now a rapidly growing later life finance market. Increasingly high-net-worth individuals are opting to utilise the products for inheritance tax reasons - see David Forsdyke on that.

Elsewhere in mortgages, rates keep coming down. Platform, the mortgage lending arm of the Co-operative, has introduced a 60% LTV two year fixed rate mortgage at 0.79%.

In other news...

Faisal Durrani on Saudi Arabia's ten-fold increase in mortgage lending since 2016.

Berlin buys 15,000 apartments amid pressure to counter rising rents, ripples from China's real estate crackdown, and finally, the European economic perspective on the energy price squeeze.