All eyes on energy, and what markets are predicting for base rates

Discover key economic and financial metrics, and what to look out for in the week ahead.

1 minute to read

Here we look at the leading indicators in the world of economics. Download the dashboard for in-depth analysis into commodities, trade, equities and more.

EU realigns energy sources

The EU aims to reduce its dependency on Russian energy imports by two thirds this year, and has agreed a deal with the US to buy 15bn m3 of liquefied natural gas (LNG) by the end of 2022. This will likely ease uncertainty for manufacturers, distribution firms and retailers in European countries, which rely on this supply to power warehouse facilities, for example.

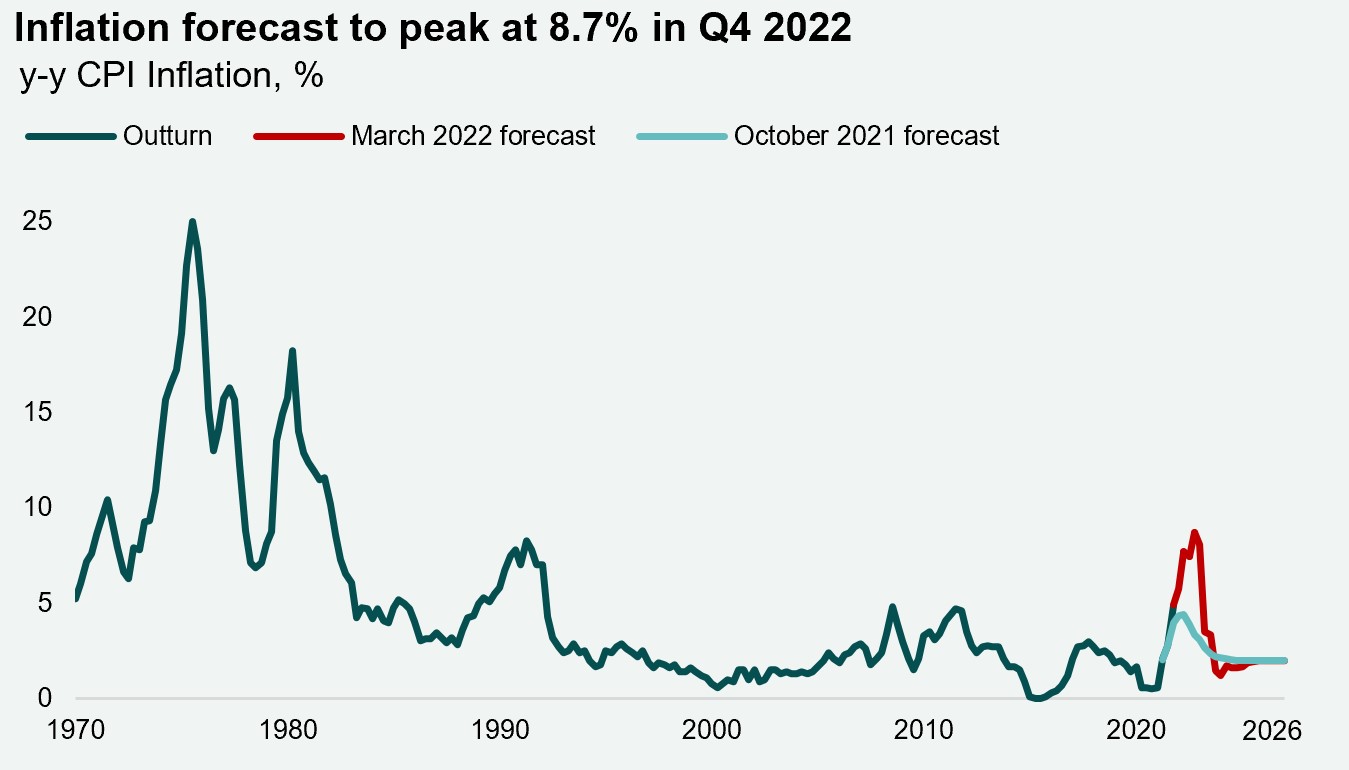

Strongest UK inflation for 30 years

UK inflation reached 6.2% in February, up from 5.5% in January, a level last seen in 1992. Inflation is expect to accelerate further in the coming months as regulated energy prices increase from April. The OBR’s latest forecast shows inflation peaking at 8.7% in Q4 2022, noticeably higher than its previous prediction of 4.4%.

Already planning for rate cuts?

In the UK, markets are expecting five 25bps rate hikes by year end. However, looking further ahead, they are also indicating more than a quarter-point in interest rate cuts within the next two years. Here, markets are factoring in warnings that surging costs for energy, clothing and food could lead to a weaker growth outlook. In Europe, markets are positioning for four 25bps rate hikes from the European Central bank. With Europe’s inflation data due on Friday, there could be calls to tighten more rapidly.

Download the latest dashboard