Interest rates up, oil up, volatility down

Discover key economic and financial metrics, and what to look out for in the week ahead.

1 minute to read

Here we look at the leading indicators in the world of economics. Download the dashboard for in-depth analysis into commodities, trade, equities and more.

Pace of rate hikes sparks debate

In the UK, there are some concerns surrounding the downside risks to growth from higher interest rates, which could mean that a 25bps rate hike in May would be the last one for some time. In contrast, Jay Powell, Chair of the US Federal Reserve has noted that the US should ‘expeditiously’ move towards tightening monetary policy and that doing so would not cause a recession.

Oil prices set for more uncertainty

Oil prices rose to $115 per barrel on Monday, 40% above levels seen in January, but down from last week’s peak of $139 per barrel. Prices are expected to remain volatile as NATO and EU leaders meet later in the week to discuss further Russian sanctions, including potentially banning Russian oil. Meanwhile, countries including the UK and Germany are looking for alternative energy sources to alleviate dependency on Russia and reduce end-costs.

Equities sell off abates

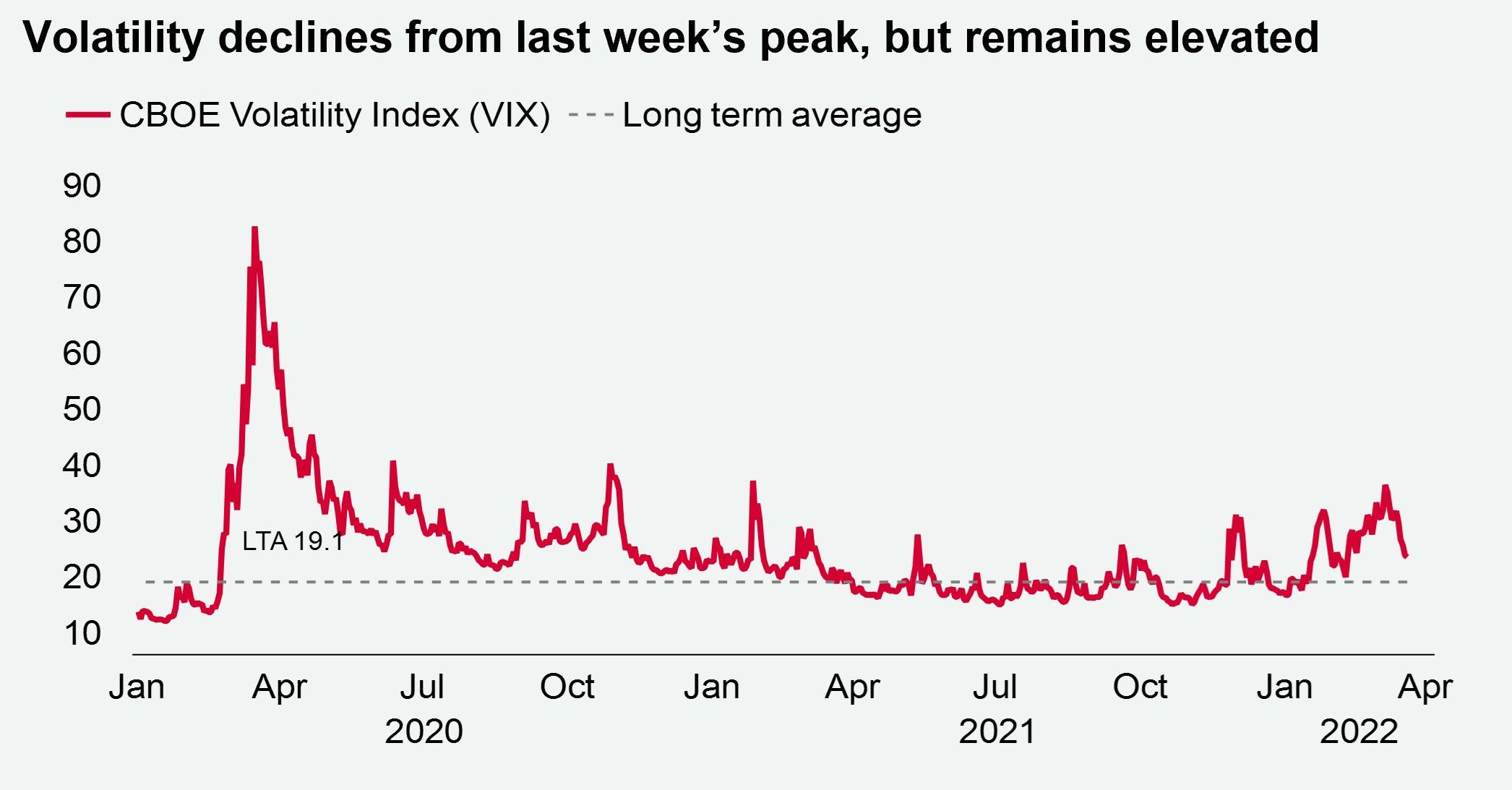

While conflict in Ukraine sadly continues, markets have started to settle. The CBOE VIX volatility index is down 35% from its peak last week, while the European Stoxx 600 has now recovered its losses incurred over the past month. Analysts expect this growth in equities to continue, as investors seek to realign portfolios to capture higher returns before the financial year ends.

Download the latest dashboard