Neom named most desirable Saudi city

Saudi Arabia’s new Giga projects mark the birth of what could be the emergence of one of the world’s hottest new real estate markets.

3 minutes to read

In our first survey as part of the Saudi Arabia Real Estate Market Survey, 1,003 Saudi national households’ opinions have been gathered across the cities of Riyadh, Jeddah and Dammam, split between tenants and homeowners we discovered there is a domestic appetite to purchase, invest and live in some of the world’s largest and most unique real estate projects.

At 41%, NEOM has been named as the most attractive of the Giga projects, some of the largest projects of Vision 2030. This is where most of our respondents would be interested in buying a home. The US$ 500bn project’s popularity was highest in Dammam (44%), followed by Jeddah (43%) and then Riyadh (39%).

The Red Sea Project (23%) is a distant second, however respondents in Jeddah (34%) have the coastal development higher up in their minds than those in Riyadh (17%). This is quite an interesting dichotomy, given that The Red Sea Project is arguably the most advanced in terms of visible development.

Riyadh’s Diriyah Gate (13%) has been named as the third most likely project Saudi nationals are likely to buy a home in.

Interestingly, the popularity of NEOM rises with monthly household income, with those earning above SAR 60,000 (48%) naming it as their most preferred target for a home purchase. When it comes to Diriyah Gate, the opposite is true, with those earning less than SAR 10,000 per month citing the SAR 20bn development as their favourite target for a home.

In terms of the likelihood of making a purchase, NEOM (72%) again tops the list amongst respondents that named it as the most attractive Giga project to buy a home in. The Red Sea Project, while emerging as the second most “attractive to buy a home” falls in last place when it comes to the likelihood of making a purchase at just 56%.

The fans of NEOM are also most likely to pay a price premium (60%) to purchase here, while those who find Diriyah Gate the most attractive Giga project are least likely to pay a premium to own a home in the project (37%).

Key statistics

- 70% of those keen on making a purchase in one of the Kingdom’s Giga projects earns less than SAR 20,000 per month

- Those living with their spouses (71%) name NEOM as their primary target for a home

- 36% of tenants saving to buy a home believe NEOM is an attractive location for their first purchase

- 61% of homeowners who believe purchasing a home has helped them achieve a life-long goal prefer NEOM above other Giga projects

- 52% would buy in NEOM purely for investment reasons; the rest would buy here for family use.

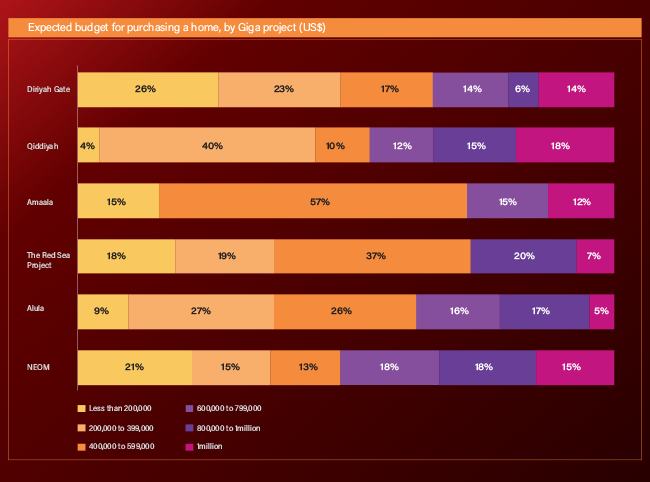

- Just 15% of NEOM’s fans are willing to spend over US$1 million on a home here.

- 33% of those who find NEOM an attractive place to buy claim to know a lot about the project; however, this is second to Qiddiyah (40%)

Saudi Arabia survey

Knight Frank’s 2022 Saudi Arabia Real Estate Market Survey, carried out in in partnership with YouGov, strives to understand domestic appetite for residential property in the Kingdom, with a particular focus on the attractiveness of the planned Giga projects as investment hotspots.

Discover the full Saudi Arabia Residential Survey 2022