WFH 2.0, the return of expats and our predictions for 2022

Making sense of the latest trends in property and economics from around the globe.

4 minutes to read

Omicron

The government's latest guidance to “work from home, if you can" isn't quite as direct as last year's "everyone must work from home unless they are unable to do so" and it shows. Various large companies tallied by the Telegraph plan to keep offices open as leaders try to minimise the disruption caused by fluctuating policies.

Sentiment and spending remain robust for the time being, though much will depend on the latest scientific data on the Omicron variant. In an interview with AP yesterday, Dr Rochelle Walensky, director of the US Centers for Disease Control and Prevention, said “the disease is mild” in almost all of the cases seen so far but admitted they are working with limited data.

UK credit and debit card spending hit its highest level since the first lockdown during the week leading up to 2nd December and economists tallied by the FT believe the economic impact of the government's "Plan B" will be limited. The most dire warning comes from the Institute of Economic Affairs, which said the additional restrictions could knock 2% off GDP.

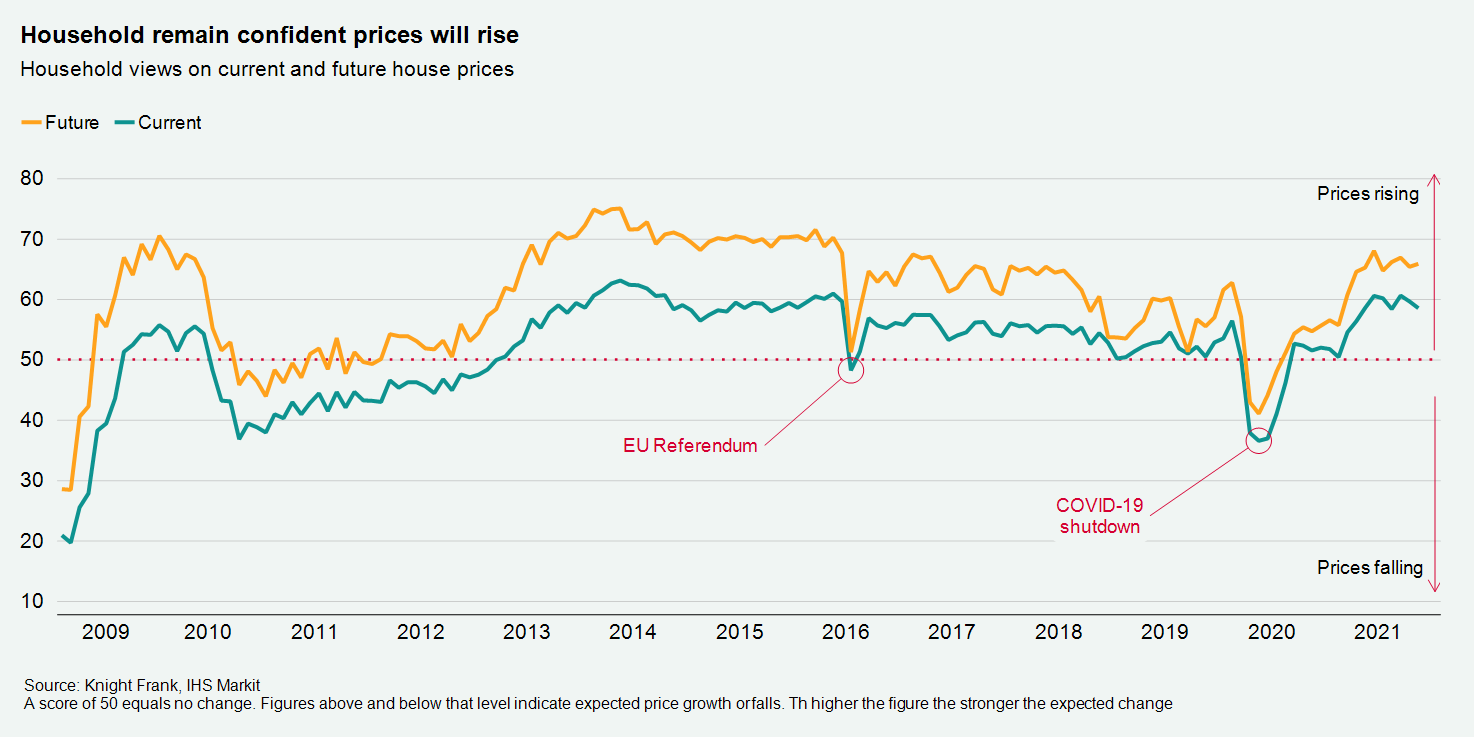

Sentiment in the housing market remains strong (see chart), suggesting homeowners have largely shrugged off the end of the Stamp Duty Holiday, news of potential interest rate rises and broader, heightened uncertainty.

Prime London

London's residential market strengthened in November. The number of offers accepted in prime central and prime outer London hit a ten-year high (see chart).

Other leading indicators suggest the new year will be a busy period in the capital. Across the UK, the biggest increases in the number of new prospective buyers in the three months to November compared to last year were all in London.

Meanwhile, tight supply continues to drive the recovery in rental values in prime London. Average rents rose 5.3% in the three months to November in prime central London while there was an increase of 5.1% over the same period in prime outer London. That's the largest quarterly gain in prime outer London since March 2004 and the biggest such increase in prime central London since September 2010

Renters

The proportion of households in England living in privately rented accommodation has approximately doubled in the past 20 years and regulation of the sector isn't up to scratch, according to a National Audit Office report published this morning.

There are differences in the extent to which landlords comply with the law in different regions, and tenants from certain demographic groups experience worse property conditions or treatment, the NAO found. The Department for Levelling Up is not proactive in supporting local authorities to regulate effectively either.

The Department said it is planning "large-scale reforms" to address the issues, which will be laid out in a white paper due to be published in 2022.

Expats

Chris Druce tracks an influx of expats to the south east.

The number of exchanges involving returning UK expats in the 18 months since the market reopened last May was up by 25% in South East England compared with the 18 months before the UK’s first lockdown. In the Home Counties, which includes locations like Elmbridge in Surrey and Henley-on-Thames in Oxfordshire, exchanges involving expats increased by 22% over the same period.

"Many expats have been extremely motivated to return home to be closer to either family roots despite the barriers they’ve had to overcome,” says Nigel Mitchell, regional partner for the South East at Knight Frank.

Our predictions for 2022

For our final podcast episode of the year, Anna Ward is joined by head of international residential research Kate Everett Allen, head of UK commercial research Will Matthews and global head of occupier research Lee Elliott.

They share their key predictions for 2022, explore whether the ‘race for space’ in residential property markets will run out of steam, and look at what the easing of travel restrictions will mean for cross-border activity across all property markets.

They also discuss what the year holds for working habits and how employers' use of real estate will change. Listen here, or wherever you get your podcasts.

In other news...

Tilda Mwai explores the pandemic's impact across Africa's property sectors.

In the latest instalment of The Wealth Report autumn webinar series, editor Andrew Shirley takes another dive into the world of investments of passion. Watch back here.

Elsewhere - Evergrande defaults (NYT), new US jobless claims fall to lowest level since 1969 (FT), high streets ‘need a strategy’ after Covid (Times), court ruling that a fall during the walk from bed to desk is a workplace accident (Guardian), the remote work consulting boom (Businessweek), and finally, British housing boom created £3tn ‘unearned’ and ‘unequal’ windfall (FT).

Photo by Luke Peters on Unsplash