London sales pipeline reaches ten-year high amid Omicron uncertainty

November 2021 PCL sales index: 5359.8

November 2021 POL sales index: 264.7

2 minutes to read

It should certainly be an active few months in the London property market.

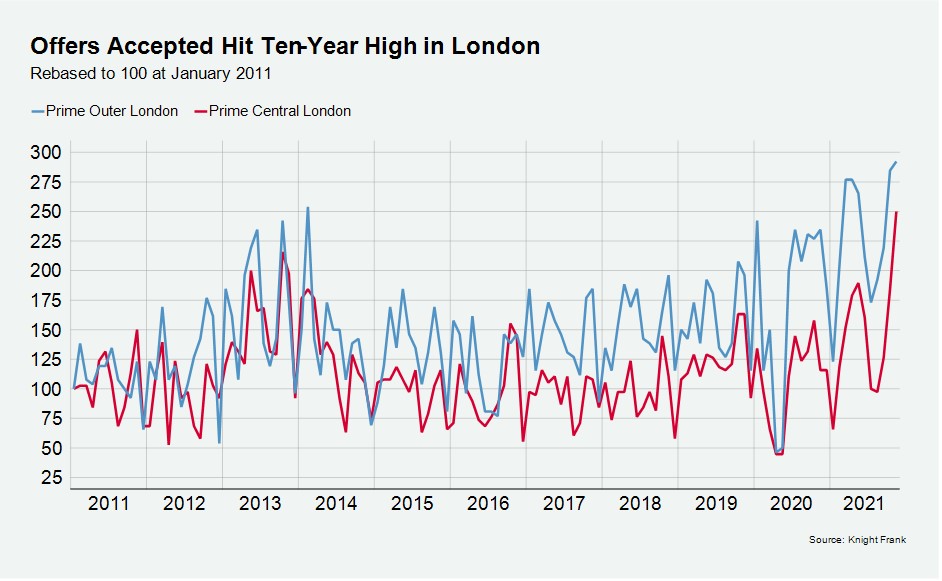

The number of offers accepted in November reached a ten-year high as the capital moved firmly back onto the radar of buyers.

In prime central London, the figure was 116% higher than the same month last year while in prime outer London, there was a 25% increase on last November.

It is indicative of how demand has shifted back towards London as the pandemic has evolved.

Across the UK, the biggest increases in the number of new prospective buyers in the three months to November compared to last year were all in London, recent analysis shows.

“Activity has picked up dramatically across the board,” said James Clarke, head of London sales at Knight Frank. “In the last few weeks a large number of deals have come to fruition.”

Meanwhile, the ratio of demand (new prospective buyers) to supply (sales instructions) in November reached its highest level in PCL and POL since the start of the pandemic, suggesting upwards pressure on prices will be maintained.

The figure was 10.9 in POL, which compared to 6.1 in November 2020. In PCL, the ratio climbed to 7.8 from 3.9 over the same period.

The strength of the London market comes despite the fact overseas buyers are not yet back in meaningful numbers, as we explore here.

Uncertainty surrounding the new Omicron variant could still have a dampening impact on the market if its severity is worse than early anecdotal evidence suggests. It has already caused some overseas buyers to delay viewings until after Christmas.

How the severity of the new variant eventually compares to Delta is the key question.

If the severity is broadly equivalent, January could bring a ‘relief bounce’ in the London sales market. If the severity is lower than Delta, the transmissibility higher and Omicron becomes the dominant strain, it could trigger even higher levels of activity if the end of the pandemic appears closer. If severity is worse than Delta, much will depend on to what extent and how quickly a vaccine can be adapted.

In the meantime, price growth has solidified across many London markets.

Average prices in PCL increased by 1.2% on an annual basis for the second consecutive month in November. Last month, we explored in more detail how that compares to previous years.

In POL, average prices rose by 3.1% over the same period, the sixth time the figure has been recorded over the last seven months.

The biggest rises were still seen in outer London as space and greenery remain on the agenda for buyers.

The largest annual increases included Wimbledon (11.4%), Dulwich (6.1%), Queen’s Park (6.6%) and Richmond (7.3%). In central areas, the biggest rises were recorded in Islington (6%), South Kensington (3.6%) and Notting Hill (2.4%).