Rental values continue to bounce back at fastest rate in a decade

November 2021 PCL lettings index: 147.9

November 2021 POL lettings index: 158.7

2 minutes to read

Rental values continued their strong recovery in November, pushing the annual change into positive territory in some parts of London for the first time since early 2020.

Average rents rose 5.3% in the three months to November in prime central London (PCL) while there was an increase of 5.1% over the same period in prime outer London (POL).

It was the largest quarterly gain in POL since March 2004 and the biggest such increase in PCL since September 2010 as the lettings market continued to recover from the pandemic.

Average rental values in PCL fell by 0.2% in the 12 months to November while there was a rise of 1.8% in POL.

Alongside stronger demand from office workers and students, lower supply is also behind the rebound. The flood of short-let properties that came onto the long-let market has dried up as lockdown and staycation restrictions have been relaxed.

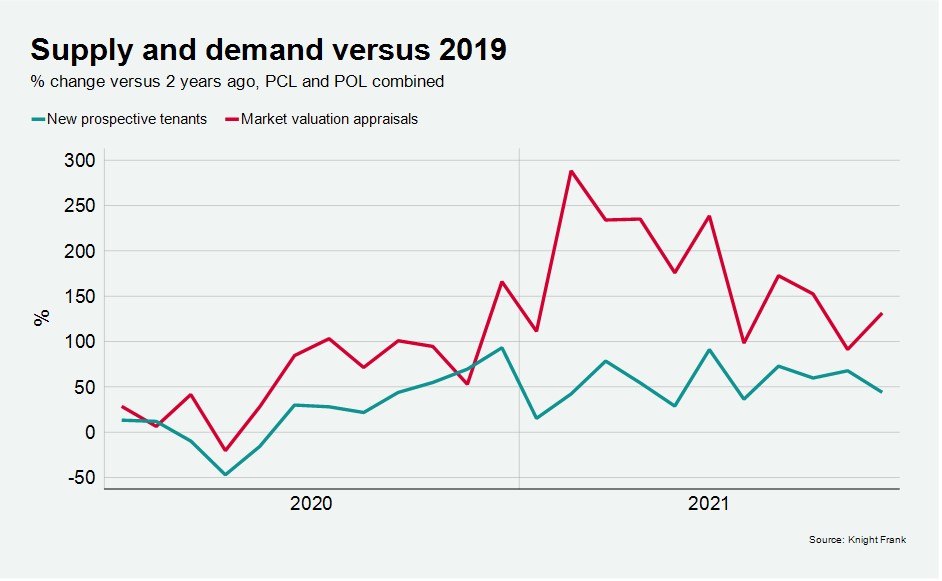

This year, the peak month for market valuation appraisals (a leading indicator of supply) was February. The figure in November was down by 46%, underlining to what extent supply has fallen, see chart below.

Demand has risen as offices have re-opened and Universities re-introduced face-to-face learning. The number of new prospective tenants registering in November was 44% higher than the same month in 2019, which was already considered a strong year for the lettings market.

Meanwhile, the number of enquiries from companies looking to relocate staff to the UK reached pre-Covid levels in October, as explored in more detail here. Leads in October were up by 78% compared to the same month in 2020 and 1% higher than 2019.

The future trajectory of this trend depends on how severe the Omicron variant proves to be versus Delta. If the severity is worse, this will delay the rebound in demand as vaccines are adjusted.

The rising number of enquiries between March and October this year demonstrates how corporate demand strengthened against the backdrop of the initial vaccination drive.

If the severity of Omicron is comparable with or lower than Delta, demand should continue improving from January following a seasonal blip at the end of the year.

Houses in PCL were the top-performing section of the market for the second month in a row, due to historically-low levels of supply in markets like Chelsea, Notting Hill and Islington. Average values increased 2.9% in the year to November.

As rents rise sharply and sales prices increase more modestly, rental yields are strengthening. In PCL, average gross yields were 3.18% in November, which compared to 2.98% in June. In prime outer London, yields rose to 3.34% from 3.17% over the same period.

As well as rising income return, investors may also be attracted to the relative lack of volatility in holding residential property, something evident in recent weeks due to uncertainty surrounding Omicron.