Africa property markets roar back to life

Pandemic induced demand has boosted property markets in Africa, with high quality office space, larger homes and bigger warehousing space now sought after. Tilda Mwai rounds up how the property markets have been impacted over the last year.

5 minutes to read

Since we published our Africa Horizons 2021 report in April, the global economy has begun to roar back to life, with Covid-19 restrictions easing in some countries, allowing life to resume to an extent.

This has spurred global real estate markets, with the quality of office space occupied by businesses coming under sharpened focus as issues such as ESG and the war for talent dominate board rooms.

And across Africa, these themes are intensifying, with markets from Lagos to Nairobi experiencing unprecedented demand for top quality office accommodation. New space requirements are back to pre-pandemic levels with the flight to quality trend underscoring the emergence of a distinct two-tiered market across most cities.

The logistics sector, meanwhile, is being underpinned by a wave of demand for quality warehousing space fuelled by drivers such as e-commerce, infrastructure development and government industrialisation policies in the wake of the pandemic.

In the residential sector, with greater flexibility towards remote working likely to emerge as a lasting legacy of the pandemic, we are seeing first time buyers and homeowners gravitating towards larger homes, with amenities such as access to green space and reliable, high-speed digital connectivity topping considerations.

What is driving these changes in dynamics in the Africa property market? We explore these trends in more detail below.

Office markets

Across the continent, prime offices demand is making a comeback. As we outline in the latest edition of our Africa Offices Dashboard, many office lease deals that had previously been put on hold have now been reactivated, with prime rents remaining stable in the majority of the cities across Africa.

Regional hubs such as Lagos and Nairobi have continued to record increased occupier activity indicating a return in business confidence. Nairobi for example, saw a 64% increase in prime office absorption recorded at 202,000 sq ft. in the first half of 2021 compared to the same period last year as we discuss in our latest Kenya Market Update.

From aligning their corporate brand and image, reducing costs to ensuring employee wellbeing, majority of the occupiers now view real estate as a strategic device within their business according to this year’s Your Space report. As such, the flight to quality is only expected to intensify across the continent, with occupiers keen to occupy space that places employee wellbeing above all else.

Residential markets

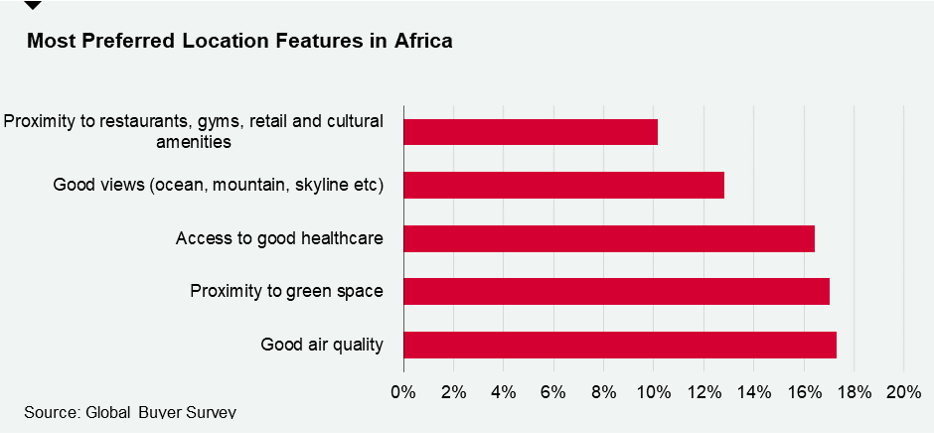

Our latest edition of the Global Buyer Survey reveals that one in four people are looking to move homes in the next 12 months. Across Africa, flight to quality continues to underpin this demand something we predicted in Africa Horizons. Proximity to green space, access to good healthcare and good air quality featured as the top factors influencing location decisions for prospective buyers.

As the landscape constantly evolves, remote working will continue to impact on buyer’s decisions. Access to high–speed broadband and a home study office feature at the top of buyers’ lists when determining whether to make a purchase. These features are now impacting on development activity even as markets such as Kampala see an uptick in the supply of prime residential property. In addition, the pandemic has supercharged demand for quality, affordable homes in the suburbs with 57% of African homebuyers indicating they are more likely to live in the suburbs, compared to just 33% globally.

Industrial and Logistics markets

Although not featured in Africa Horizons, the industrial sector remains a key sector of interest. The sector is being underpinned by rising demand for quality warehousing space as trends such as e-commerce accelerate in the wake of the pandemic.

According to the latest logistics report ,industrial assets across Africa are commanding attractive yields of approximately 12% on average compared to 9% for both retail and offices, and 6% for residential. As such, they have emerged as the best performing real estate sector across Africa. However, with limited stock options, developers such as Agility have had to act fast and plug the existing demand gap. Still markets like Nigeria present developers with an opportunity, recording the highest deficit of 1,000,000 sq m.

Alternative asset classes

Away from the mainstream residential and commercial markets, data centres are a growing investment opportunity in Africa. Johannesburg continues to be the leading data centres market and saw 80 MW of new supply being added into the market in Q3 2021. Notably, take-up increased threefold compared to 2020 indicating the vibrant nature of the sector at the moment.

In markets such as Nairobi, new data regulations have amplified demand over the past three years with the city poised to be a significant hyperscale region. Already, data centres operators such as IX Africa are making their mark by adding more than double the current capacity in the city.

In addition, Lagos has continued to undergo expansion with total supply now at 80 MW. With new fibre links, and a large, increasingly connected population, the country’s economy is becoming more reliant on communications infrastructure. Key operators such as Africa Data Centres, MainOne and

Cloud Exchange West Africa are all set to develop over 20MW of IT power in the City.

Conclusion

While our outlook on 2022 remains upbeat, varying approaches by the region’s governments to recurring infection flare-ups means the economic outlook is likely to remain mixed, this could act as a deterrent for occupiers and potentially hamstring any recovery momentum built up throughout this year.

That said, there will be some bright spots. Nairobi, Dar es Salaam and Lagos for instance, are all showing signs of a gradual return in business confidence. We anticipate this will result in increased occupier activity throughout 2022.

Download the Africa Horizons report here.