UK business jitters, China's property slowdown and the patchwork of demand in prime central London

Making sense of the latest trends in property and economics from around the globe.

4 minutes to read

Sentiment

UK business confidence fell to a 12-month low in October as companies fretted over inflation, supply chain problems and staff availability, according to an IHS Markit survey of 12,000 firms.

Those fears appear well founded. Three in five companies are gearing up to raise prices in order to cover rising wages and supply chain costs. Just one third of businesses were confident they would be able to get the staff they need over the next twelve months. Global surveys are throwing up similar results, centred on the US and a number of key European nations.

The results may weigh on short term decision making but need to be taken in the context of the broader, complex recovery. Confidence remains higher than seen throughout much of the last five years and UK businesses are more confident than those in every other European country apart from Ireland.

China's property slowdown

China's property market slowdown continued in October: new home prices dipped 0.2% month-on-month, investment in new projects by developers is down 5.4% year-on-year and construction starts are down by a third.

The property market by some estimates accounts for as much as a quarter of China's GDP and China's stocks fell overnight, despite a separate release showing industrial output and retail sales grew more quickly than analysts had been anticipating.

The slowdown has been sparked in large part by government measures introduced to cool the sector, mostly targeting developers and speculators. Whether those measures remain in place if the sector begins to drag on the wider economy remains a source of uncertainty. According to Bloomberg, the banking regulator is sticking to its lines, saying late Friday that the government will continue to curb the “financialization of real estate” and prevent bubbles in the sector.

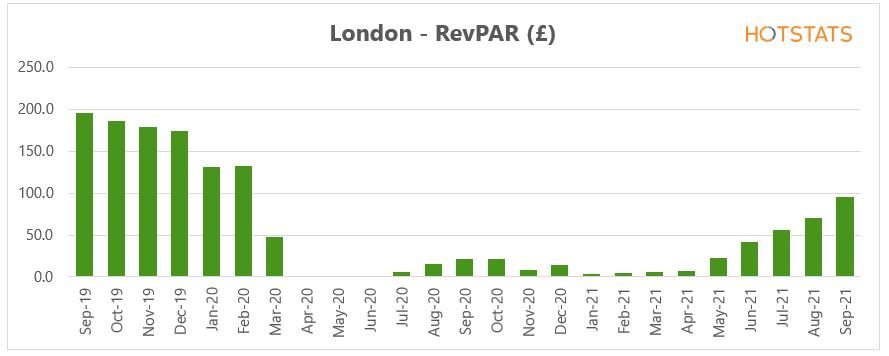

The hotel sector recovery

The UK hotel sector surprised on the upside during September.

London hotels achieved a 91% month-on-month increase in profit per available room, whilst regional UK hotels witnessed the highest levels of revenue and profitability since September 2019. What had been a predicted slowdown during the month was replaced with an uplift in midweek domestic corporate demand, transient business-related travel and an increase in demand for conference-led room nights, according to Philippa Goldstein.

London's revenue per available room (RevPAR), the performance metric used by the hospitality industry, climbed 37% to £82.70.

Retail

The consumer is still spending and many have started their Christmas shopping early, according to the latest retail market analysis from Stephen Springham.

Retail sales increased by 1.3% year-on-year in October and were up 6.3% compared to the same month in 2019. Retail footfall continues to improve, with 89% of consumers comfortable returning to retail destinations.

High street vacancy rates hit a new high of 15.9% during the quarter, though that rate has since plateaued. Meanwhile, retail capital value growth strengthened by +80 basis points (bps) to +1.6% in September, the strongest monthly performance since 2016. Investment volumes increased +31% year-on-year to reach £1.89bn across 167 deals.

Prime London

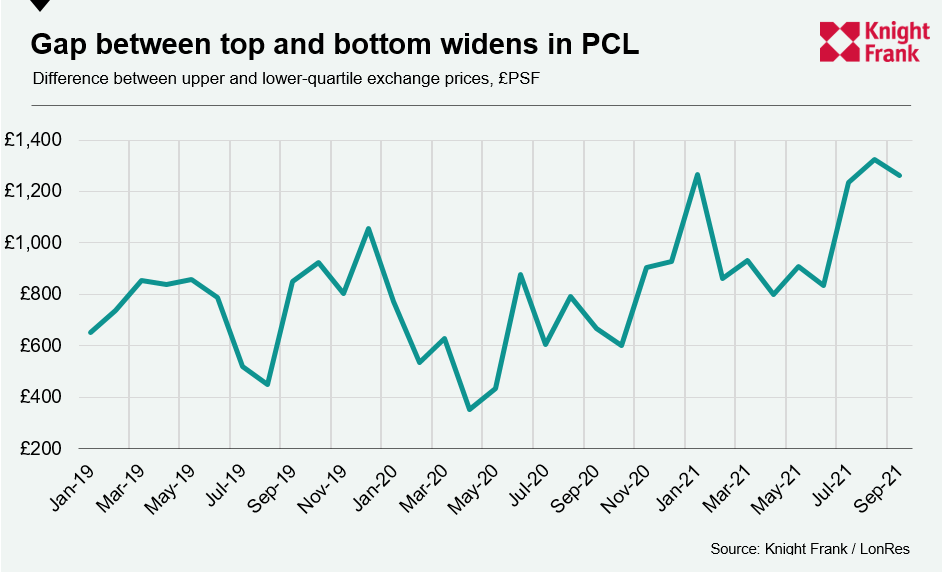

The patchwork of demand for property in central London is widening the spread between the top and bottom in prime central London.

Apartments are back on the radar of buyers, particularly those with outdoor space like a roof terrace or those that are located on garden squares. Properties with space to work from home and amenities such as gyms and meeting rooms are also more popular, including completed new-build developments.

Others are proving a hard sell, particularly those that require building work - largely due to construction supply chain disruptions and spiralling costs.

As a result, the difference between the lower quartile (the price point below which the bottom 25% of properties transacted) and the upper quartile (the corresponding top 25%) rose above £1,000 pound per square foot in July and has stayed there - through 2019 that figure stood at £777.

In other news...

Britain and the EU stand on the brink of a trade war (Telegraph), record numbers of Americans quit their jobs in September (NYT), business schools respond to a flood of interest in ESG (NYT), Spain takes on private equity landlords (FT), zero-Covid countries have run out of road (FT), UK consumers are in no hurry to spend their savings (Times), global wealth surges as China overtakes US for the top spot (Bloomberg), and finally, George Soros goes long property (Bloomberg).