UK hotels rebound with highest levels of profitability since pandemic began

The month of September yielded stronger results than expected, following substantial pent-up desire for travel.

3 minutes to read

Demand for corporate and meeting room nights build

London hotels achieved a 91% month-on-month increase in profit per available room, whilst regional UK hotels witnessed the highest levels of revenue and profitability since September 2019. There is no doubt though that the UK hotel trading performance has been positively impacted by the temporary reduction of VAT.

The predicted decrease in leisure demand in September was replaced with an uplift in midweek domestic corporate demand, transient business-related travel and an increase in demand for conference-led room nights. This marks a new phase of the UK hotel sector’s recovery, with clear signs of increased demand for room nights in both London and across regional UK towns and cities.

Hope of rebound in international travel

With early signs that inbound international travel is starting to return, this bodes well for further recovery in the larger cities more dependent on sizeable events taking place and on hotel demand from international visitors. Robust and strong performing assets pre-pandemic are set to emerge more efficient, with the visibility and outlook of the UK hotel market, now on much steadier ground.

Yet the recovery to date continues to take place in the most challenging operating environments ever endured. Market-wide supply issues, a hike in utility bills, increasing cost of sales and wage costs, as well as much tighter labour supply, continues to impact upon the speed of the sector’s revival.

The Budget 2021 – Underwhelming for the hotels sector

The Chancellor’s recent budget was underwhelming for the UK hotel sector, failing to provide the level of ongoing support many had hoped for. There was no announcement made to extend the temporary rate of VAT payable of 12.5% beyond the 31st March 2022 and the devil is in the detail, with one-year’s temporary business rates relief, capped at £110,000 per business rather than per property.

London’s hotel recovery gathers pace

- Whilst London’s occupancy has been steadily improving each month, the city cemented its recovery with 17.6% growth in its average daily rate (ADR) performance for the month of September, following strong uplift in international visitors arriving at Heathrow Airport.

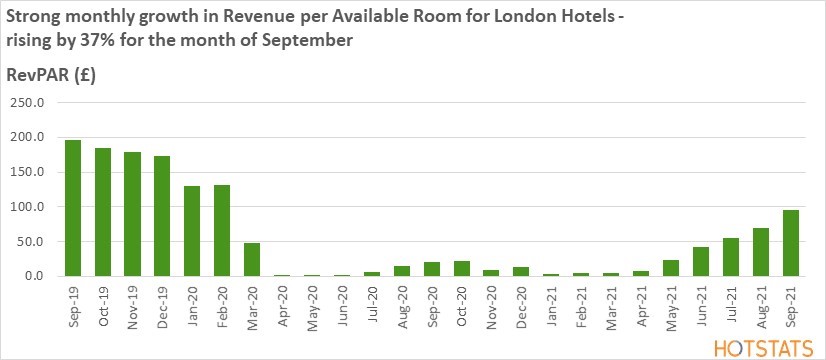

- This month’s strong top-line performance translated into 37% growth in Revenue per Available Room (RevPAR) to £82.70, with the uplift in Total Revenue per Available Room (TRevPAR) even stronger, rising by 40% to £141.70.

- From a recovery perspective it gives investors growing confidence that the London market will bounce back strongly. Whilst caution remains for hotels that are very much business and conference led, optimism regarding London’s outlook is strengthening, fuelled from both international and domestic visitors.

Market Focus – Luxury Hotels, London

- Occupancy for London’s Luxury hotels has climbed 37 percentage points since the end of April to its current high of 40%. Meanwhile, ADR growth has been more moderate, with a 6% rise for the same period to £400. Positively impacted by the temporary reduced rate of VAT, ADR is broadly at the same level achieved as at September 2019.

- This strong uplift in trading resulted in an impressive boost in September’s RevPAR, rising by over 50% to £159.10, with a corresponding rise in TRevPAR of 56% to £258.30.

- Gross Operating Profit per Available Room (GOPPAR) for the month of September increased by 175% to £91, an impressive and resilient recovery following the 16-months of negative profit, which lasted until the end of June.

Download the latest Hotel Dashboard for Knight Frank’s latest sector outlook. We provide an overview of performance for both London and Regional UK hotel markets, using the latest HotStats benchmark data, with a spotlight this month on both London’s Luxury Hotels and Regional UK’s Upper-Upscale hotel sector