Hotel Dashboard - UK Hotel Market Recovery, October 2021

Hotel fundamentals have continued to improve during the summer months of 2021, with the highest level of profitability achieved for both London and Regional UK since the start of the pandemic.

3 minutes to read

Hotel trading has been driven by strong domestic leisure demand, with many regional UK hotels witnessing exceptional levels of revenue generation, reaching heights beyond that achieved in summer 2019. How the pandemic plays out this winter will be fundamental to the short-term prosperity of the UK hotel sector. With flexible room rates and free cancellation now widely available, any change in government messaging can rapidly impact upon forward bookings.

Critical to the ongoing recovery of the sector, will be the transition from predominantly leisure-based demand, to a mix of leisure and high yielding corporate, meetings and events business. The ability to secure room nights from a much broader and balanced segmentation mix is essential if the sector is to resume the year-round high levels of occupancy and ADR performance enjoyed pre-pandemic.

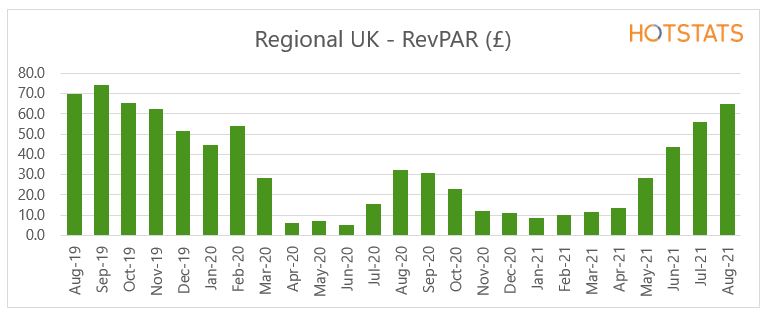

In our revamped Hotel Dashboard, to improve our understanding of the progress made in recovery, we provide analysis on both the London hotel market and Regional UK, charting their respective performance over a 25-month period. We continue to provide a more detailed review of performance of two specific hotel datasets, showing the Key Performance Indicators by month, YTD and full-year trading for the period 2018 to 2021, including our Knight Frank forecasts for FY-2021.

- August RevPAR for Regional UK was at its highest level since September 2019 at £70.10, with strong growth in occupancy and ADR both contributing towards the 19.4% uplift in RevPAR. YTD RevPAR is up on 2020 performance by 68%; but remains 36% below 2019 YTD performance.

- Whilst London’s RevPAR has rebounded strongly since the dismal lows of Q1, the continued depressed occupancy levels in the city are holding back RevPAR. At £60.50 for the month of August, RevPAR is currently 62% below the 2019 achieved performance and 13% below the monthly RevPAR recorded for the regional UK hotel market.

- After adjustment for VAT, the variance between 2021 performance compared to 2019 would be even greater.

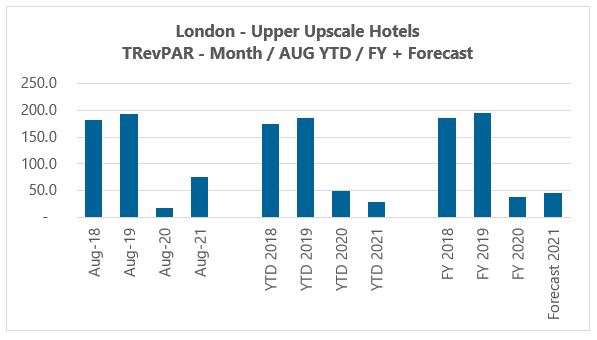

London – Full Service, Upper Upscale Hotels

- London’s Upper Upscale hotels have seen positive sequential progress since the spring, yet the recovery still remains far away from the historical stabilised pre-pandemic trading norms. August RevPAR and TRevPAR remain at 65% and 61% respectively below 2019 levels and 29% below the TRevPAR of regional UK Upper-Upscale hotels.

- The strengthening TRevPAR performance, however, is having a profound positive impact on profitability, improving each month from a loss-making position in May. London’s Upper Upscale hotels achieved a GOPPAR of £24.40 in August, a 70% increase compared to July, with a GOP as a percentage of turnover of 32.3%.

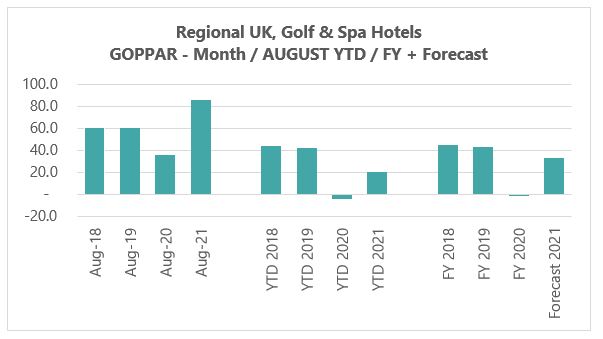

Regional UK - Golf & Spa Hotels

- For Regional UK Golf & Spa hotels, whilst August occupancy was five percentage points below Aug-2019, when combined with a 33% uplift in ADR, the Rooms departmental gross operating income (GOI) was propelled to new heights of 71.2%, contributing over 56% of the total GOI.

- Regional UK Golf & Spa hotels achieved a record GOPPAR performance in August at £85.90, a 42% increase over Aug-2019. Whilst the GOP% (of total revenue) of 36.8% was at its highest since Sep-2017.