Hotel Dashboard - UK Hotel Market Recovery, March 2021

A whole year has passed since the start of the pandemic, yet the UK Hotel sector remains in limbo with the extended period of forced closure continuing to devastate the sector.

2 minutes to read

The continued easing of lockdown restrictions, allowing for the UK Hotel sector’s reopening from 17th May, remains on target. However, given the extension to the Coronavirus Act, a gradual, staggered re-opening is likely to prevail, with ongoing social distancing measures beyond 21st June, now considered highly possible.

Yet, the reduction in vaccine supply throughout April and potentially beyond, combined with the ongoing threat by the EU to impose an export ban on vaccines to the UK, both have potential to disrupt the government’s roadmap.

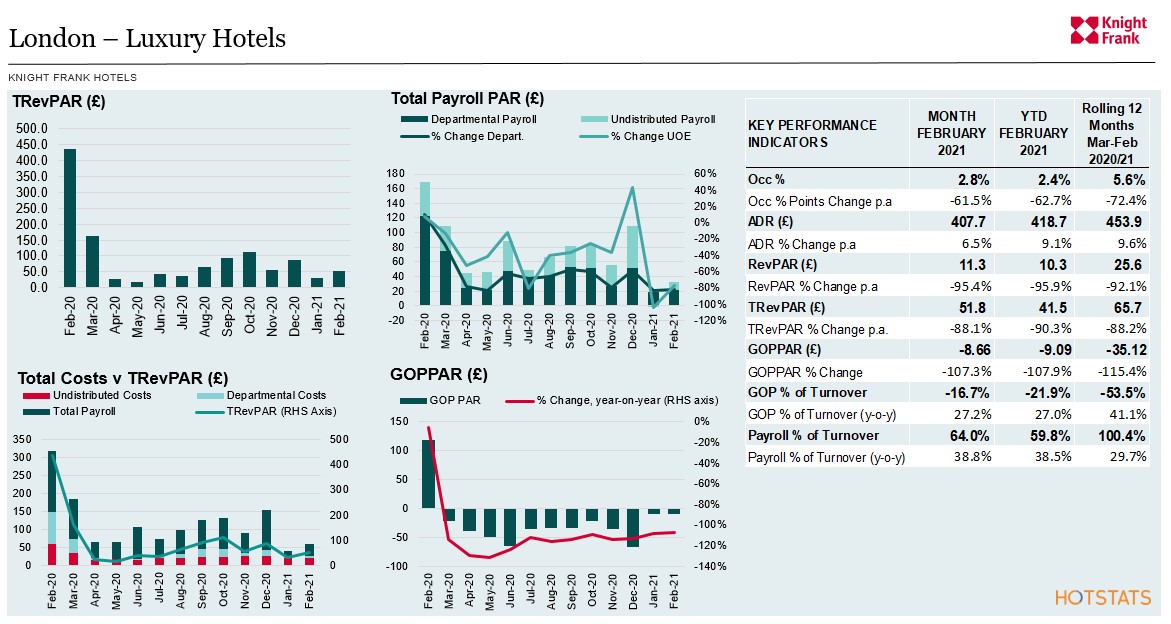

In our March edition of the Knight Frank Hotel Dashboard, we look at the devastating economic impact of Covid-19 on the London Hotel Market, observing key variances in performance between London hotels which have continued to trade throughout the pandemic and those which have temporarily closed.

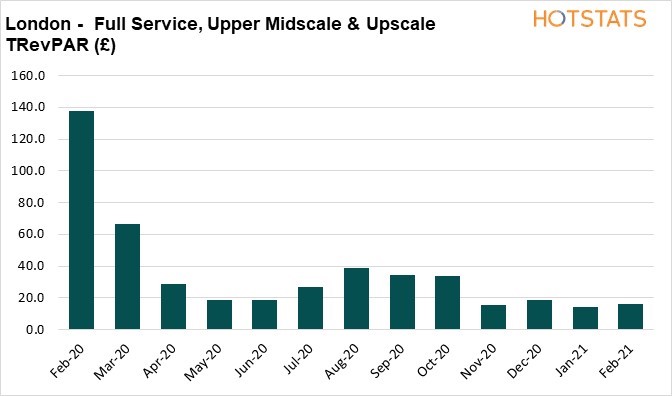

We also provide a spotlight analysis on two London hotel datasets – Luxury Hotels and Upper Midscale & Upscale Hotels.

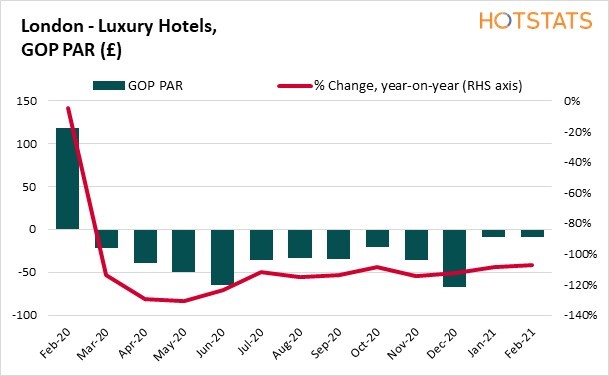

- The severely restrictive trading conditions have been devastating for the London hotel market. Both London’s Luxury and Upper Upscale hotels have been loss making since the start of the pandemic, generating a consolidated loss to date of approximately £35 PAR and £9.0 PAR respectively.

- London’s Upper Midscale & Upscale Hotels have been loss making since the start of November, generating a loss of £5.50 PAR to date.

- Single digit monthly occupancy performance has been the norm during periods of lockdown, whilst the ADR has declined by between 50%-60% compared to the same period 12-months prior.

- Since the start of November, London’s hotels which continue to trade have achieved a RevPAR of just £11.00, 16% lower than the RevPAR recorded for Regional UK over the same time period.

- At the start of 2021, trading has slowed even further with reduced demand from key workers. ADR has declined by 37% compared to the month of December, to £98.30 as at February YTD; whilst RevPAR has averaged £6.90.

- Whilst London’s hotel market continues to be loss making with GOPPAR averaging a loss of £10.00 as at February YTD 2021, the monthly loss is an improving picture, from -£16.10 in December 2020 to -£8.50 in February 2021 - with a significant reduction in payroll costs, as potentially more staff have been furloughed since the start of the year. February also achieved a stronger trading performance compared to January, with a 20% enhancement in ADR and 39% uplift in RevPAR.