Hotel Dashboard - UK Hotel Market Recovery, June 2021

Tightening restrictions concerning overseas travel is an opportunity for UK hoteliers - a UK staycation now remains the only real viable option for a summer vacation.

2 minutes to read

For hoteliers, holding firm on room rates is likely to reap overdue rewards, taking further advantage of the temporary reduced VAT rate of 5% until 30th September.

The state of limbo, anxiety and anticipation came to a close on the 17th May, with the welcome reopening of UK hospitality to all guests, albeit still with significant restrictions in place. Hotels have opened across the UK, with renewed vigour and with a heightened focus on hygiene, safety, service and hospitality.

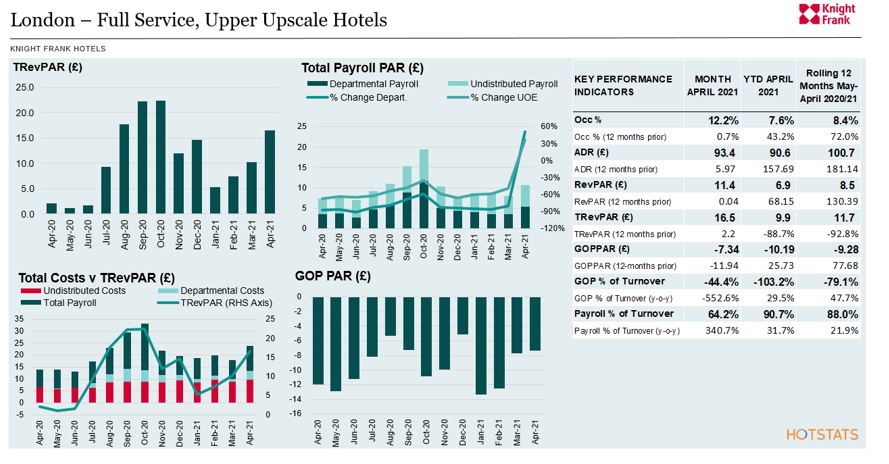

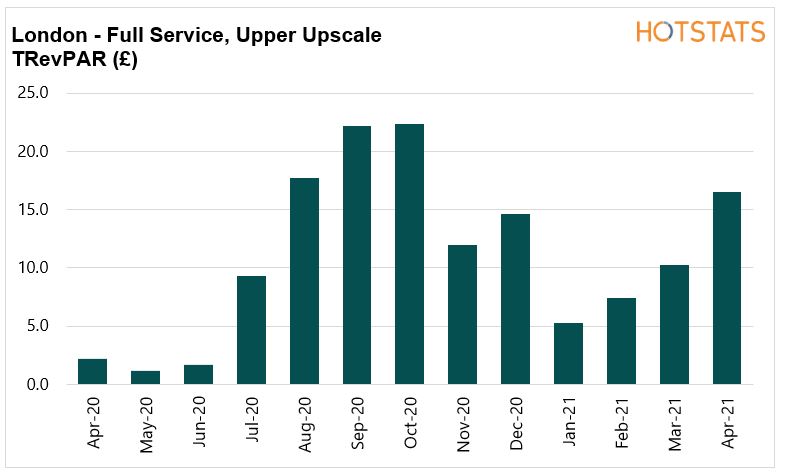

Following small positive steps reported in March, the pace of business shifted up a gear in April, with trading hotels in London recording a 47.9% rise in monthly TRevPAR and growth of 21.6% recorded by Regional UK hotels.

- The month of April was all about TRevPAR for Golf & Spa hotels, with performance boosted by the reopening of outdoor hospitality, golf and to a lesser degree spa days. Month-on-month growth in TRevPAR of 131% was recorded, to £42.40.

- London’s Luxury hotels benefitted, with a four-fold increase in F&B RevPAR, albeit off a very low base, but significantly contributing to a 61% increase in monthly TRevPAR to £50.80.

- Regional UK Upper Upscale dataset achieved strong RevPAR growth of 43.8% in April - through a 4.7 percentage point rise in occupancy and an 8.8% increase in ADR.

- Resilience of the extended stay market was reinforced with RevPAR growth rising to over 60% in April, driven by a 14-percentage point rise in occupancy to over 42%.

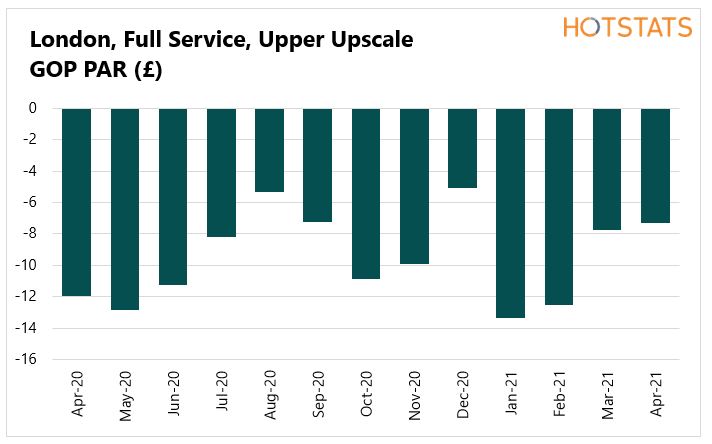

Cause for concern, however, across all datasets, is the ongoing low levels of Gross Operating Income and rising undistributed costs, with GOPPAR thwarted by rising payroll costs, increasing cost of sales and expenses. Continued tight control of all costs is critical to prevent dilution of GOPPAR, thereby maximising cash flow and working capital during the early stages of the recovery.