Fate of Ireland’s tech boom is about more than tax

G7 leaders last week came to an agreement on global corporate tax that, if adopted globally, could see a 15% minimum corporate tax level applied to multinationals. Here we examine the likely impact on Ireland, which has seen huge success in luring global tech companies in recent years, in part due to its low tax regime.

2 minutes to read

Corporations that have seen revenues boom in the past year have come to the attention of global policymakers as they to make inroads tackling growing inequality and swelling government debts.

Large multinationals including Starbucks or Amazon have long come under fire for circumventing potentially huge corporation tax bills through profit shifting and carry overs. Last week’s agreement could tighten these rules and become watershed moment for the global tax system.

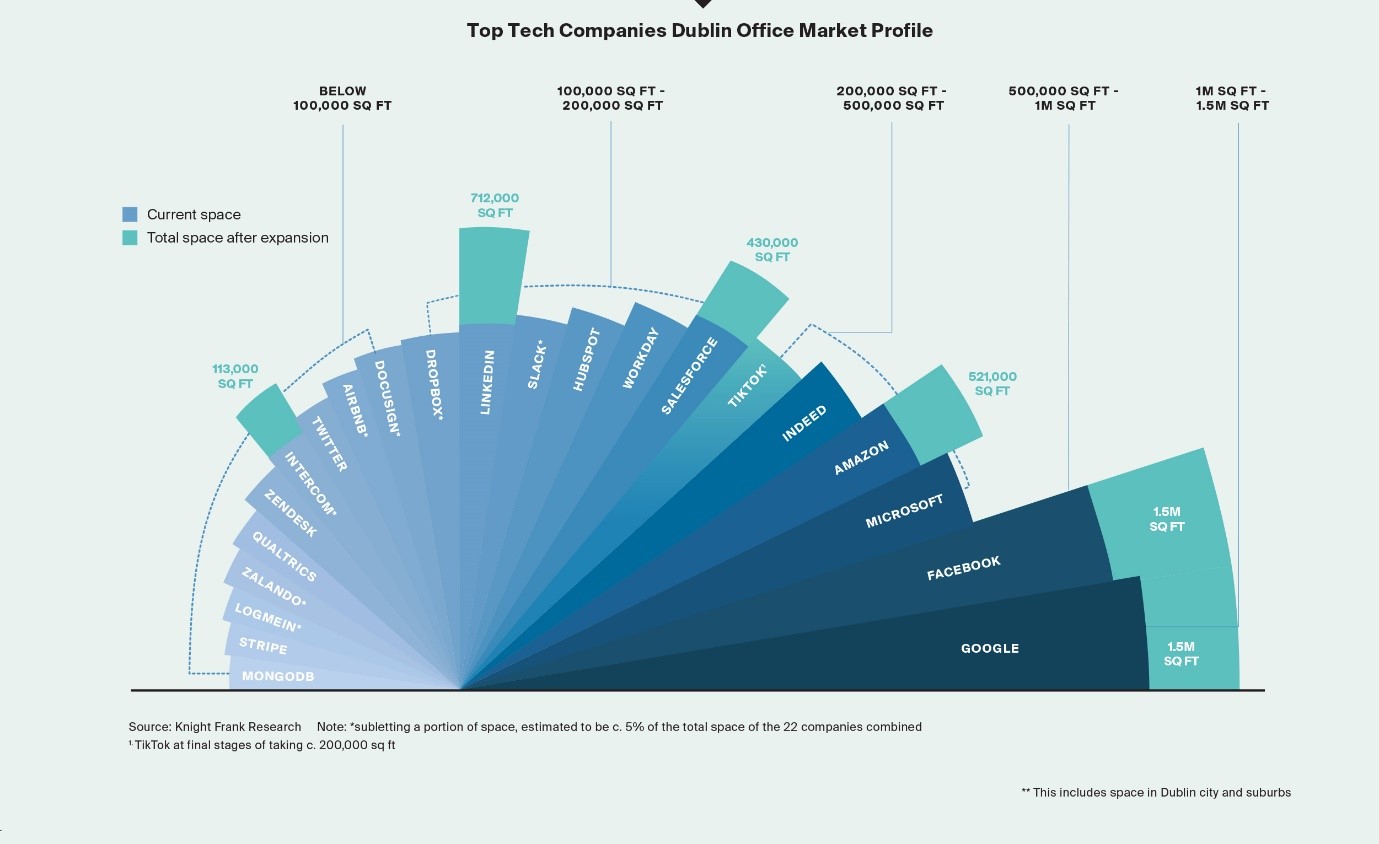

Ireland has benefitted from a favourable tax regime like few others. Investment from large multinational corporations (MNCs) over recent decades has been “central to Ireland’s recovery from the financial crisis,” according to a recent OECD report. An influx of global technology companies has been a boon to the economy. The top technology, media and telecommunications (TMT) companies now occupy a total of 4.8 million square feet in Dublin, according to Knight Frank Ireland’s Q1 2021 Investment Market Report.

These companies continue to expand - Amazon for example recently invested in a 170,000 sq ft Campus in Charlemont Square in Dublin 2. TMT now accounts for 16% of the value of the country’s GDP. Apple, Facebook, Google and other MNCs directly employ around one in eight workers in Ireland and account for over 80% of corporation tax receipts, according to a Reuters report last week.

So though potential tax hikes pose some risk to Ireland’s TMT dominance, the risks are offset by how embedded these multinationals have become since establishing themselves as many as thirty years ago, according to Joan Henry, Chief Economist and Head of Research Knight Frank Ireland.

“While Ireland’s favourable tax regime may have been a reason for companies to originally invest here 20 to 30 years ago it is not the only reason and is not why they continue to operate and expand in Ireland,” she adds. “Considerable investment in Research & Development and in education has made Dublin an attractive location to source the level of talent required to attract high value adding companies.”

For the time being, the proposed global changes to corporation tax have a lot of hurdles to jump before being implemented, not least garnering two-thirds backing the divided US senate as well as G20 and OECD backing. Some countries, including Switzerland, are already drawing up subsidies and other incentives for companies to maintain their competitive stance.

If they do pass, the attractiveness of Ireland will remain underpinned by its EU membership, connectivity, and transatlantic ties (you can even clear US customs in Ireland). That’s why business from the US accounts for 70% of foreign direct investment in Ireland, which could climb further amid a new wave of technology companies entering the market, says Henry.

“Google, Facebook and LinkedIn continue to lead the expansion having started projects to expand before Covid-19,” she adds. “The existing tech companies have created an eco-system allowing for a further wave of tech companies, such as Tik Tok, to enter the market.”