PCL prices: gap between top and bottom widens

The pandemic means the property market in prime central London has become increasingly patchwork.

3 minutes to read

We have explored how it is not yet business as usual in prime central London (PCL) despite the relaxation of international travel restrictions.

While it became easier to travel to the UK from 4 October, there is still a degree of caution among some overseas buyers.

There are other ways in which normal service has not yet resumed.

Demand for houses spiked at the start of the pandemic as flats fell out of favour. Now, with the prospect of further lockdowns tentatively fading in the UK, apartments are back on the radar of buyers in central London. Just not all apartments.

Flats with outdoor space like a roof terrace or those that are located on garden squares are in higher demand. Properties with space to work from home and amenities such as gyms and meeting rooms are also more popular, including completed new-build developments.

For flats that don’t tick these boxes, it’s still a harder sell.

Other buyers are being deterred from taking on properties that require building work because of construction supply chain disruptions and spiralling costs.

Meanwhile, competition for the most in-demand properties has intensified. It means the supply of houses has fallen to historically low levels in areas including Notting Hill and Chelsea.

For buyers and sellers in PCL wondering how much a property is worth, it is a slightly confusing and patchwork picture that increasingly depends on neighbourhood, property type, amenities and state of repair.

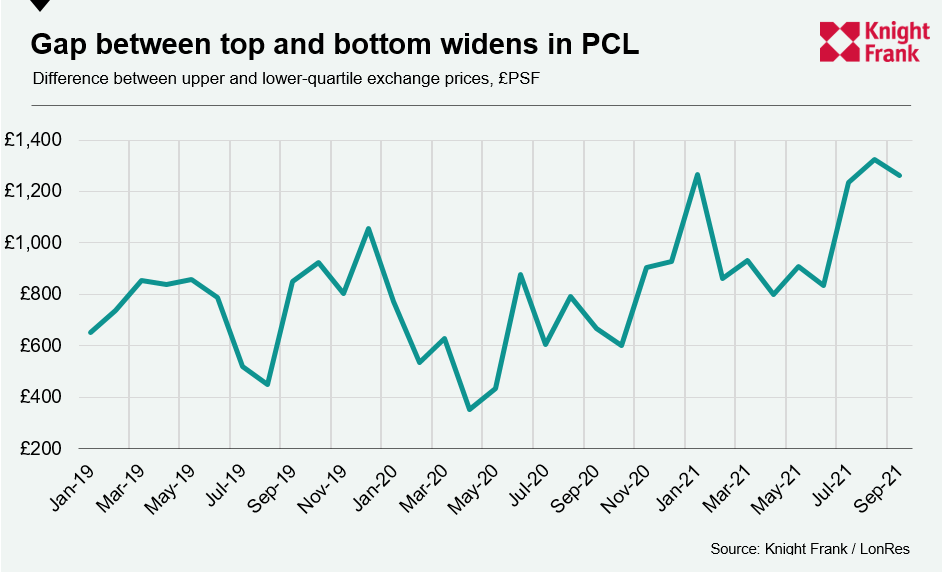

Underlining this point, the difference between the highest and lowest sale prices has widened over recent months, as the chart below shows.

The difference between the lower quartile (the price point below which the bottom 25% of properties transacted) and the upper quartile (the corresponding top 25%) rose above £1,000 pound per square foot in July and has stayed there. The average difference throughout 2019 was £777 and £675 in 2020.

Further underlining the point, while prices for houses in PCL rose 1.3% in the three months to October, the equivalent increase for flats was 0.2%. The last time this difference was wider was in August 2009.

“The market is getting more binary and you are seeing wider spreads for apartment prices in the same building depending on the floor and how much outdoor space they have,” said Stuart Bailey, head of prime London sales at Knight Frank. “On top of that, refurb costs have doubled over the last year in some cases, due to the shortage of materials and labour, which means taking on a project has become more of a consideration.”

It has put new-build property on the radar of more buyers. Its appeal was highlighted recently by Rupert des Forges, head of prime central London developments at Knight Frank. “The pandemic has not altered London’s status as a global safe haven. West End developers have received over £250 million of offers in the W1 postcode alone in the last month.”

Despite the re-opening of international travel and the fading prospect of further lockdowns, it will be next year before more normal service resumes in PCL.