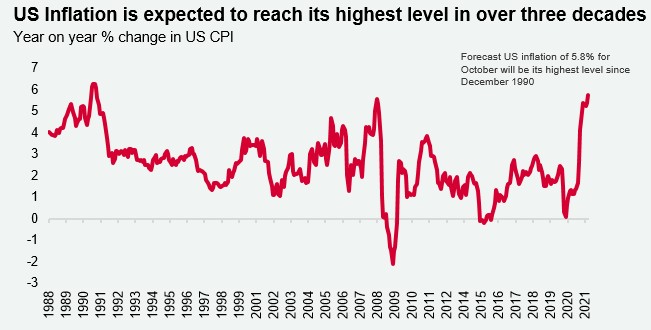

US Inflation expected to reach highest level in over three decades

Discover key economic and financial metrics, and what to look out for in the week ahead.

1 minute to read

Here we look at the leading indicators in the world of economics. Download the dashboard for in-depth analysis into commodities, trade, equities and more.

COP26 and the $35tn sustainable finance market

Sustainable finance will become a key focus as COP26 enters its final stages, and a coalition of 18 countries led by the EU and China, which represents 55% of global GDP, has announced a common taxonomy for sustainable finance standards. The UK, having been an early adopter of Green gilts and other green finance initiatives, is fast becoming a world leader in this area.

UK REIT sector posts robust returns, ahead of a busy week of quarterly updates

This week sees a full calendar of UK REIT updates, and with the sector recording a YTD total return of 19.2% (vs. 17% for the wider UK equity market), the tone of announcements is expected to be positive, especially for those able to highlight healthy development or repurposing pipelines.

Will they or won’t they? Central banks remain hesitant to raise rates – for now

Last week, the US Federal Reserve and Bank of England unexpectedly held interest rates at 0.25% and 0.10%, respectively. This coincided with Sterling’s worst week since August, down -1.5% over the week. However, rate rises are anticipated in the near future, and in the case of the UK, ‘over the coming months’ according to the BoE monetary policy committee.

Download the latest dashboard for all the up-to-date information.