Prime cities price growth – what you need to know

Miami leads the world for house price growth as coastal living and low taxes prove too good to resist for remote workers.

2 minutes to read

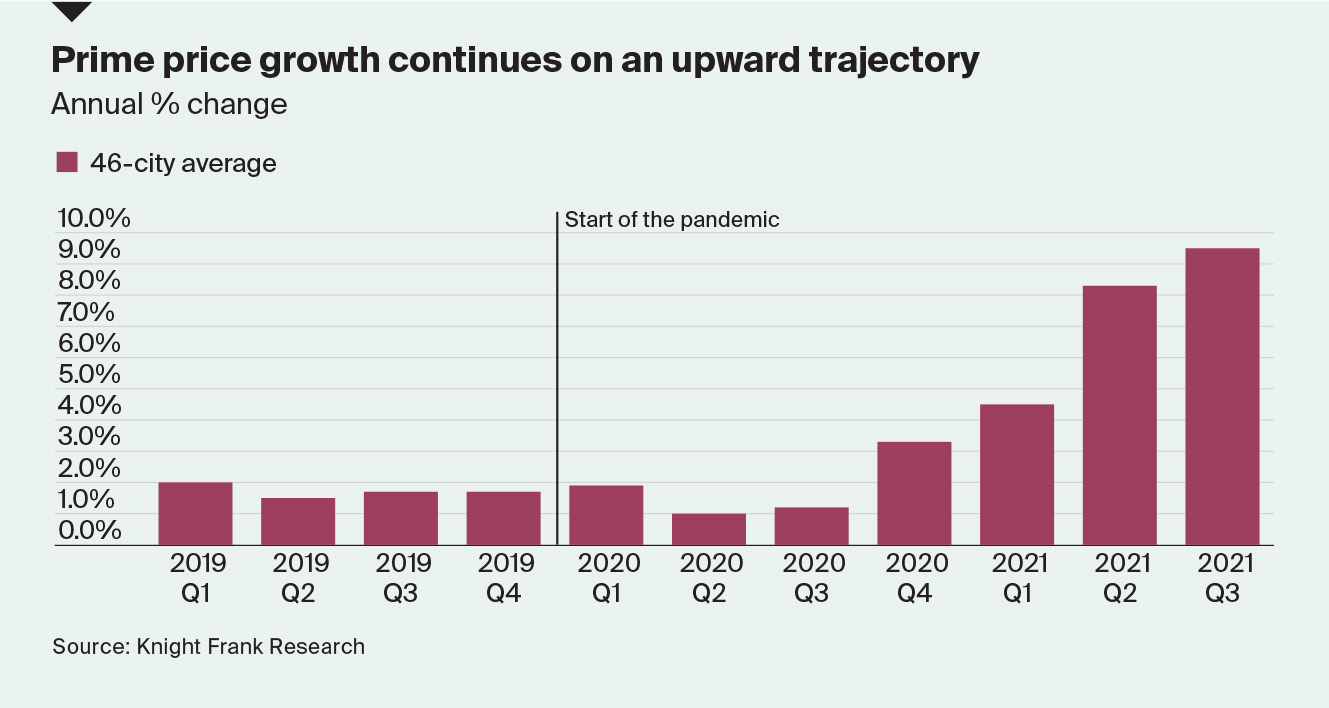

Prime prices in global cities continue to rise. The index, based on the average price performance of 46 cities, surged by 9.5% in the year to September 2021, up from 8.3% in June.

The Prime Global Cities Index is a valuation-based index tracking the movement in prime residential prices across 45+ cities worldwide using data from our global research network during the 12 months to September 2021.

With travel starting to normalise, the prospect of tighter monetary policy on the horizon, as well as higher taxes and cooling measures, evidence suggests prime markets had a busy third quarter.

Some 85% of cities saw prices rise on an annual basis, up from 76% last quarter and 16 cities (35%) saw prices increase by more than 10% during the 12-month period.

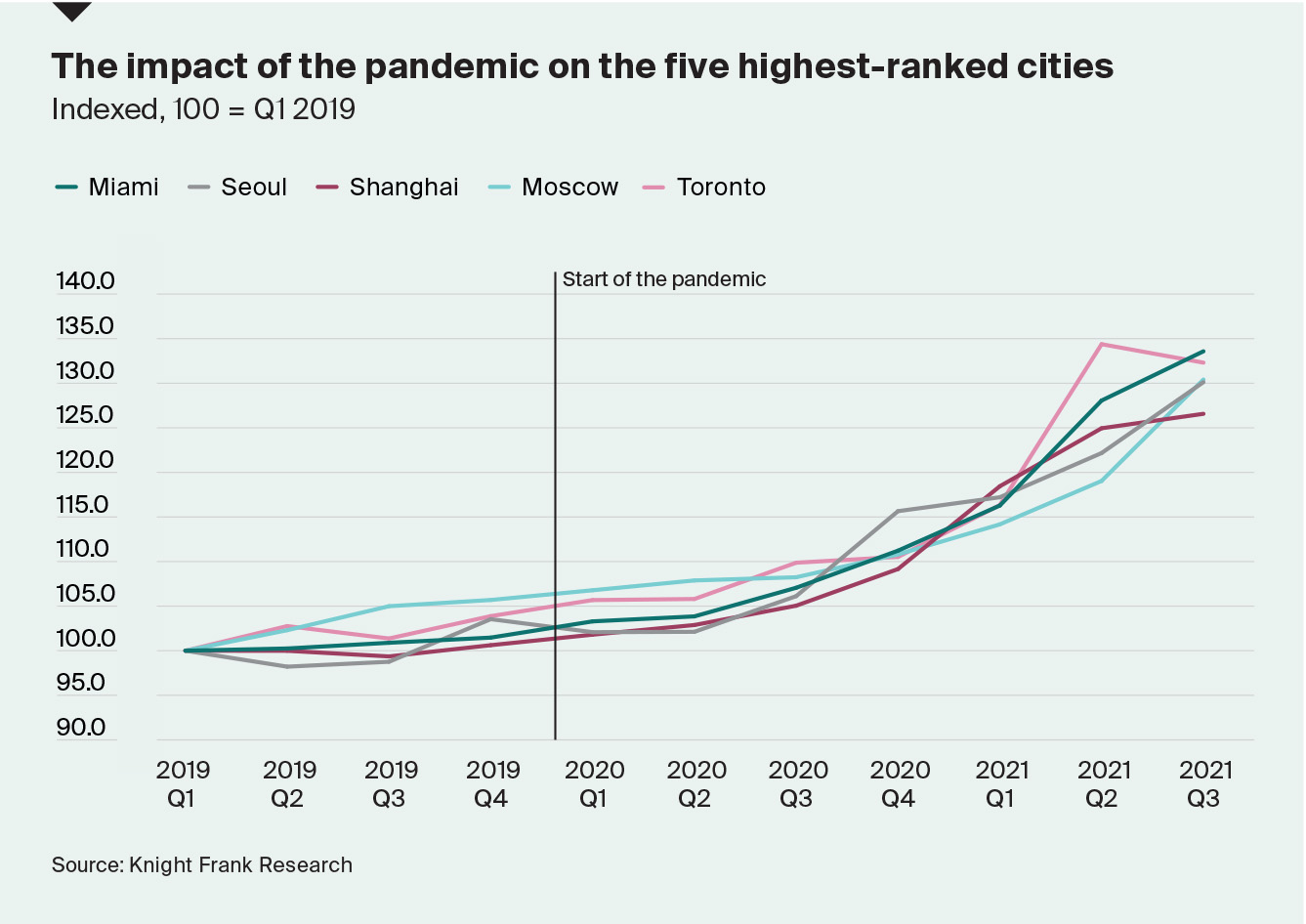

Miami (26.4%) leads the index this quarter for the first time since the index started in 2007. The hunt for larger accommodation, coastal living, and Florida’s low taxes acted as a key draw for a new breed of remote workers in the US.

Amongst the 15 cities that saw their annual rate of growth decline in Q3 compared to the previous quarter are the four Chinese mainland cities we track: Shanghai, Beijing, Guangzhou and Shenzhen as well as Toronto and Vancouver.

The Evergrande crisis, a raft of cooling measures and localised outbreaks of Covid-19 explain the slowdown in luxury price growth in the Chinese mainland’s top tier cities and whilst the mooted two year nationwide ban on foreign residents in Canada won’t impact domestic buyers directly, it may be adding to jitters as homeowners reflect on the government’s overall direction of travel.

Russia is another hotspot with prime prices up 20.5% and 15.5% in Moscow and St Petersburg respectively. With the luxury market heavily skewed to new-build or primary sales and the delivery of projects delayed due to the pandemic, the demand/ supply imbalance has boosted prices.

With New Zealand one of the first key economies to hike interest rates, Auckland’s housing market is one that policymakers will be watching closely. Prior to the recent rate rise, prime prices were rising at a rate of 9.8% per annum, and demand in the last 12 months was almost entirely domestic, due to travel rules and foreign buyer restrictions. As more governments look to tighten monetary policy we expect the prime market to be better insulated given the sector’s large proportion of cash purchasers.