Markets price in rate hikes sooner than anticipated

Discover key economic and financial metrics, and what to look out for in the week ahead.

1 minute to read

Here we look at the leading indicators in the world of economics. Download the dashboard for in-depth analysis into commodities, trade, equities and more.

Heightened expectations for interest rate rises

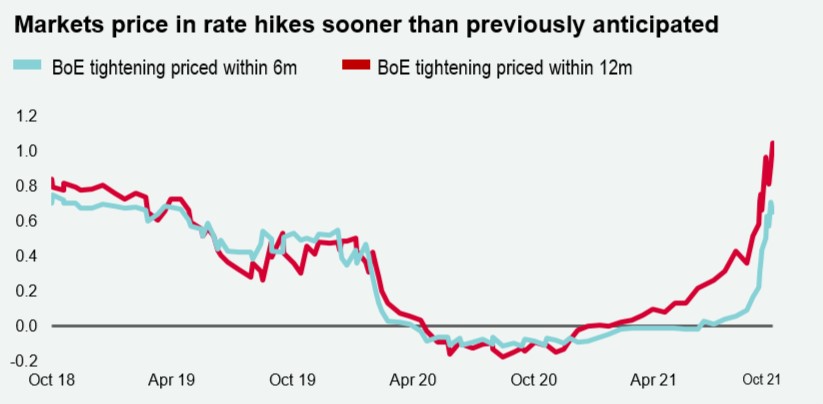

Markets are currently pricing in a 15bps rise from the Bank of England (BoE) when its monetary policy committee meets on Thursday, fuelled by hawkish comments from the central bank’s governor, Andrew Bailey. Markets will also be looking to the US Federal Reserve on Wednesday to see whether it too will increase rates. In Europe, the ECB envisages no interest rate increases in 2022.

Climate emergency takes centre stage as COP26 gets underway

Boris Johnson has committed a further £1bn towards climate finance by 2025, bringing the UK’s overall contribution to £12.6bn and helping to support further growth in the UK’s rapidly expanding green finance sector. For the real estate sector, a key focus of the summit will come on the 11th of November, when the topics of cities and the built environment feature on the programme.

An upbeat economic outlook from the OBR

Announced at last week’s budget and spending review, the Office for Budget Responsibility’s (OBR) latest assessment of the UK economy was much more positive than at the last budget in March. Instead of a +4% increase in 2021, the OBR is now forecasting +6.5% GDP growth in this year, followed by +6.0% in 2022 - the strongest acceleration in 50 years. Brief commentary on the budget itself is outlined here.

Download the latest dashboard for all the up-to-date information.