Prime London market still digesting the mini-Budget as year ends

December 2022 PCL sales index: 5,449.4

December 2022 POL sales index: 276.8

2 minutes to read

Rarely has the current state of the property market been such a poor guide for what happens next.

Yes, prices and transaction volumes will come under continued pressure, but the last quarter of this year is hardly a useful yardstick for 2023.

The reason is straightforward. Kwasi Kwarteng’s mini-Budget took place more than three months ago, but mortgage rates have not resumed the path they were on at the start of September.

Financial markets took fright at the previous government’s low-tax economic plan and borrowing costs spiked in anticipation of higher inflation.

It has created a disorderly picture at the end of 2022.

Some buyers have mortgage offers that pre-date the mini-Budget and are motivated to move quickly.

Elsewhere, budgets have been cut as monthly repayments rise. More discretionary buyers are stepping back and waiting for mortgage rates to come down while others still need to move now.

Until mortgage rates settle, the great recalculation that will have to happen among buyers and sellers cannot take place.

In the meantime, the property market in prime London postcodes is proving resilient.

The fact cash buyers are more prevalent in higher-value markets will protect prices as borrowing costs rise, as we explored here and here.

The number of exchanges in November in prime London markets was 16.2% higher than the same month in 2021 and 15% higher than the five-year average, Knight Frank data shows.

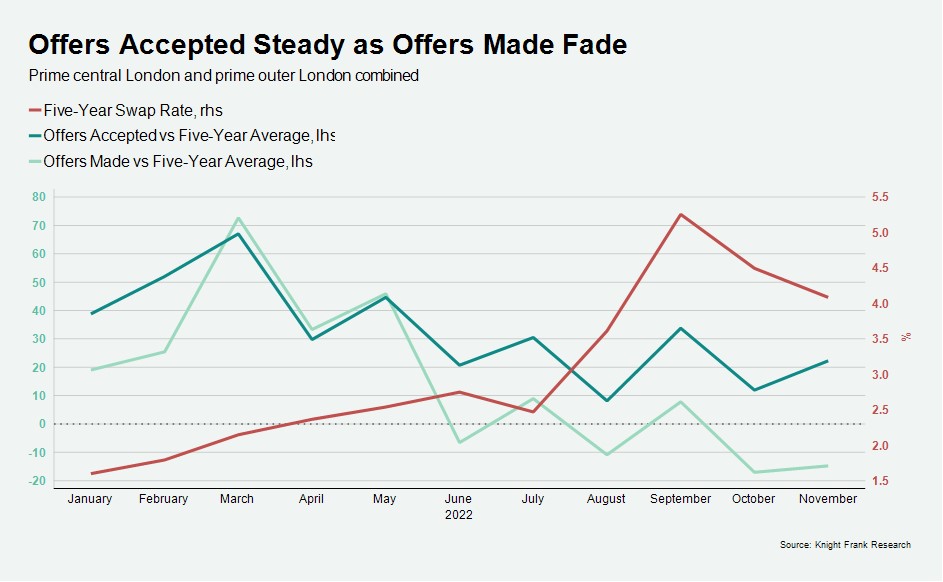

However, buyers are understandably wary, as the chart shows.

The number of offers made in November was 16% below the five-year average, reflecting the uncertainty that has arisen from the recent spike in borrowing costs.

However, as the falling five-year swap rate shows, mortgage rates should continue to decline, which means the fall in offers made may have bottomed out.

Meanwhile, the number of offers accepted was 22.2% above the five-year average in November, which suggests the nervousness among prospective buyers does not mean sales volumes are about to fall meaningfully.

The resilience of prices in prime London property markets will be put to the test next spring, when activity levels traditionally pick up across the UK, as we analysed here.

Until then, prices should remain in somewhat of a holding pattern, although the monthly declines that followed the mini-Budget have now ended.

Average prices were flat in both prime central London and prime outer London in December, taking annual growth to 1.5% and 4.4%, respectively.

We forecast both of those figures will come under greater downwards pressure next year.