Kenya

Kenya’s young demographic is sustaining growth in the affordable homes and co-living segments of the residential market. A young population, combined with a strong middle class is also helping the office and retail sectors to recover. Nairobi remains the strategic capital of East Africa and the first-place international investors list as a preferred entry point into Africa.

3 minutes to read

ESG considerations grow in the office market

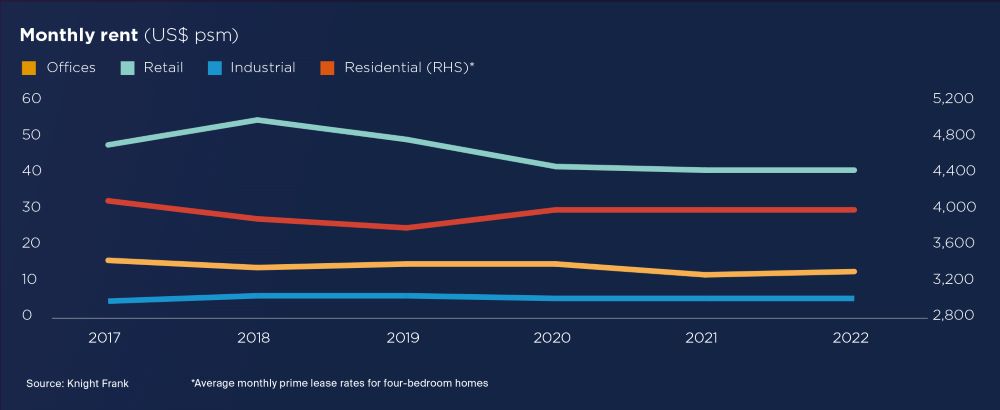

We are starting to see the oversupply of office space developed in the lead up to the Covid 19 pandemic being absorbed by the market. We have seen some rental growth over the last quarter and our view is that we will see prime rents begin to climb again off the back of improving occupancy rates and renewed interest from global tenants looking to either set up or expand their operations in Nairobi.

Overall, demand is centred on best-in-class space, with investors and occupiers zeroing in on schemes that satisfy their ESG (environmental, social and governance) criteria; a theme we believe will continue to intensify, raising questions about the future of older, more secondary, non ESG-compliant stock. Despite this, the number of green certified developments remains low.

Supermarkets: the darling of the retail sector

The Covid 19 pandemic certainly helped fast-track e-commerce adoption and we have seen an increase in online purchasing and retailers focused on developing their platforms particularly in the F&B space. Having said this, traditional retail, especially convenience led schemes, has also seen a strong rebound in the last six to nine months off the back of easing restrictions and people’s eagerness to get back to life as normal.

We also expect to see more co-working operators taking advantage of low mall lease rates and establishing bases in shopping centres.

Elsewhere, supermarkets have emerged as a star performer. Increased sales and store expansion activity from both domestic and international players means supermarkets will remain a robust asset class over the short to medium term.

In spite of Carrefour being the most dominant name in the retail sector, local retailers Quickmart and Naivas are the largest supermarket chains in Kenya by number of stores, having increased their branches by 30% over the past 2 years, equating to an expansion of c. 100,000 sqm.

Rejuvenated industrial market hots up

The industrial sector is highly active and remains full of opportunity as one of the asset classes which has benefitted most from the pandemic globally. This has been primarily fueled by the increase in e-commerce, local storage and data center requirements as well as home markets looking to reduce their reliance on internationally manufactured goods. We are optimistic for the sector which remains the least mature in the region.

In the investment market, new strategies are emerging, including ‘develop to hold’, and we expect more landlords to enter sale and leaseback transactions. This will likely result in greater capital redeployment into the sector given its favourable outlook.

Affordable housing development continues

Despite COVID-19 restrictions, investment into the affordable residential sector continues to improve. This is being underpinned by the government’s commitment to deliver 500,000 homes to address the well-publicised deficit of 2 million homes. In contrast, the prime residential market continues to soften, with transaction volumes, sales prices and lease rates continuing to trend downwards as buyers and tenants become increasingly cost conscious in the wake of the rising cost of living.

"In Kenya, we have seen an increase in Purpose-Built Student Accommodation due to the young population leading to growth in the requirement for quality student accommodation in close proximity to educational institutions."

- Mark Dunford, CEO of Knight Frank Kenya,

Key Asset to Watch

The growing number of undergraduates, a youthful population and an undersupply of formal student housing has resulted in the increased development of purpose-built student accommodation (PBSA) as well as co-living schemes.