Malawi

The pandemic continues to negatively impact the economy and overall level of real estate activity in Malawi.

2 minutes to read

Cost conscious occupiers

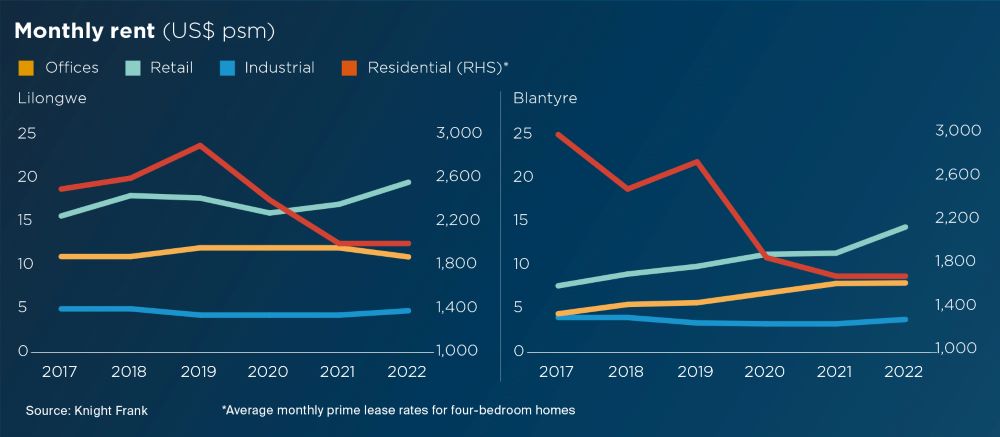

The prime office market remains relatively subdued; however, occupier interest remains firmly centred on best-in-class space, which remains in short supply in cities such as Blantyre. Indeed, Blantyre has a negligible office supply pipeline, suggesting that the slightest increase in demand will lift prime rents.

A different story is unfolding elsewhere. Older office buildings in Lilongwe, for instance, are likely to experience declining occupancy levels and rents as tenants migrate to newer buildings.

Despite the emerging trend of a flight to quality, occupiers remain cost conscious. Erratic energy supplies and utility price escalations, coupled with inflationary pressures, have exacerbated operational costs, with service charges rising by just over 26% so far this year. This level of inflation has prompted landlords to lift office rents by upwards of 10-15% across the board, which is further suppressing demand.

"Despite Malawi not imposing lockdown measures, business activities slowed during the pandemic. Further economic challenges brought on by rising inflation necessitated the recent 25% devaluation of the Kwacha. The devaluation is expected to drive a notable, but sustainable improvement in both economic growth and the real estate market."

-Martin Chimangeni, Managing Director Knight Frank Malawi

Warehousing demand poised for growth

Lease rates in the industrial market remain steady, dominated by purpose-built, owner-occupied warehouses, as has been the case historically. The long-established status quo may be set to change with the planned improvement in power generation through the Malawi—Mozambique interconnector line, which we believe will fuel a rise in demand for warehouses.

International retailers

The retail market on the other hand is set to experience a new wave of growth. While currently dominated by local retailers, interspersed with a smaller number of international tenants such as Shoprite, Game and PEP, we expect that pipeline developments, which include Pamodzi Shopping Mall and OG, in Blantyre and Lilongwe respectively, will prompt the entry of more international retailers who have been waiting on the sidelines for greater volumes of formal retail space.

Notable recent completions include the Mall of Africa, Build Africa, and other smaller retail developments in Limbe- Blantyre, which have added c.33,000 sqm to the existing stock.

Weak prime residential leasing market

Self-funded home construction remains strong in both Lilongwe and Blantyre mainly due to unfavorable lending rates. That said, we anticipate that the number of residential units under development will start to taper off rapidly this year due to the sharp increase in construction costs.

Elsewhere, economic weakness has undermined the prime residential leasing market. Weak job creation rates have translated into subdued demand and stable rental rates. Like many other African markets, demand remains centred on more mainstream and affordable housing, where a lack of supply is sustaining upward pressure on lease rates.

Key asset to watch

Rising demand from young professionals is sustaining residential rental demand for more mainstream and affordable housing products, which we expect developers will rapidly want to capitalise on.