Ghana

The economy is slowly recovering from the pandemic-induced recession that heavily impacted core economic activity areas around oil and cocoa; two of Ghana’s biggest exports.

2 minutes to read

Best-in-class office buildings outperform

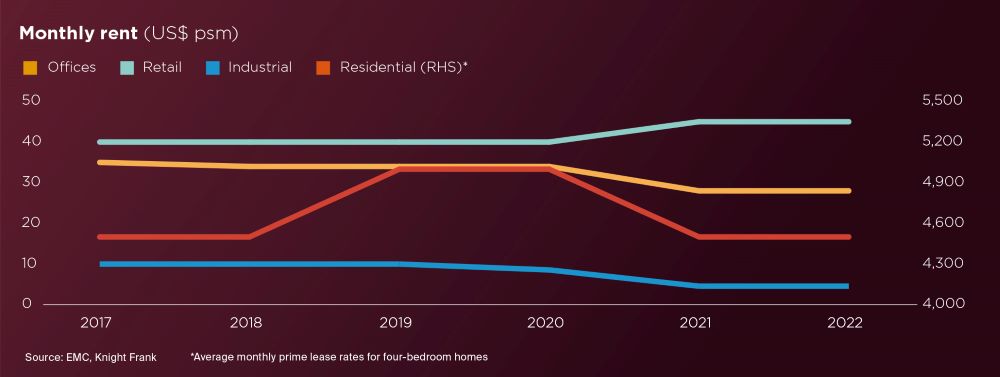

The prime office market remains subdued, with rents falling by 21.4% over the last two years. This has left monthly rents hovering at around US$ 28 psm.

Demand for office space continues to be undermined by 'rightsizing' post-Covid occupational strategies as well as the Covid-driven economic weakness.. Indeed, grade A space in some buildings can be secured for as little as the mid to low US$ 20’s, with larger deals being agreed in the high teens.

That said, higher quality, best-in-class buildings have fared much better. For instance, the 13,500 sqm Atlantic Towers in Airport City, which was completed in 2020 and is one of the country’s few energy-efficient buildings, is fully leased, with monthly rates upwards of US$ 28 psm. The spillover demand from Atlantic Towers has spurred the scheme’s developers to alter the planned use of the project’s second tower from a hotel and serviced apartments to a second office tower, which should be completed later this year.

Elsewhere, landlords continue to offer concessions and rent reductions in an attempt to attract demand.

Retail recovery threatened by economic conditions

Like elsewhere in the world, the pandemic has altered shopping habits. In Ghana this has manifested itself in the form of a higher preference for local shopping. Unsurprisingly, convenience retail and neighbourhood malls have thrived.

Developers have responded by focussing on smaller neighbourhood retail developments such as the 6,800 sqm A&C development which is expected to complete later this year.

On average, retail rents are 12.5% up on Q1 2020 and while the apparent resilience is attracting new retailers such as Giordano, the recovery remains fragile. The biggest downside risk, in our view, is the recent currency devaluation and rising inflation, both of which are expected to lower real household incomes and subsequently drive down consumer spending.

Rents in the industrial sector dip

Like many other markets globally, key drivers of demand in Ghana’s industrial sector are the logistics and data centre sub-sectors.

Investors are actively securing land plots and built assets to cater to the burgeoning level of requirements from these sectors. The increased demand for space from these two sectors has however been unable to offset the wider decline in space requirements as a result of the economic weakness and rents are currently some 44% below 2020 levels.

Our outlook is however one of cautious optimism. As demand gathers pace from the logistics and data centre sectors, coupled with Ghana’s historical position as an industrial hub in West Africa, we expect rents to slowly begin to recover. Volkswagen’s decision to open an assembly plant capable of delivering 5,000 vehicles a year in 2020, for instance, has been a huge vote of confidence for Ghana’s industrial sector and we believe it will encourage more international manufacturers into the market.