Ethiopia

The situation in the Ethiopian real estate market remains delicate because of the political and social instability that has prevailed for the last two years.

1 minute to read

Lack of high-quality of office space driving up rents

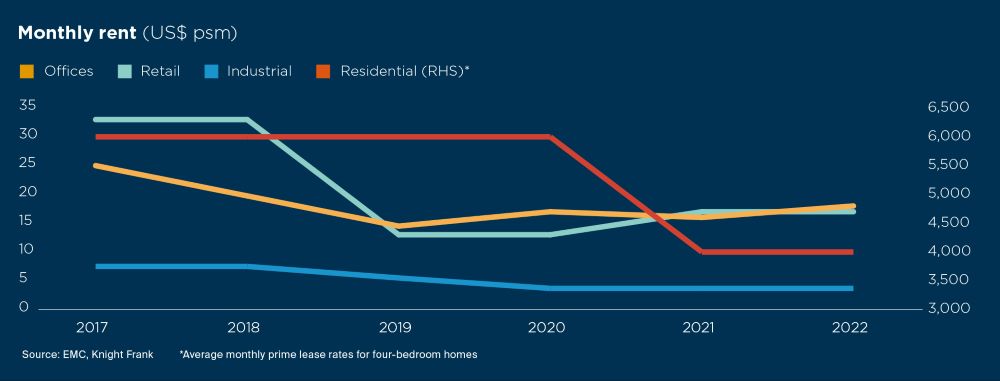

Right before the Civil War commenced in late 2020, the telecoms sector was opened to international operators and investors, which boosted demand for office space; however, the unprecedented political instability quickly curbed almost all activity in the office market. Paradoxically, despite the lack of activity in the market, office rents have experienced a slight increase, mostly driven by the lack of new product coming to the market, and the dearth of high-quality office space. Monthly rents currently stand at US$ 18 psm, up by about 6% since 2020.

Much of the development activity is concentrated in In the Financial District, where banks and insurance companies are pursuing ‘build-to-suit’ options. The driver behind this is the acute shortage of office space, despite Addis Ababa boasting nearly 90,000 sqm of Grade A and Grade B office space.

Inflation threatens consumer spending

The retail sector has been the hardest hit by the current unrest. The pandemic has only worsened matters, with the war in Ukraine further exacerbating conditions. The disruption of food supply chains drove inflation to 36.6% in April 2022, a 10-year high. As a result, consumer spending is expected to decline rapidly. Inevitably, should the current conditions persist, demand for retail space will slide further.

Industrial sector remains stagnant

Prior to 2020, there were plans to create industrial parks to accelerate and deepen the industrialisation of the agricultural sector. However, with the current economic and political constraints, the industrial and logistics sector has also suffered. Leasing activity is hovering near record low levels and monthly rents remain weak at approximately US$ 4 psm.