Inflation concerns, London rental recovery and Zambia election optimism

Here we round up some of latest comments, opinions and insights from the industry-leading experts from the commercial and residential research teams, so you have all you need for the week ahead.

3 minutes to read

Dive into the latest dashboards, research reports and survey analysis from our commercial and residential research teams.

Your commercial catch up

Leading Indicators

Last week Will Matthews spoke about inflation concerns, EV sales and looked forward to the autumn spending review in his regular update on the latest key economic and financial metrics.

Will looks at ongoing global concerns surrounding inflation. He says that "continued commodity price pressures will make it harder for central banks to argue that inflation remains ‘transitory’, and we expect their tone, if not yet their actions, to become more hawkish."

Get in-depth analysis from the latest Leading Indicators dashboard, updated weekly.

UK Hotel market recovery

A tumultuous time for many industries, the hotel sector has not been immune to the pressures of the last 18 months, but strong domestic leisure demand is driving hotel recovery.

Phillipa Goldstein analyses the UK hotel recovery which has recently seen the highest level of profitability achieved for both London and regional UK since the start of the pandemic.

Discover in more detail what hotels are performing well and why in the latest Knight Frank Hotel Dashboard.

Commercial Conversations

Season 4 of Commercial Conversations kicked off last week. In the first episode, Will Matthews, head of UK commercial research is joined by Karen Callahan, head of hotel valuations, Henry Jackson, head of hotel agency and Philippa Goldstein, head of hotel research, to discuss the UK hotel market.

Keep your eyes peeled for the coming episodes.

Your residential round up

Rental recovery accelerates and supply trails demand

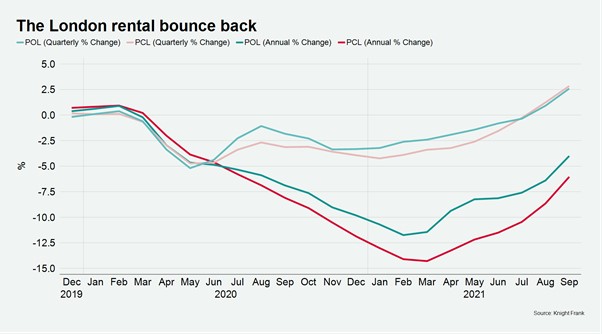

Tom Bill assesses the latest Prime London Lettings Index and Prime London Sales Index which showed that the bounce back in the prime London lettings market gathered pace in September, whilst supply shortage continues to affect values and transactions in the sales markets.

Average rental values rose on a quarterly basis by the largest amount in a decade in prime central (+2.8%) and prime outer London (+2.6%), as the below chart shows.

Meanwhile, in the sales market, demand continues to surge this autumn as supply plays catch up. Excluding 2020, the number of new prospective buyers registering in London was 27% above the five-year average in the third quarter.

Zambia real estate market could benefit from election results

The general election in Zambia is already sending vibrations through the economy after president Hakinde Hichilema achieved his landslide win in August.

Tilda Mwai assesses the top five areas of change that we are seeing, and expect to see, in the coming weeks and months and how they could impact the real estate market.

Middle East homebuyers value energy efficiency

Shifting our focus to the Middle East, Faisal Durrani looks at the results from the Knight Frank Global Buyer Survey, which shows that half of the respondents cited the energy efficiency of their next home being a ‘very important’ issue, compared to 42% of global buyers.

The coronavirus pandemic has driven a shift in attitudes amongst Middle East homebuyers which shows proximity to green space and good air quality are the most important location criteria.

Don't forget to sign up to the latest Knight Frank research for exclusive market news and opinions from our expert research teams.