Inflation concerns persist as EV sales soar

Discover key economic and financial metrics, and what to look out for in the week ahead.

1 minute to read

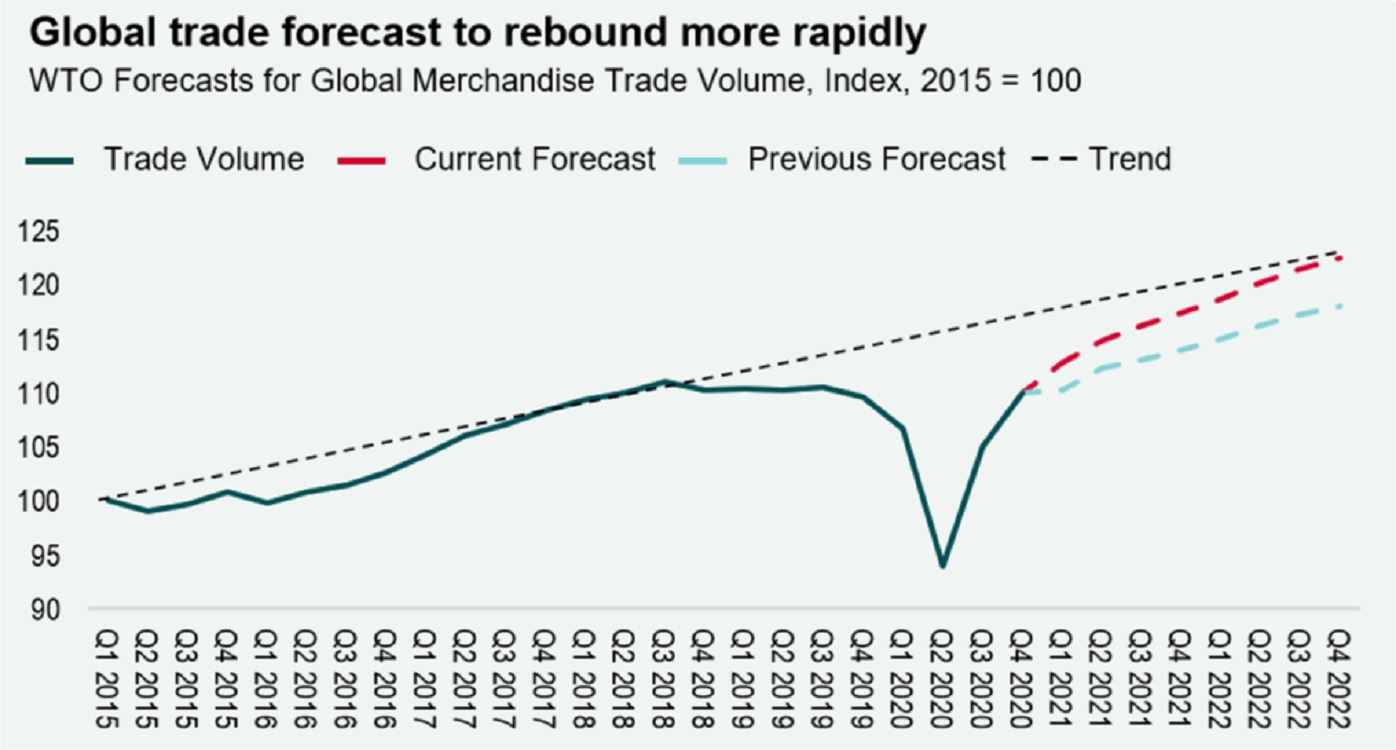

Here we look at the leading indicators in the world of economics. Download the dashboard for in-depth analysis into commodities, trade, equities and more.

As UK party political conferences draw to a close, focus shifts to the autumn spending review

While the chancellor announced a £500m extension to the government’s ‘plan for jobs’, which aims to boost labour supply, the conservative party conference was light on new economic policy. We expect more detail in the spending review due at the end of the month, with clarity sought on future R&D funding and education spending, as well as potential ‘green’ announcements ahead of the UN Climate Change Conference (COP26), which begins in Glasgow at the end of this month.

Globally, inflation concerns remain centre stage

Oil prices have reached multi-year peaks, with the West Texas Intermediate (WTI) at its highest level since 2014 at $78 per barrel, while Brent Crude has topped $80 for the first time since 2018, currently at $81.86 per barrel. Continued commodity price pressures will make it harder for central banks to argue that inflation remains ‘transitory’, and we expect their tone, if not yet their actions, to become more hawkish.

UK electric vehicle sales up 49% year on year

Electric vehicles had their best ever September, as the UK continues to target a ban on sales of new fossil fuel powered cars by 2030. Battery Electric Vehicles and Plug-in Hybrid Electric Vehicles saw increases of 49.4% and 11.5% year on year in September 2021, the only vehicle types to record an annual increase.

Download the latest dashboard for all the up-to-date information.