4 minutes to read

Ranked in the top 70 of The Complete University Guide, Brighton’s two universities generate a diverse talent pool. Fuelling TMT growth, the University of Brighton is known for its creative courses, whilst the University of Sussex is considered a leading research-intensive establishment. The Sussex Innovation Centre, a business incubator subsidiary of the university, bridges the gap between education and the workplace by supporting the formation and growth of tech and knowledge-based companies.

Alongside a strong student representation, the more affluent population of the neighbouring Hove provides an employee base for the long established Professional Services sector. The lifestyle offering that Brighton delivers acts as a magnet for talent. The town centre has many amenities, with over 400 independent bars, cafes and restaurants in the Lanes with an abundance of leisures facilities. Not only will people come, but they will stay.

What is the shape of the office market?

The Brighton office market has consistently recorded strong demand and rental growth, but 2024 is seeing a shift in supply-side dynamics and the nature of occupier demand.

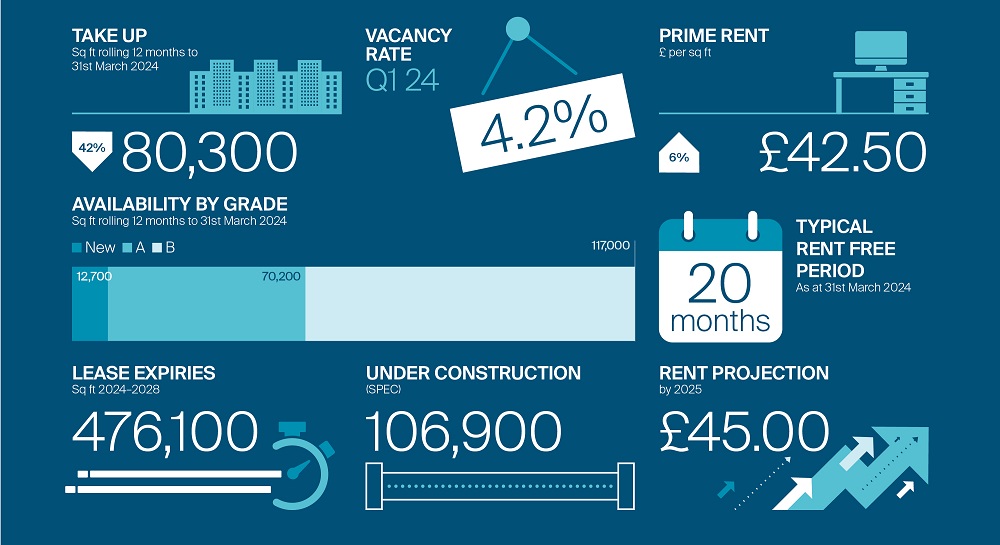

Annual take-up in Brighton reached 72,139 sq ft in 2023, 13% above the 5-year average. Although this is 55% below the previous year, deal numbers increased by 43%, with Financial and Business services underpinning activity. Significantly, take-up levels are dependent upon development, with supply not always able to meet potential demand.

Unlike other key markets, there is a notable grade B market in Brighton. In 2023, grade B space accounted for 29% of total take-up. However, new and grade A space remains the principal focus of occupier demand, pushing up rents in an acutely supply-constrained market.

Who is taking space?

The drivers of occupier demand are changing. Although the Technology and specifically Gaming sectors are principal clusters, this has not translated into occupier demand recently. Professional Services, Business Services and Financial occupiers have been growing in activity, with leading names such as NatWest, Knights Plc and Close Brothers all taking grade A space in the best available buildings. Over the past year, letting activity has been underpinned by demand from the Financial and Business services sectors, accounting for over two-thirds of take-up in 2023.

What does future demand look like?

Looking forward, 74% of named demand in Brighton is from occupiers within Financial and Business Services, with the balance from the Technology sector.

What factors will challenge growth?

The growth of the Brighton office market is hampered by a lack of high quality supply and a limited pipeline of development. Availability of new and grade A stock stood at 82,896 sq ft in Q1 2024. This was all out-of-town and does not reflect the very best quality that occupiers are increasingly demanding. MRP’s Portland Building is the most recent development to reach practical completion. However, 50% of this space is leased to Close Brothers and DMH Stallard at record headline rents, leaving just 15,000 sq ft of town centre availability.

Living in Brighton comes at a premium. The average house price fell by 5.5% year-on-year to £422,000 but remains 13% and 49% above the South East and UK averages, respectively. Private rents continued to rise, reaching an average of £1,723 per month in March 2024. Compared to the South East average of £1,279, Brighton presents a 35% premium. The affordability issue has the potential to prevent a proportion of the potential workforce from locating in and around the town.

Is office supply to grow?

The future office development pipeline offers little relief, with just 106,900 sq ft of stock currently under construction in Brighton. At the time of writing, no buildings could accommodate larger occupiers with requirements of 50,000 sq ft or above. However, approximately 70,000 sq ft of space is being repositioned in phases at Trafalgar Place, albeit such a requirement would be split across multiple buildings.

What will underpin longer-term growth?

There is good reason to be optimistic about Brighton as an office market. Continued rental growth owing to a lack of supply provides an opportunity for investors, whilst the current prime rent of £42.50 offers a discount to occupiers compared to other key South East markets. Brighton has seen rental growth of 31% since before the pandemic in 2019 and currently commands quoting rents of £45.00 per sq ft for the best quality space. Although there is a lack of land availability due to the natural barriers of the South Downs National Park to the north and the sea to the South, the supply and demand imbalance drives rental growth.

Public and private investment into Brighton demonstrates continued confidence in the area. The proposed redevelopment of Brighton’s marina will be led by Brighton & Hove City Council, funded by Coast to Capital, and will improve the environment and infrastructure of the seafront. Whilst it is not currently focused on office space, the improvement of public spaces and additional housing will attract occupiers and workers to the local area, maintaining the momentum of Brighton as a key market into the future.