5 minutes to read

Renowned for its globally leading university and, more recently, a burgeoning Life Sciences sector, Cambridge is firmly on an accelerating growth path. Alongside London and Oxford, Cambridge forms part of the UK’s Life Science ‘Golden Triangle’, with the sector’s ‘post-Covid’ expansion fuelling new research and development space demand. Organisations in the city, however, extend beyond the Life Sciences sector and stem from a wide array of disciplines ranging from other science-derived industries to technology and financial services. Notably, many of Cambridge’s resident organisations originated in the city, a product of a commercial offshoot from the university. Globally recognised corporations have also gravitated here, enticed by the high-calibre workforce and a well-established research base. Consequently, Cambridge is rightly regarded as a principal global centre of innovation.

What is the shape of the office market?

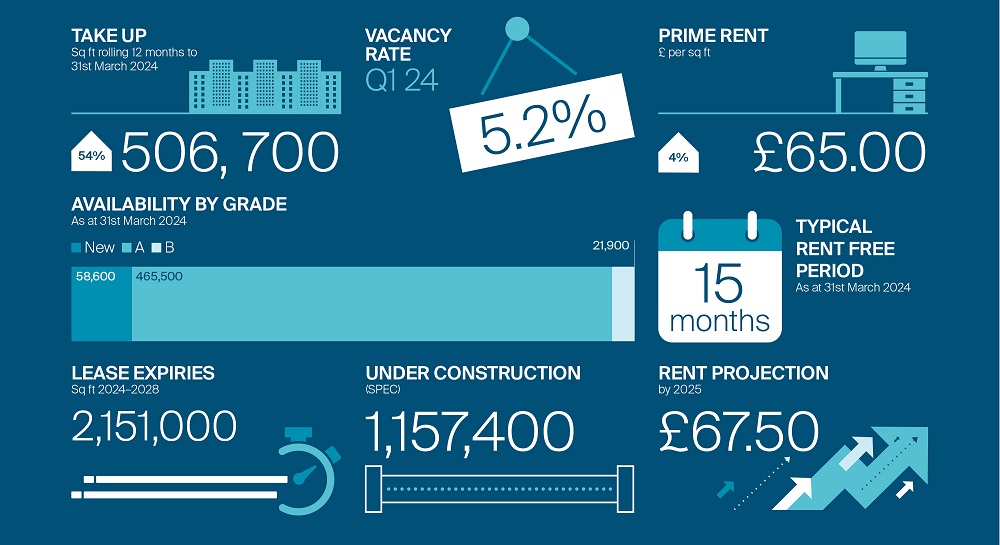

The market in Cambridge comprises circa 10m sq ft and is a mix of science and business parks and city centre offices. Over the past five years, occupier demand has principally concentrated at out-of-town centres, accounting for 75% of take-up. On average, Cambridge records around 440,000 sq ft of take-up annually, albeit stronger activity in 2023 propelled the overall take-up to 8% ahead of the longer-term trend.

Increasingly, lab-enabled space accounts for a more significant proportion of market demand as science-derived organisational interest grows. In 2023, 39% of overall takeup was for this type of space. If considered by the number of deals completed, this percentage rises to 51%.

A lack of suitable space to service occupier demand and the growing Life Science sector has given landlords the confidence to keep pushing rents. During 2023, office rents increased by 11% and lab enabled space by 4%.

Who is taking space?

Given the strong research basis of the university and proximity of Addenbrookes Hospital, organisations from Pharmaceutical and Healthcare denominations account for 51% of take-up over the past 5 years. This increased to 64% in the last full calendar year, with BioNTech’s 79,000 sq ft lease of the newly completed 1000 Discovery Drive, Cambridge Biomedical Campus, in Q4 2023 supporting this high representation.

The TMT sector additionally holds a strong interest in Cambridge. Global firms such as Apple, Roku, Amazon, and Microsoft have established a presence, while ARM Holdings - a succession of Acorn Computers - originated in the city. The sector accounts for 30% of take-up over five years and 34% in 2023, with the standout deal of 2023 being Nyobolt – creator of ultra-fast battery charging solutions - signing a pre-let for 37,000 sq ft at Evolution Business Park.

What does future demand look like?

Research and development dominate the forecast of business growth in Cambridge and, as such, potential real estate activity. At the time of writing, 610,000 sq ft of space requirements are active in the city, with 92% derived from Pharmaceutical, Healthcare or TMT firms.

What factors will challenge growth?

Supply is the most significant tow on growth. The overall vacancy rate in Cambridge was 5.2% at the end of Q1 2024, one of the lowest in the South East markets monitored. This has decreased by 100bps in the last 12 months. Significantly, only two buildings could accommodate a requirement of 50,000 sq ft.

Is office supply to grow?

As of Q1 2024, 1.2m sq ft of space was under construction, of which 1.1m sq ft is speculative. Delivery is scheduled relatively evenly over the next three years, with 255,000 sq ft in 2024, 461,000 sq ft in 2025 and 441,000 sq ft in 2026.

Most of the market’s major speculative schemes are aimed at Cambridge’s burgeoning Life Science and Technology sectors. Close to 586,400 sq ft of ‘Lab Enabled’ space is due to be completed before the end of 2025. Key projects include BioMed Realty’s (Blackstone) One Granta at Granta Park. The speculative scheme will deliver 105,000 sq ft on completion at the end of 2024.

Also underway is Abstract Mid Tech’s South Cambridge Science Centre (SCSC). Part of Dales Manor Estate was bought by Canmoor and Tristan, called Accelerator Park and Phase 2 will add 86,000 sq ft of mid tech space in Q2 2025.

For delivery in 2026, RailPen is advancing two major developments in Cambridge. Botanic Place is a 304,000 sq ft sustainable office scheme, and Devonshire Gardens is a 120,000 sq ft mixed-use development. Socius is developing both projects on behalf of Railpen.

What will underpin longer-term growth?

Several significant announcements over the past 12 months support the prediction of continued growth in Cambridge.

AstraZeneca will expand its presence at Europe’s largest Life Sciences cluster in Cambridge with £200 million in investment. The facility will house around 1,000 employees and be adjacent to its £1.1 billion global R&D Discovery Centre (DISC), which already hosts 2,300 researchers and scientists.

A new mixed-use regeneration scheme at Cambridge North has been given the go-ahead. Brought by the Chesterton Partnership – a venture comprising Network Rail Property and DB Cargo and development partner Brookgate – the scheme will deliver 578,000 sq ft of commercial space, including provision for new laboratories and offices. Once fully completed, Cambridge North will support 4,300 jobs.

The National Infrastructure Commission will boost the economic contribution of the Cambridge-Milton Keynes-Oxford corridor by more than £160 billion a year by adding an East-West Rail. The city council has set a goal of 2030 for the rail service, which will allow for continued growth along the corridor, further growing Cambridge’s labour force and economy.

A new station is already underway, with Cambridge South due to open in 2025. This will connect the Biomedical Campus with potential destinations such as Central London, London Stansted Airport, Ely and Birmingham, and is expected to form part of the new East West Rail route from Bedford to Cambridge when constructed.