Why Guildford and Woking?

4 minutes to read

Education is the backbone of these leading Surrey office markets. Ranked 13th according to the Complete University Guide 2024, the University of Surrey provides occupiers with a competent talent pool nearby. With the university ranked first for informational technology and systems, the highly active TMT firms benefit from a vastly capable potential workforce.

Guildford and Woking are commuter towns. As such, they are highly connected, with Woking arguably Surrey’s best-connected town centre, meaning London Waterloo and Clapham Junction can be reached in just 22 minutes and 18 minutes, respectively. Alongside accessibility to talent and clients, they benefit from investment into local amenities as key markets.

Woking has benefitted from recent new mixed-use development in the town centre, whilst people are drawn to Guildford for its abundance of amenities and historic charm.

What is the shape of the office market?

Woking has arguably had more public and private investment over recent years but both markets have attracted a breadth of major occupier lettings including LGC, Allianz, Colgate, Nomad Foods and BDO.

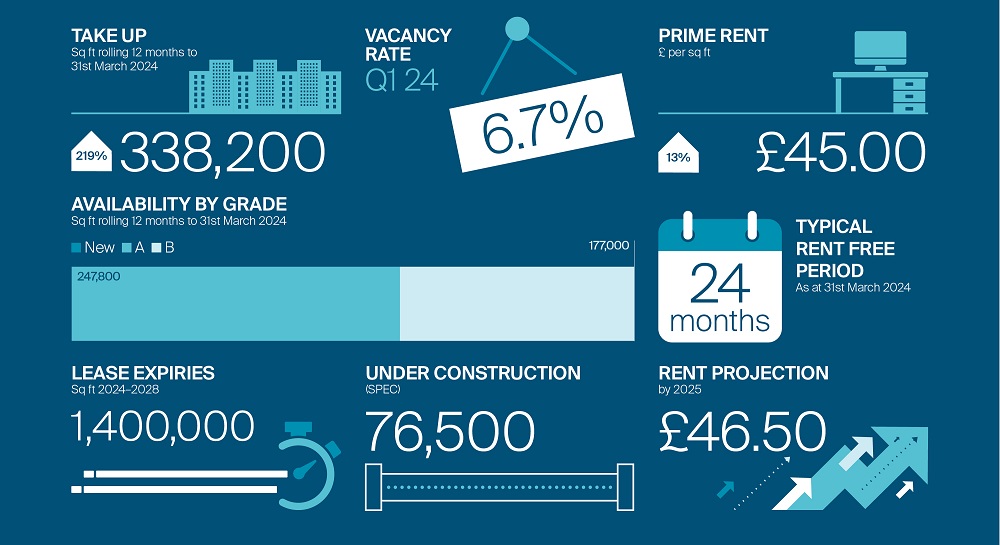

Occupier demand is growing. Take-up in 2023 finalised at 253,394 sq ft, more than double the previous year and 56% above the 5-year annual average. Q1 2024 has begun positively, with 97,779 sq ft of take-up recorded, more than double the 5-year first quarter average.

Over the past five years, 64% of occupier activity has been within the town centres of Guildford and Woking. In the first quarter of 2024, this increased to 93%, with occupiers gravitating toward amenities and accessibility.

Who is taking space?

The Surrey markets benefit from continued interest from both TMT and Financial and Business Services companies. Over the past 5 years, these sectors account for 35% and 20%, respectively. However, in 2024, Surrey County Council took 66,415 sq ft of grade A space in Woking’s Victoria Gate, bolstering activity from the Public Sector.

Gaming companies are the mainstay of TMT activity, accounting for 47% of total space leased to the sector. Guildford has established a gaming cluster centred around Electronic Arts, who moved to Guildford in 2004. Supermassive Games, Wargaming and Glowmade Games have grown within this 5-year period, completing multiple deals for grade A space across this timespan.

What does future demand look like?

The TMT sector remains the most active. Of the 417,500 sq ft of named demand in Guildford and Woking, 63% is derived from the TMT sector.

Significantly, over 1.4m sq ft of space is subject to a lease event before the end of 2028, with Electronic Arts the most high profile.

What factors will challenge growth?

Like many other key South East markets, limited space restricts growth. The availability of new and grade A space is 247,781 sq ft, 45% below the 5-year average in Guildford and Woking. Most of this space is out-of-town, meaning no new or grade A space is ready for immediate occupation in the town centre markets. In Woking, nearly all available new and grade A space is currently under offer.

Is office supply to grow?

Development is thin. There is just one scheme of note in Woking at 1 Chobham Road, which has consent for c.130,000 sq ft of highly sustainable brand-new office stock on underutilised brownfield land in the town centre. In Guildford, Kingsbridge Estates’ Bottleworks development is the only scheme under construction in its town centre, and it is already 60% pre-let ahead of practical completion later this year.

Redevelopment opportunities in Woking appear more limited than Guildford given the scale of recent development. An arguably restrictive planning environment in Guildford has held back new schemes being delivered in the town centre but there are interesting opportunities close to the station, ripe for re-positioning, in the coming years.

What will underpin longer-term growth?

Continued public and private investment in the local areas will be essential for future market growth. Solus’ £150m regeneration of Guildford Station and the surrounding area demonstrates investor confidence in the market, as the enhancement of the station building is in anticipation of passenger growth over the next 20 years. The added amenity of 438 new homes, c.37,000 sq ft of retail and c.20,000 sq ft of office space will support the town’s growth of Woking into the future. In Guildford, the proposed transformation of the former BHS site would provide more than 270 homes, with a strong focus on sustainability. Much like in Woking, the infrastructure is being transformed to accommodate the expected continuation of momentum in the market.

The emergence of a new wave of development will be key to achieving further rental growth in Guildford and Woking. All eyes are on the potential redevelopment of 1 Farnham Road by Orchard Street Investment Management, providing c. 75,000 sq ft of brand-new office space to Guildford’s town centre by 2026. If speculatively developed, its delivery would undoubtedly see new record headline rents achieved in the market.