Slim Opportunities for Pre-election Tax Giveaways to Boost UK Housing Market

Renewed speculation about a stamp duty cut comes as the government’s room for manoeuvre shrinks and interest rate uncertainty intensifies.

3 minutes to read

Tax cuts moved back onto the political agenda last week. Unfortunately, the focus was on the limited headroom any government will have to make them.

The UK government said borrowing was higher than expected last year, creating a budget deficit of £120.7 billion. Government debt was 98.3% of GDP in March, a level last seen in the early 1960s.

It means Chancellor Jeremy Hunt will be hoping for a favourable revision to the official figures before his autumn Budget to enable pre-election tax giveaways.

In what will probably be the last roll of the dice for the current government, he could announce them anyway.

Whatever happens later this year, high debt levels mean a period of belt-tightening and possible tax rises is likely from 2025, helping to keep house price growth in check, as per our latest forecast.

A weaker economic backdrop means demand in prime property markets could become stronger than mainstream markets given the higher levels of affluence among buyers and sellers. Once mortgage rates start to edge lower, of course.

While uncertainty around nom-dom tax changes persists, the same thing may not happen in the highest price brackets above £5 million. As we have pointed out before though, what political parties say before and after an election often differs.

Stamp Duty Cut Coming… Again?

Despite the limited scope for tax cuts, the perennial prospect of a stamp duty reduction resurfaced last week.

There were reports Hunt would increase the nil-rate band from its current temporary level of £250,000 to £300,000, presumably on a permanent basis.

Given how many times the idea has been floated in the past and the fact the maximum saving would be £2,500, the speculation doesn’t feel like a major impediment at the moment. However, it is a useful reminder that pre-announcing a stamp duty cut is never a good idea.

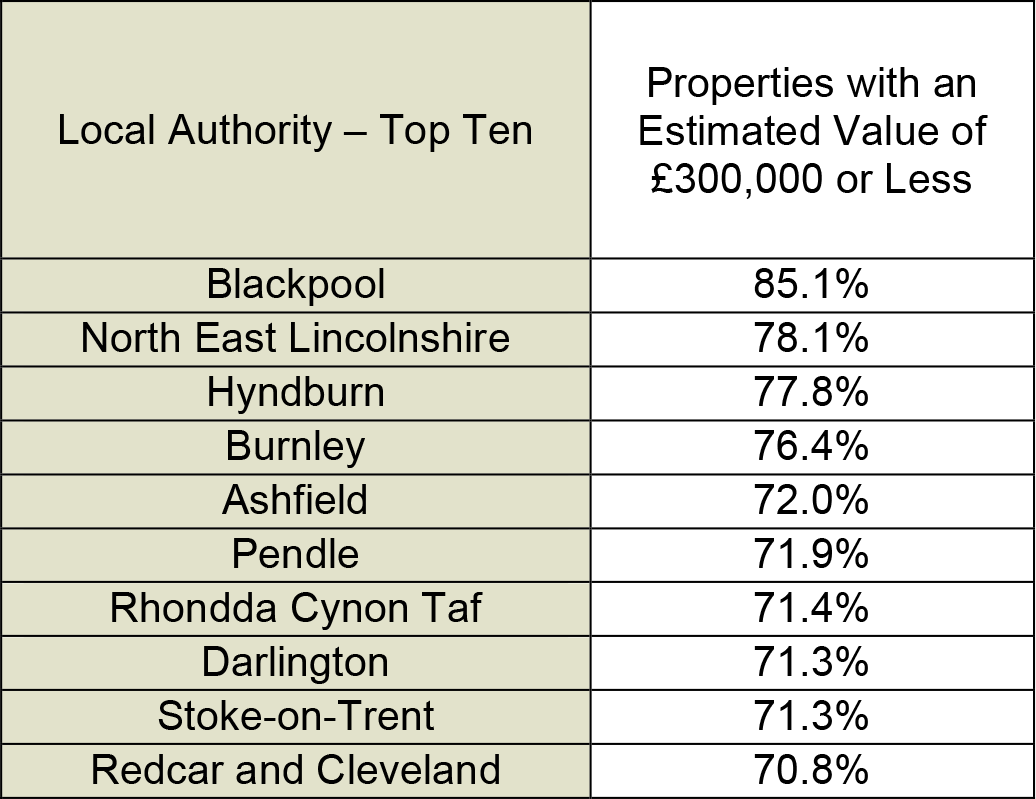

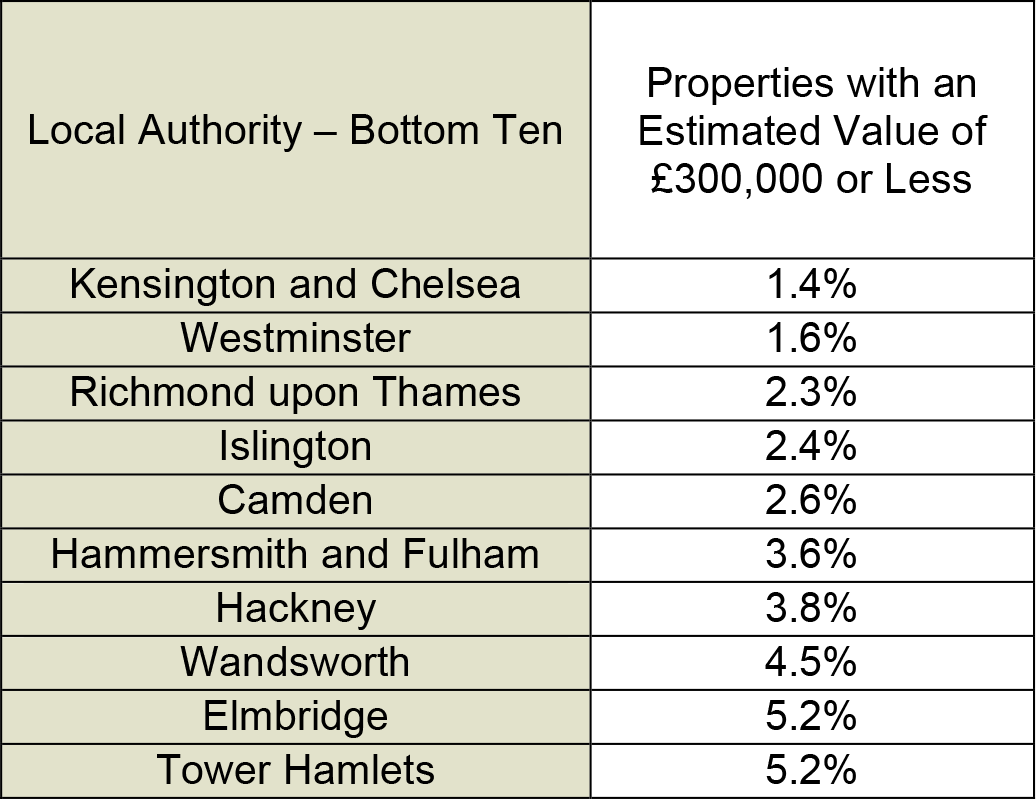

Which areas would benefit most from the changes if they ever happened? The results of an analysis of house prices across England and Wales have a ‘Red Wall’ tinge.

We estimated the percentage of properties in each local authority valued at £300,000 or below – in other words the areas with the highest proportion of properties where the stamp duty bill would be zero. The smallest number was in Kensington & Chelsea (1.4%). The highest was Blackpool (85.1%).

Source: Knight Frank Research

Source: Knight Frank Research

That Elusive Rate Cut

In other news last week, the latest financial results from Lloyds Bank reminded us of the tight margins mortgage lenders are operating within at the moment, a theme we explored in more detail here.

Rising rates have already had an impact on house prices, as recent releases from the Halifax and Nationwide have shown.

Sales volumes have so far held up better. We will discover if that remains the case when mortgage approval data and HMRC transaction numbers are released on Tuesday.

Meanwhile, two key questions remain. In what month will that elusive first rate cut since March 2020 come? And, will the Bank of England cut before the US Federal Reserve?

As this recent article shows, don’t ask a group of economists if you want a clear answer to either at the moment.