September data indicates signs of stability for UK housing market

Higher mortgage rates keep prices under pressure in subdued market.

4 minutes to read

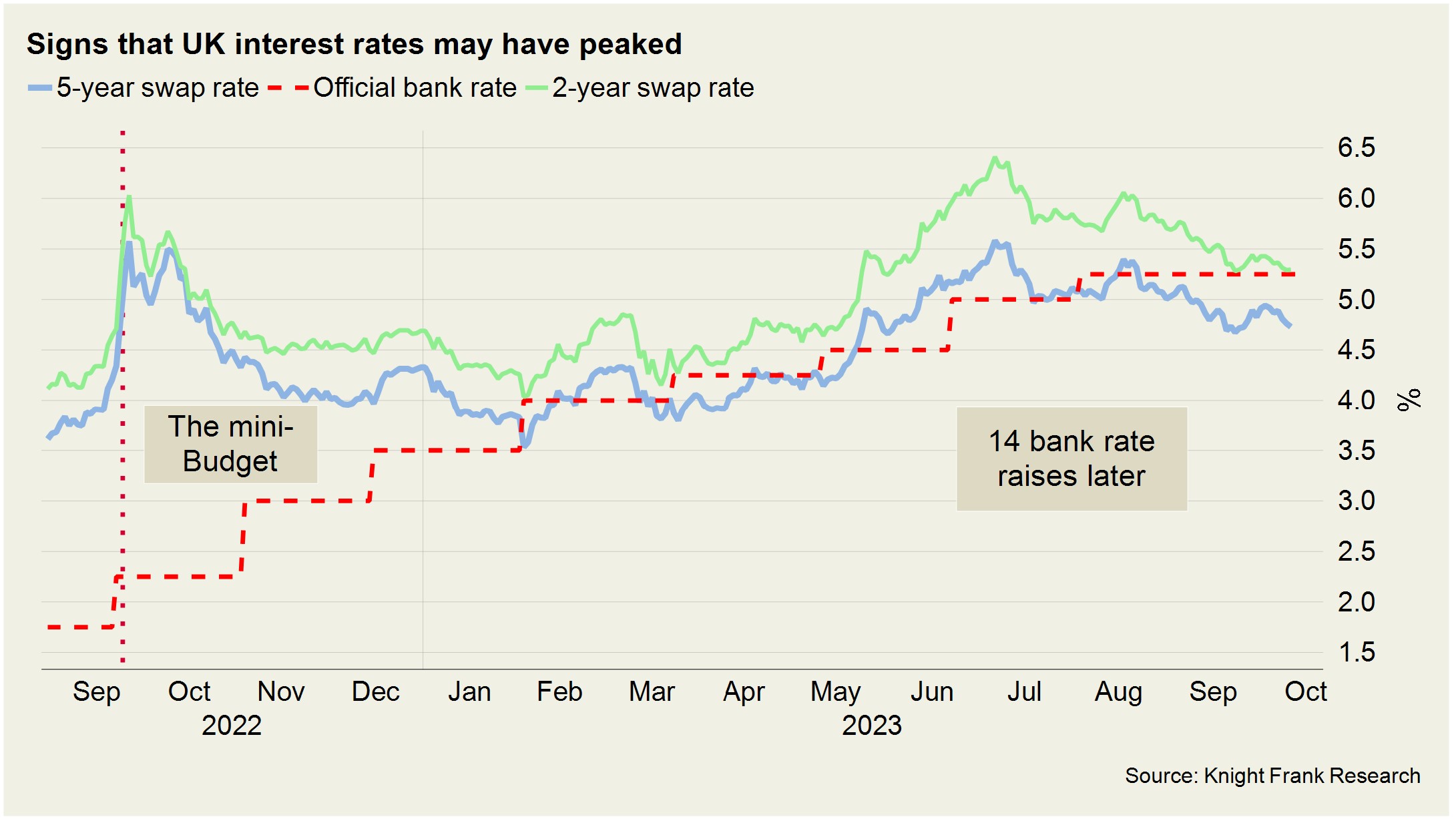

After a volatile year that has seen the cost of borrowing climb, fall and climb again following the mini-Budget, September brought the first signs that the roller coaster ride may be at an end.

Swap rates, which are used by lenders to set the price of fixed-rate mortgages, levelled out ahead of the Bank of England’s (BoE) decision to hold the UK interest rate at 5.25% in September (see chart).

The strength of the UK’s employment market and strong wage growth has seen the BoE ratcheting up intertest rates to rein in inflation, however 14-consecutive increases appear to be having an impact.

Job vacancies in August dipped under one million for the first time since July 2021, and CPI core inflation, which includes wage growth, fell by more than economists expected, down from 6.9% in July to 6.2% in August.

It adds weight to the view that UK interest rates have peaked, with the BoE recently warning that the full impact of higher borrowing costs is still to be felt by households.

While current conditions remain challenging across the sales market, surveyors responding to RICS’ September Sentiment Survey saw improved conditions ahead if rates are held.

The twelve-month sales expectations series returned a net balance of +3% (up from -5% in August), signalling more stability ahead.

The net balance is the proportion of respondents reporting a rise in prices minus those reporting a fall.

For now, activity in the UK residential property market remains subdued. Transactions nudged up 1% in August to 87,000 but remain 17% below 2022’s monthly transaction average.

There is little momentum with mortgage approvals for purchase, a leading indicator of demand, slipping 8% from 49,500 in July to 45,500 in August.

The reduction in demand is keeping downwards pressure on pricing. The three-month change to September in house prices was -0.8% according to Nationwide while the Halifax registered a drop of 1.8%. The lenders put the annual change at -5.3% and -4.7%, respectively.

Ultimately, this year’s volatility and the higher cost of borrowing are reasons that we have revised out forecasts for house prices. We now expect UK house prices to fall by 7% this year, more than our forecast of -5% in March. Next year, we expect prices to fall by 4% as the economy stabilises and sentiment improves.

Lettings (outside of prime London, see below) remained a story of demand outstripping available supply.

Data from Rightmove underlined this, with the average rental property across the UK receiving 25 enquiries from prospective tenants to letting agents in September. This is more than triple the eight received on average before the pandemic in 2019.

Prime London Sales

The Bank of England paused its cycle of interest rate hikes in September, but demand for residential property remains fragile in higher-value postcodes in the capital.

While the number of new prospective buyers in London rose 12% between August and September as this year’s autumn market began, it was half the increase experienced in the previous two years.

Essentially, the prime London property remains in a holding pattern. It has not experienced the extent of price declines seen across the UK but neither have the capital’s more affluent postcodes been immune from the deteriorating economic sentiment.

Prime central London experienced a 1.7% fall in annual values in September, with prime outer London experiencing a decrease of 1.4%.

Prime London Sales Report - September 2023

Prime London Lettings

The downwards trajectory for annual rental value growth in prime London markets continued in September as supply increased and demand held steady.

The number of new prospective tenants in prime London postcodes was flat compared to the five-year average in the third quarter of this year, our data shows. Meanwhile, listings in PCL were only 12% down, according to Rightmove, a figure that compares to decline of 37% in the same quarter last year.

Annual rental value growth in prime central London (PCL) was 11.2% in September, which was the lowest figure in two years. In prime outer London (POL), an increase of 10% means that next month we are likely to be back in single digits.

Prime London Lettings Report - September 2023

Country market

Prime UK regional prices suffered their largest annual fall since the global financial crisis in the third quarter of 2023, as high borrowing costs and weak sentiment curbed demand.

Prices declined 6.1% in the year to September, which was the biggest annual drop since a 13.4% fall in Q3 2009.

Despite this, prime regional prices remain 12.2% higher than they were in June 2020, the first full month after the re-opening of the property market due to Covid.

Reflecting the hesitancy felt by buyers, offers made were down by 14% in Q3 versus the five-year average (excluding 2020) and exchanges fell by 9%.

Subscribe for more

Get exclusive market analysis, news and data from our research team, straight to your inbox.

Subscribe here