UK country house prices down 6.1% in Q3

Activity subdued in prime regional markets as buyers and sellers await interest rate peak.

2 minutes to read

Prime Country House Index 273.8 / Quarterly price change -2.1% / Annual price change -6.1%

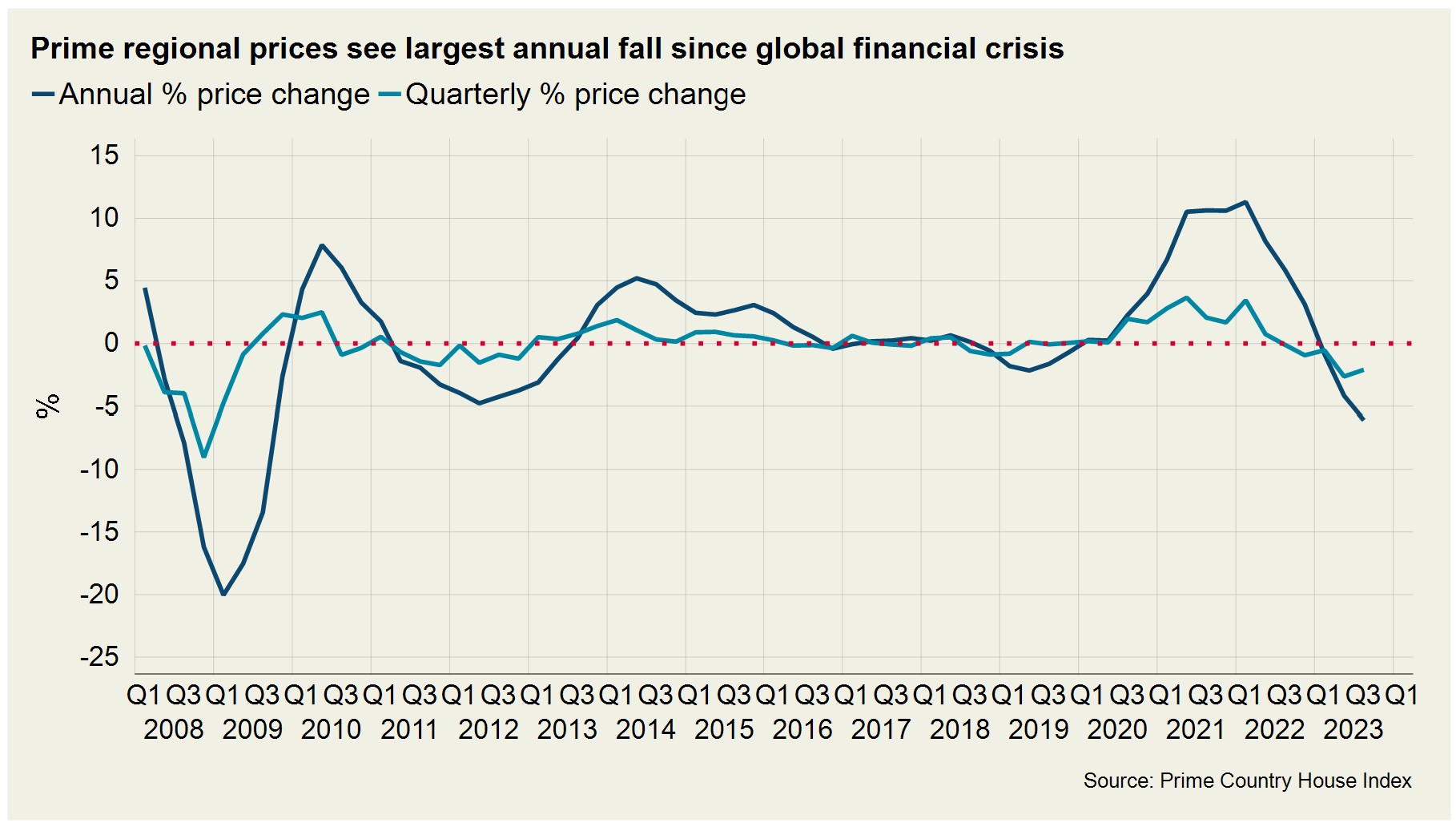

Prime UK regional prices suffered their largest annual fall since the global financial crisis in the third quarter of 2023, as high borrowing costs and weak sentiment curbed demand.

Prices declined 6.1% in the year to September, which was the biggest annual drop since a 13.4% fall in Q3 2009.

Despite this, prime regional prices remain 12.2% higher than they were in June 2020, the first full month after the re-opening of the property market due to Covid.

Prime regional markets have failed to regain the momentum lost after the mini-Budget in September 2022, which saw a spike in rates and the temporary removal of some mortgage products.

It brought the curtain down on a period of high activity and strong house price growth that had been spurred by a stamp duty holiday and the Covid pandemic. This saw a ‘race for space’ as people upgraded their homes during successive lockdowns.

Although the Bank of England held interest rates at 5.25% in September, the cost of borrowing remains at a 15-year high and continues to weigh on activity.

Offers made were down by 14% in Q3 versus the five-year average (excluding 2020) and exchanges, on the same basis, by 9%.

On a quarterly basis, average prices were down 2.1%, which was an improvement on a 2.6% fall in Q2.

Mortgage approvals for purchase across the UK fell from 49,500 to 45,500 in August, the lowest level in six months and 30% below 2019’s monthly average.

This subdued picture is why we have revised down our sales forecast for prime regional markets and expect prices to fall 7% in 2023, rather than the 5% predicted in March.

Some sellers are looking for last year’s prices, while buyers are seeking discounts in the falling market, as we have explored. With little evidence of forced selling or repossessions, the result is often a stalemate.

We expect sentiment to improve next year as the economic picture brightens and interest rates peak. Which is why our forecast for 2024 is for a smaller price fall of 3% in prime regional markets and a return to growth in 2025.

“The belief that we’ve reached the top for interest rates and the return of 5-year fixed-rate deals at under 5% has improved confidence. We’ve started seeing viewings nudging up again, as buyers that had paused their searches decide to resume,” said Christopher Dewe, regional partner for Scotland and the North of England at Knight Frank.

Subscribe for more

Get exclusive market analysis, news and data from our research team, straight to your inbox.

Subscribe here