The mortgage roller-coaster starts to wind down

The Bank of England paused interest rates this week following 14 consecutive rises since the end of 2021.

2 minutes to read

For anyone buying or re-mortgaging a property, it feels like the roller-coaster train is finally heading back into the station after a year-long white-knuckle ride.

The corkscrews, hairpin turns, and double dips appear to be behind us, which Bank of England governor Andrew Bailey hinted at this month.

In language more befitting of his position, he said: “There was a period where it seemed to me to be clear that rates needed to rise going forwards, and the question for us was how much and over what time frame. But we’re not I think in that place anymore and that’s why we shifted our language to being much more evidence and data-driven.”

Not that the evidence has been hugely positive since he spoke to the Treasury Select Committee on 6 September. UK wages grew at the fastest pace on record in the three months to July, we learned last week.

Tackling core inflation, which has been driven by a strong labour market, has been a priority for the Bank of England as it increases the cost of borrowing.

August saw the 14th consecutive rise and house prices and transaction volumes have come under pressure as mortgage rates have climbed. The Nationwide reported a 5.3% decline in UK prices in the year to August, the weakest rate since July 2009. The RICS also put out some gloomy numbers last week.

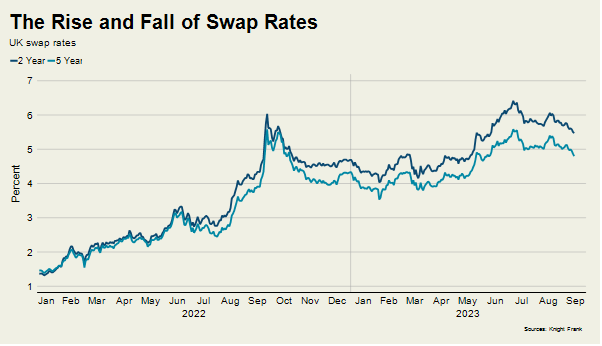

However, it hasn’t been a steady ascent for interest rates, which would have given everyone time to adjust. It is almost a year since the mini-Budget caused such consternation in financial markets and sent the cost of borrowing sharply higher. It was the equivalent of the initial steep climb that a roller-coaster makes.

The two-year swap rate (which is used to price fixed-rate mortgages of the same length) quickly rose above 6%. It has peaked above that level twice since thanks to some worse-than-expected inflation data – see chart.

There were accusations that the Bank of England had done too little, too late to tackle the spiralling cost-of-living.

In part thanks to Andrew Bailey’s words earlier this month, the two-year swap rate was trading at just under 5.5% by last Friday.

Economists think central banks are nearing the end of their current cycle of rate hikes, which the European Central Bank signalled last week.

“There will be a vote for a 0.25% rise,” said Savvas Savouri, the chief economist at hedge fund Toscafund in relation to the Bank of England’s decision. “It could be a split vote but once we get to 5.5%, that is it.”

While the downwards pressure on prices and sales volumes won’t disappear any time soon, some stability would certainly help sentiment, that all-important lubricant in the housing market.