Prime London rental value growth slows as demand cools and supply builds

August 2023 PCL lettings index: 217.0

August 2023 POL lettings index: 217.7

2 minutes to read

Rental value growth in prime London postcodes continued to decline in August as supply built and demand cooled.

More owners are opting to let out their property due to the weakness in the sales market caused by rising mortgage rates.

Meanwhile, demand has dipped over the summer for reasons that include the lower number of Chinese students choosing to attend university in the UK.

As a result, average rental value growth in prime central London (PCL) fell to 12.4% in the year to August, which was the lowest level since September 2021. In prime outer London (POL), the figure was 11.5%, the weakest it has been since October 2021.

While the strong rental value growth of recent years has calmed down, it’s still high by historical standards.

To put last year’s growth into perspective in PCL, average rents grew by 15.6% in the ten years leading up to the pandemic. In POL, the annual growth rate in August exceeded the rise of 11% seen during the decade prior to the pandemic.

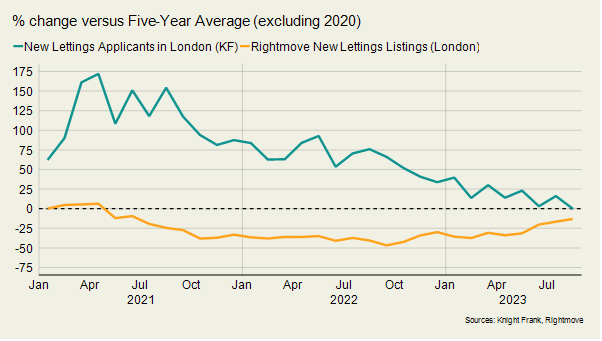

The number of new lettings listing in the capital was 13% below the five-year average (excluding 2020) in August, Rightmove data shows. That compares to a decline which was closer to a third during most of last year.

Meanwhile, the number of new lettings applicants was equal to the five-year average, after spending most of 2022 more than 50% higher, as the chart shows.

One of the reasons is that the number of Chinese students has dipped this year. UK universities may have reached “peak China”, according to the head of the Universities and Colleges Admissions Service, for reasons that include recent visa and tax changes.

“Inquiry levels are strong but not as high as we’ve seen over the last two summers,” said David Mumby, head of prime central London lettings at Knight Frank. “As supply increases, the frenetic rush for stock we have seen in previous years has calmed down.”

The re-balancing taking place in prime London markets is largely due to the more discretionary position of owners. It has not happened outside of London, where there is still strong upwards pressure on rents, which rose at their highest rate since 2016 last month.