Prime London sales activity strengthens after muted pandemic

August 2023 PCL sales index: 5,405.0

August 2023 POL sales index: 274.2

2 minutes to read

The traditional summer lull in the UK property market felt particularly noticeable this year.

Beyond the fact it was holiday season, an inconclusive set of inflation numbers in August raised doubts about how high interest rates would remain and ensured sentiment stayed firmly in check.

The light-at-the-end-of-the-tunnel moment has not yet arrived.

While the prime London market has been affected by the uncertainty of the last 12 months, it has been less marked than many areas of the UK.

For example, while the Nationwide UK index fell below -5% in the year to August, average prices in prime central London declined by 1.4%. In prime outer London, the fall was -0.8%.

There was even a 1.3% rise in Knightsbridge, an area affected disproportionately during the pandemic by international travel rules and the fact it is largely an apartment market.

The strongest annual growth in August was recorded in Dulwich (3.6%), as buyers continued to look for space and greenery in an area that is relatively more affordable than equivalent prime locations in south London.

The number of exchanges in London during July and August was 15% above the five-year average, while the figure was down by 4% across the whole country, Knight Frank data shows.

The fact prices across the capital were subdued compared to other parts of the UK during the pandemic has certainly helped support activity, as we explored in more detail last month. A higher proportion of cash buyers has also played its part.

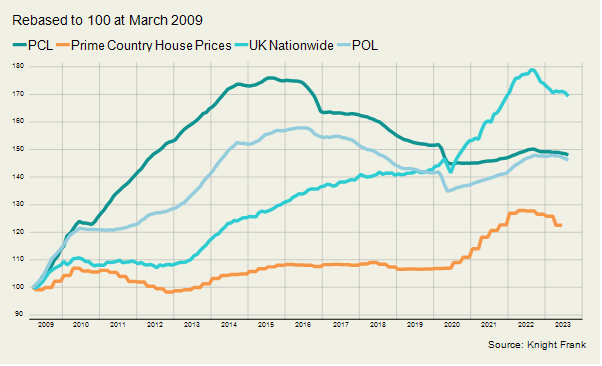

Prices are still 16% below their last peak in prime central London, while the figure is 8% in prime outer London, as the chart below shows.

For UK mainstream prices and the Country House market, prices are still coming down from a more recent high point.

The economic backdrop should stabilise over the next 12 months and downwards pressure on mortgage rates will remain as lenders compete for business in a lower-volume market, as we saw last week.

That said, the political temperature will rise next year as the general election approaches.

Labour, which has a commanding poll lead, has ruled out introducing rent controls as well as a wealth tax, which provides a degree of certainty for high-net-worth individuals.

However, until the details of both parties’ manifestos are revealed, all eyes will remain on the Bank of England.