London’s super-prime market has strongest year since Brexit vote

Political uncertainty may begin to weigh more heavily on the market as the next general election approaches.

4 minutes to read

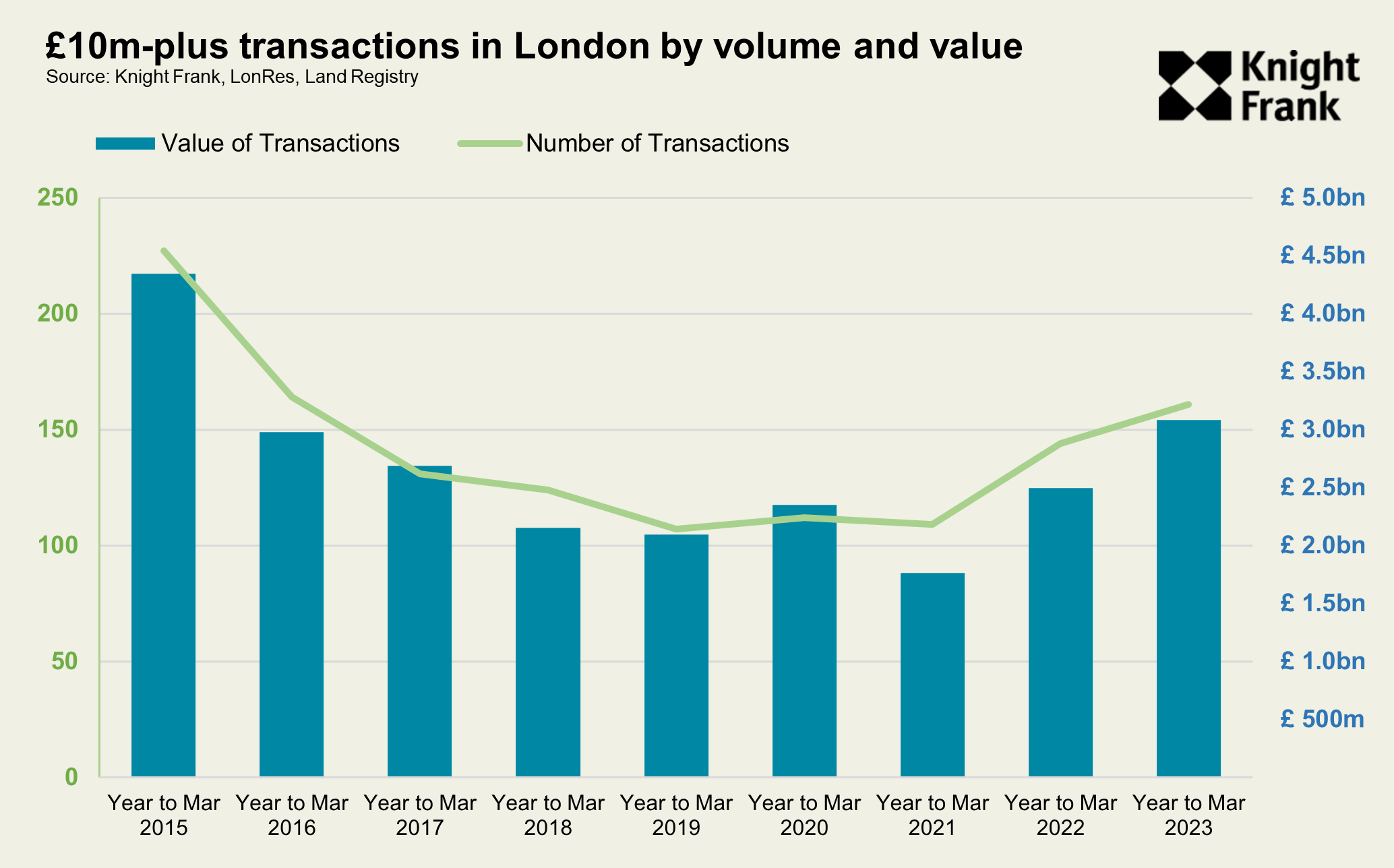

London’s £10 million-plus (super-prime) property market has had its strongest year since 2016, as the restrictions of the pandemic lift and the uncertainty of the Brexit vote fades.

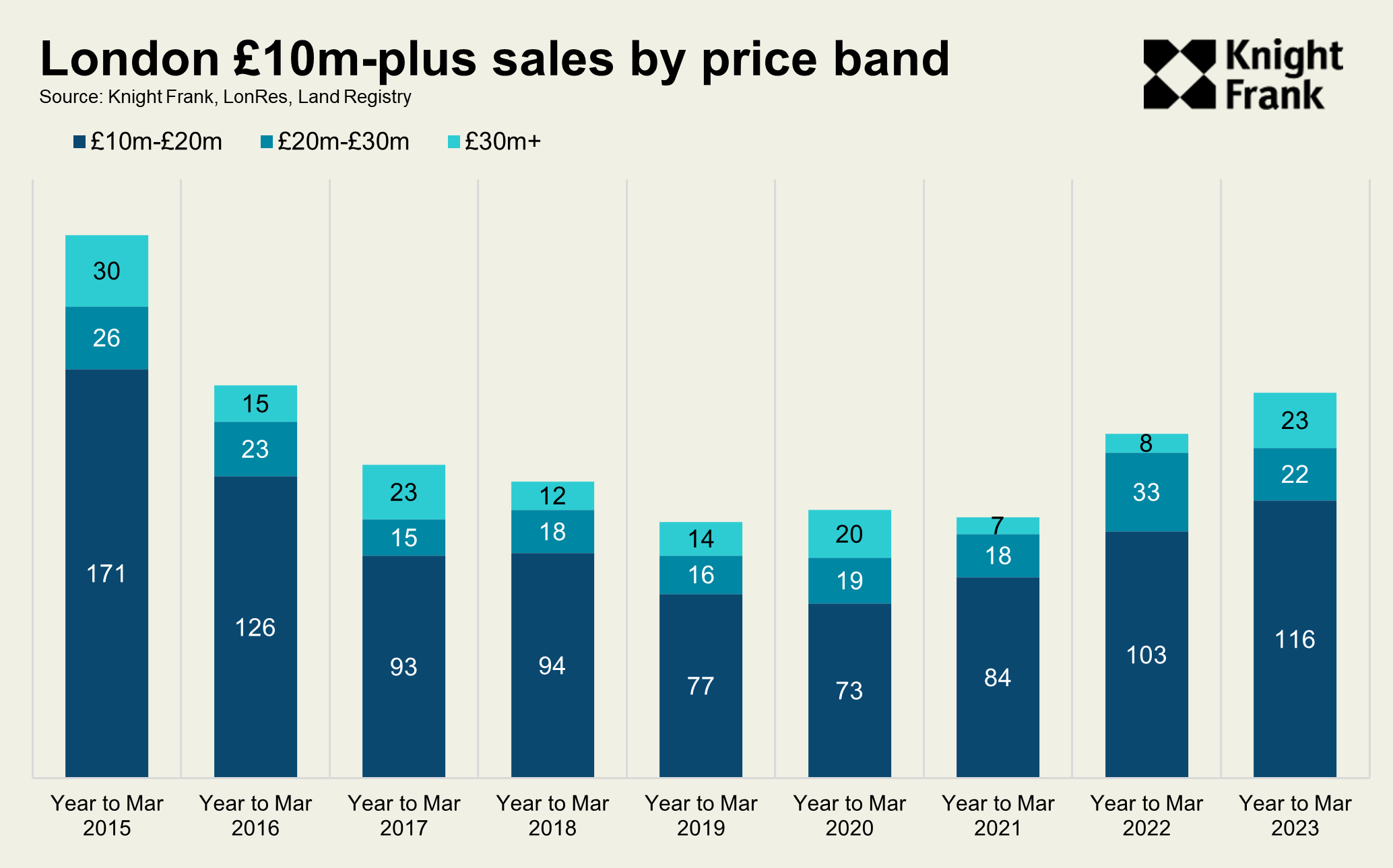

A total of £3.1 billion was spent on 161 super-prime properties in the year to March 2023, whole-market data shows.

It compared to £2.5 billion and 144 transactions in the previous 12-month period. The last time there were more sales was in 2015/16 (164). The highest amount spent in the last decade was £4.3 billion, which was spread across 227 transactions in 2014/15.

Demand was boosted as international travel resumed from many parts of the world last year. The political uncertainty that followed the EU referendum in 2016 had begun to dissipate following the election of a majority government in December 2019 but Covid struck four months later.

“After everything that has happened in recent years, London is still highly-regarded by global buyers,” said Paddy Dring, global head of prime sales at Knight Frank. “However, I expect sales volumes will decline by at least 10% over the next 12 months as political and economic uncertainty picks up.”

The decline would be in line with the wider UK property market, which is still recovering from the shock of the mini-Budget. Sales volumes across the UK were 18% down in the first two months of this year compared to 2022 but are rising steadily as mortgage rates stabilise.

A strong year for the super-prime market year came despite the fact the collective wealth of ultra-high net worth individuals (net worth of US$30m-plus) around the world declined by 10% in 2022 as economies dealt with an energy price crunch and fast-rising inflation and interest rates. See our Wealth Report for more.

This year, the bailout of Credit Suisse in March and wider concerns around the health of smaller banks has caused some hesitation.

Meanwhile, the next UK general election, which is expected in 2024, is moving onto the radar. Issues such as the taxation of wealth and property and the status of non-doms are likely to come under growing scrutiny.

“Discussions around the general election have started to creep into conversations,” said Christian Lock-Necrews, head of the Knightsbridge office at Knight Frank.

The highest number of £10 million-plus deals in London took place in Kensington (26), followed by Belgravia (25) and Mayfair (22).

Meanwhile, the popularity of houses declined slightly from last year. Some 67% of sales were houses compared to 70% in the year to March 2022, a period when lockdown restrictions increased demand for space. In the 12 months before the pandemic, 60% of transactions were houses.

“Houses still have the edge over flats which means there is a shortage of stock in areas like Notting Hill and Belgravia,” said Paddy.

A declining number of luxury new-build flats coming to the market may keep the ratio of house sales relatively high.

The number of units consented, under construction or delivered every year in developments where the blended value is £3,000 per square feet and above will fall sharply over the next five years. A figure of 1,364 in 2022 compares to 146 by 2027, although the number will rise as consented schemes come through the development pipeline.

“There will be a material reduction in the amount of new-build stock over £10 million compared to 2014,” said Rupert des Forges, head of prime central London developments at Knight Frank. “Significant prime schemes are still coming through, but buyers need to be aware of this relative shortage.”

Average prices above £10 million rose by 0.5% in the year to March, which is the same increase recorded in the three years since the pandemic first struck in March 2020. This relatively flat performance is something we explore in more detail here.

We expect prime central London prices to decline by 3% this year, outperforming the wider UK housing market due to higher levels of affluence and cash sales, the return of international travel, the currency discount and the fact prices are still 14% below their last peak in 2015.

US dollar-denominated or pegged buyers still benefit from an effective discount of 37% in prime central London compared to July 2014 when the movement of the pound and property values are combined.

Meanwhile, both supply and demand were relatively strong in the first quarter of this year compared to the five-year average, underlining the likely resilience of the market this year. The number of new prospective buyers registering above £10 million rose by 15% while the number of properties coming to the market for sale increased by 11%.