Leading Indicators | Recession Talks | Rate Hikes | UK CRE Total Returns

Discover key economic and financial metrics, and what to look out for in the week ahead.

2 minutes to read

Here we look at the leading indicators in the world of economics. Download the dashboard for in-depth analysis into commodities, trade, equities and more.

Has the UK averted a recession?

The UK economy grew by +0.1% m-m in November, surprising markets, which were anticipating a -0.2% contraction. Oxford Economics warned that it may be too premature to announce an outright aversion of a recession, however, the UK could have avoided one for now. Indeed, the UK economy would have to contract by at least -0.4% m-m in December to see a second quarterly decline in Q4, which economists think is unlikely. Despite this, economists do anticipate negative growth in December, considering PMIs were all in contractionary territory and the final month of the year saw widespread industrial action. While economists largely expect a UK recession in Q2 and Q3 this year, green shoots of renewed growth are anticipated at the end of the year as consumer energy bills moderate and government support shifts towards disposable incomes.

Bank of England to slow its pace of rate hikes?

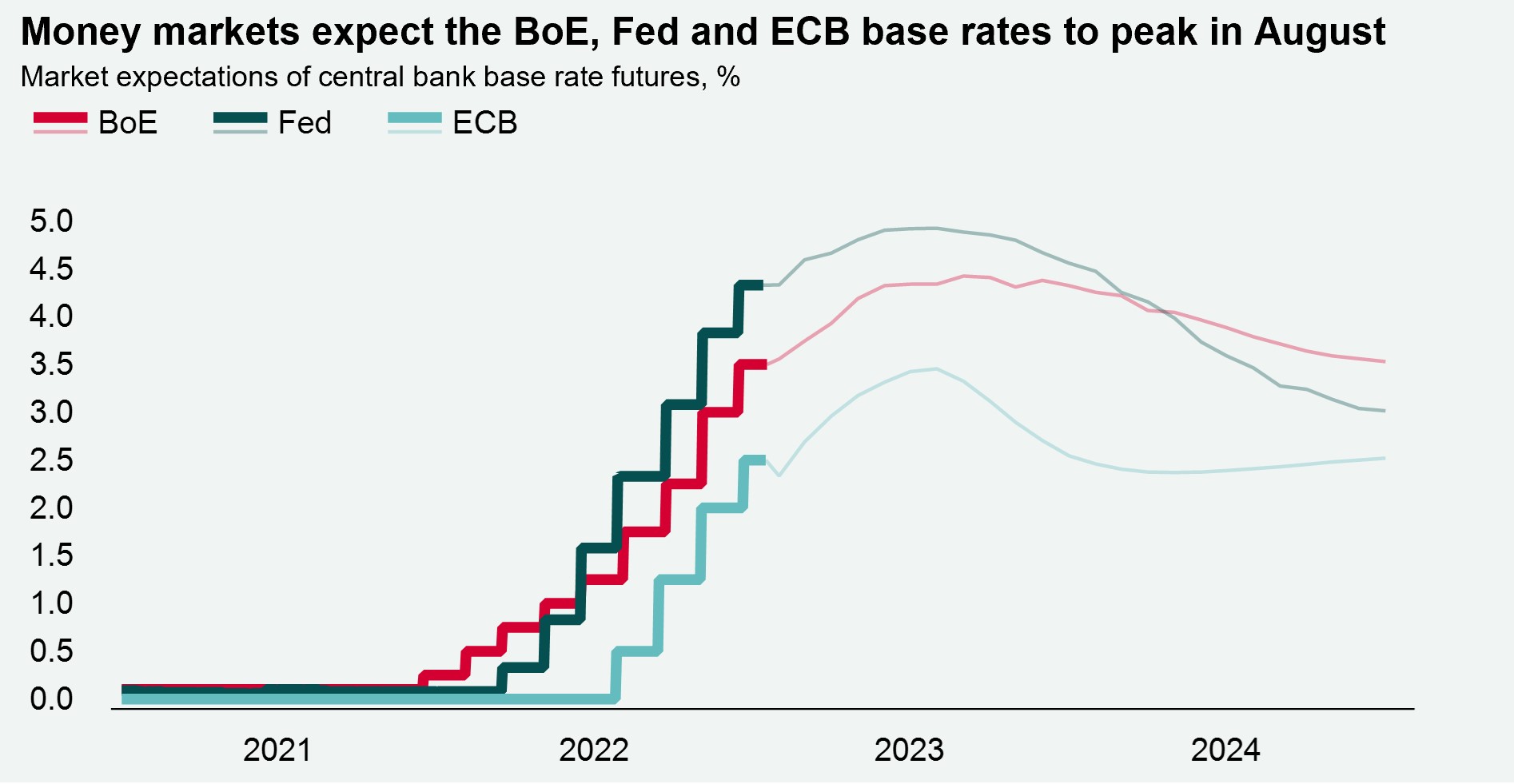

In the three months to November, the UK unemployment rate increased by +0.2ppts q-q to 3.7%. Meanwhile, the number of job vacancies fell for the sixth consecutive period to 1.16 million in the three months to December. However, the price of labour is yet to reflect the softening demand, with average wages growing by +6.4% in the quarter to November, albeit not in line with inflation. Overall, the latest labour market statistics are unlikely to deter the Bank of England (BoE) from further interest rate rises, however, economists are deliberating whether the BoE will slow its pace of rate hikes from +50bps in December to +25bps in February. At present, money markets expect the BoE base rate to peak at 4.4% this year, which compares to market expectations of a 5.4% peak in the aftermath of the ‘mini-budget’.

UK commercial total return started to improve in December

The UK All Property total return increased by +228bps m-m in December to -3.3%, the strongest monthly improvement since August 2016. The Retail sector had the highest level of total return in December at -2.1%, followed by the Office (-2.1%) and Industrial (-4.6%) sectors. Total returns have been supported by capital values declining at a slower pace in December. UK All Property capital values contracted by -3.7% in December, down from -6.0% in November. The Retail sector had the most resilient capital values in December at -2.6%, largely supported by the Shopping Centre subsector which saw capital value declines of only -0.7%. In comparison, Office capital values contracted by -3.4% in December, while Industrial values were down by -5.0%.

Download the latest dashboard